From $5 to trillion: Dr. Evil could not have imagined a company worth this much

All eyes on Santa Clara

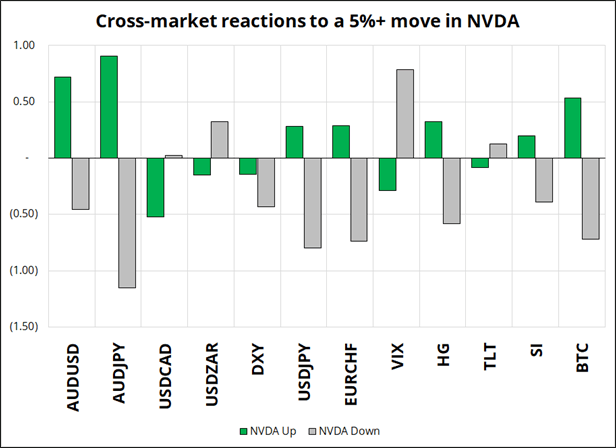

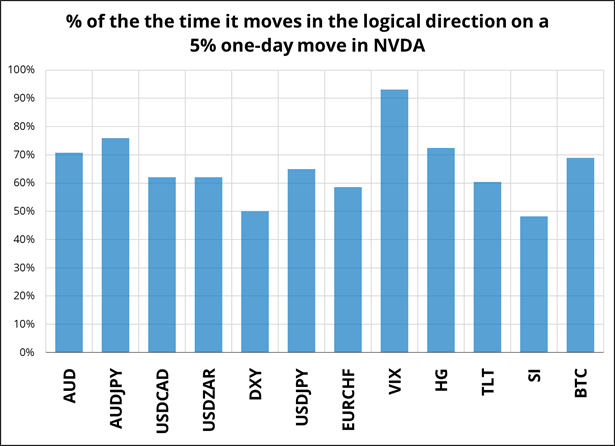

NVDA earnings today. If you’re wondering how that might impact other assets, here are some clues. I looked at NVDA back to 2023 and filtered for 5% moves up or down in the stock. Then, I looked at how many SD various assets moved, and what percent of the time they moved in the logical direction (i.e., NVDA up = AUDJPY up, VIX down, etc. etc.) Here is the output.

Y-axis is standard deviations (average)

Takeaways:

- In FX, AUDJPY is juiciest and most reliable. This is what one might expect. USDCAD and the USD overall are super unreliable. USDJPY and USDZAR are fine but not great. Stick to AUDJPY in FX. To be clear, the “logical” direction for USDJPY in this graphic is UP and USDZAR is DOWN.

- VIX is most reliable, but that goes without saying because NVDA is such a big part of the index. The index moves the same way as NVDA and VIX goes the opposite.

- Silver totally unreliable. I thought it would screen better given it’s a liquidity sponge, but it’s too idiosyncratic.

- Bitcoin is quite reliable. A strong release from NVDA might put a much-needed bottom in bitcoin. It feels to me like the haters on Twitter is doing MSTR victory laps and the moves lower in crypto have become grindy and unimpulsive.

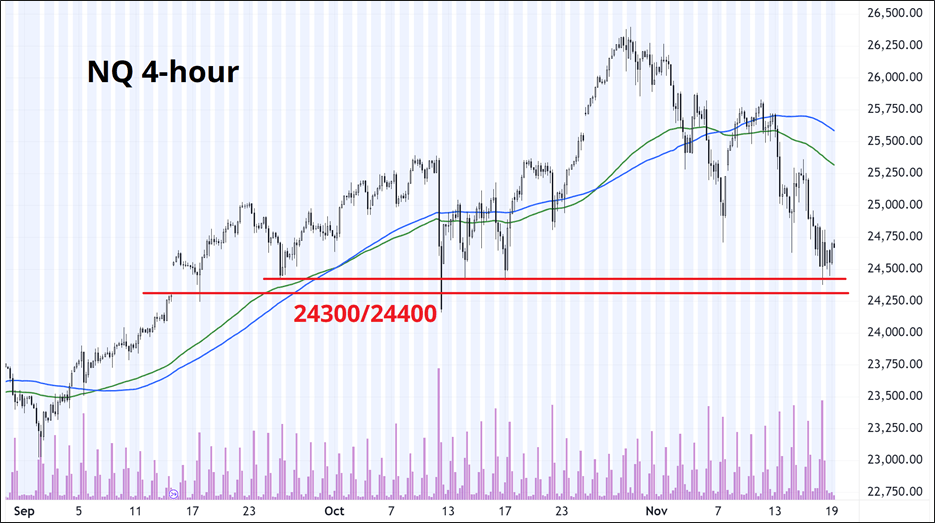

NVDA earnings day has mostly been a big, exciting, optimistic day in recent years, and the stock has performed poorly on the day of because expectations were always sky high. This time the mood is something more like trepidation bordering on fear. My bias remains long equities, and the major 24300/24400 level has held nicely so far in NQ. We have made multiple attempts on high volume as you can see here if you look at the purple bars. Note yesterday’s volume at the lows was the second largest volume bar in the past three months. If NVDA is crushed tonight, we will presumably take out that 24300/24400 gap from mid-September and all bets are off.

For what it’s worth, MSTR shows a similar pattern with massive volume on every attempt to take out the lows 190/192.

Fed chair and Russia deal

Reporters will never starve in 2025 as they can always write a story about an imminent deal on Russia/Ukraine, or a bit about how Trump is close to picking the new Fed Chair. These are evergreen stories and as long as you use words like “Trump mulls” or “Sources close to the president say” or similar, you can parade out all the old talking points and people like Brent Donnelly will link to your story. Like this:

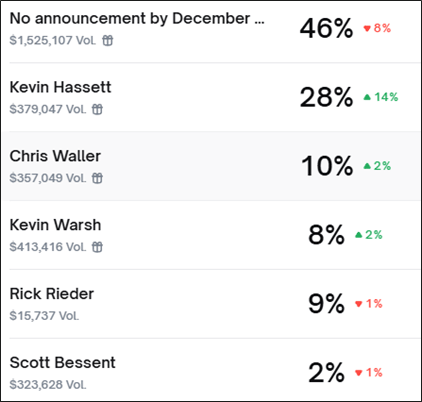

In there, Bessent suggests “hopefully have an answer before Christmas.” As mentioned, these stories are evergreen. There are dozens of them like this one from mid-August.

Here is what bettors think. Note the daily changes in red and green. Hassett has spiked, at the expense of the “No announcement by end of 2025” bucket…

It feels stupid chasing these narratives, but at some point, the administration will need to name a Fed chair and that choice is important. And hey, it felt stupid to buy stocks on April 10 when Trump tweeted “it’s a good time to buy stocks” and yet it was a good time to buy stocks!

Greg Marks, of HSBC and Citibank fame, wrote a good piece about Warsh. To me, Warsh looks underpriced as his vision of a less interventionist Fed and more domestic focus on bank deregulation fits nicely with the admin’s way of thinking. Here’s Greg’s piece:

Final thoughts

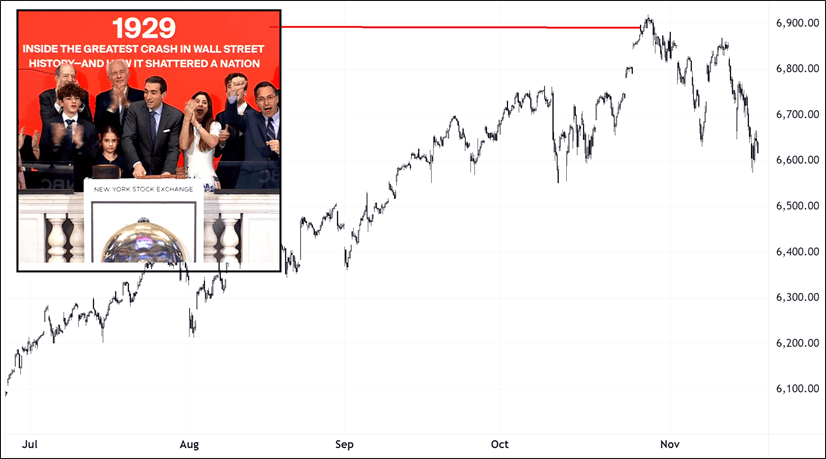

Advice to the NYSE Public Relations Department: When deciding who to pick to ring the bell… Maybe don’t pick a guy who wrote a book about a Wall Street Crash triggered by commercial banker greed, retail excess, Fed capture, and stock market manipulation? That might be… Bad karma? They literally rang a bell at the top.

The latest Russia/Ukraine story. If it’s on Axios, is it still a secret? I hope your day is money.

Author

Brent Donnelly

Spectra Markets

Brent Donnelly is the President of Spectra Markets. He has been trading currencies since 1995 and writing about macro since 2004. Brent is the author of “Alpha Trader” (2021) and “The Art of Currency Trading” (Wiley, 2019).