2022: The year of (gold) inflation

High inflation won’t go away in 2022. Good for gold. However, it is likely to continue to climb and reach its peak. That sounds a bit worse for gold.

If 2021 was tough for you, I don’t recommend reading Nostradamus’ predictions for the next year. This famous French astrologer saw inflation, hunger, and much more coming in 2022:

So high the price of wheat,

That man is stirred

His fellow man to eat in his despair

Yuk! So, life is about to get a little more complicated: we must now avoid becoming infected and being eaten by our fellow citizens! If you are interested in how cannibalism will affect the gold market, I’m afraid that I don’t have adequate data. Anyway, if you end up in the pot together with vegetables and your colleagues, gold’s performance probably won’t be your top priority.

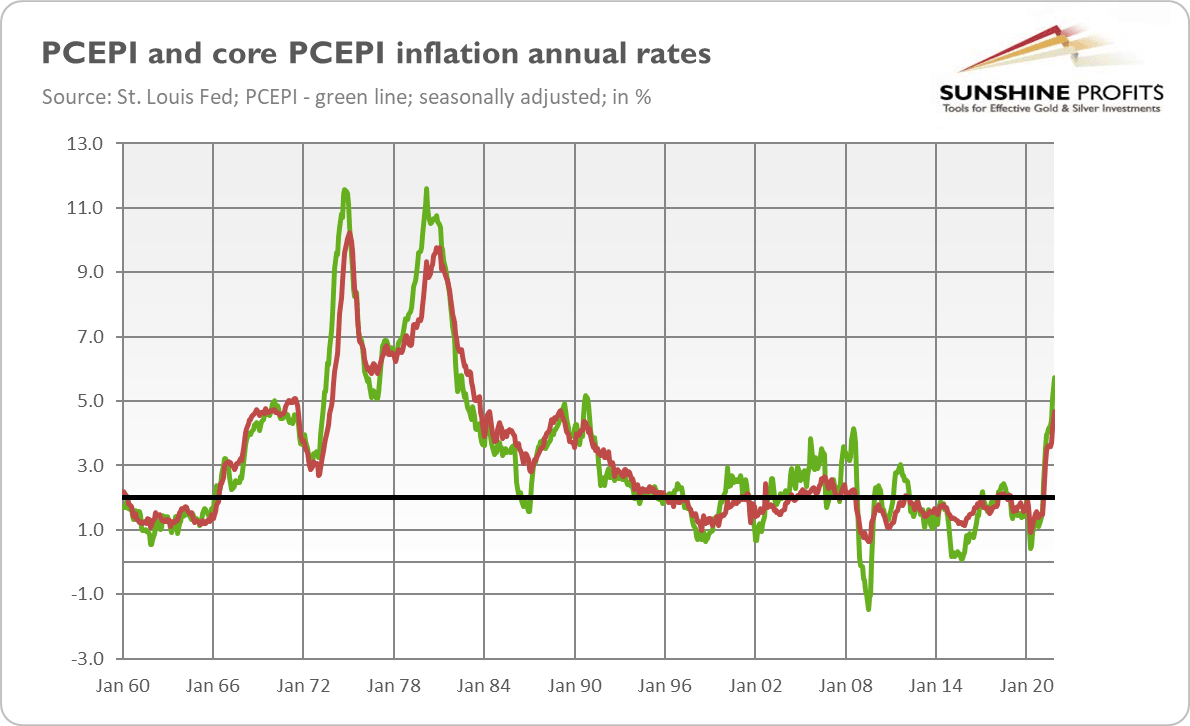

Hence, let’s focus on inflation. Last week, the Bureau of Economic Analysis released the latest data on the Personal Consumption Expenditures Price Index. This measure of inflation surged 5.7% in the 12 months ended in November, which was the fastest increase since July 1982. Meanwhile, as the chart below shows, the core index, which excludes energy and food, rose 4.7%. It was the highest jump since February 1989.

This is very important, as it shows that inflation is not elevated merely by rising energy prices. Instead, it’s more broad-based, which can make inflation more lasting. Indeed, there are strong reasons to expect that high inflation will stay with us in 2022.

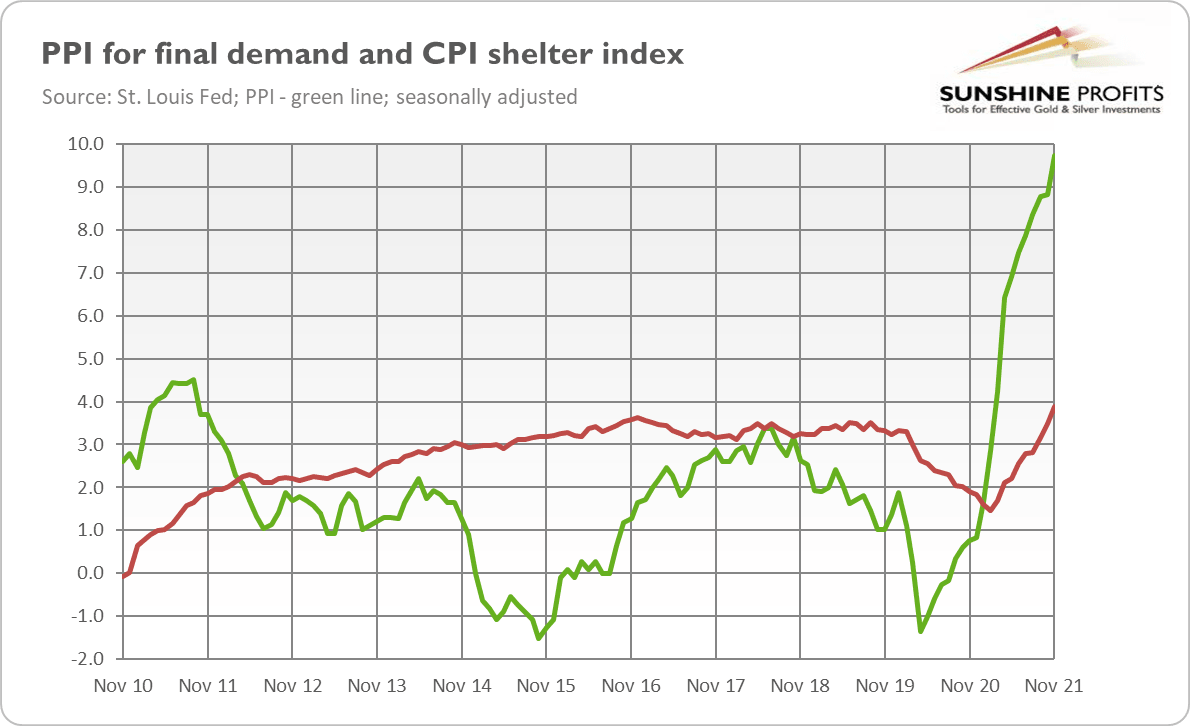

As the chart below shows, the shelter index – the biggest CPI component – has been rising recently, which should move the whole index up. In other words, surging home prices could translate into higher rents, supporting consumer inflation.

Additionally, the Producer Price Index has also been rallying this year. The final demand index rose 9.6% on an annual basis in November, the largest advance since 12-month data was first calculated in late 2010. Moreover, the commodity index surged 23%, and it was the highest jump since November 1974. All this indicates that inflationary pressure remains strong.

Implications for Gold

To be clear, inflation will eventually peak, and this will probably happen in 2022. This is because a one-time helicopter drop (the surge in the money supply) leads to a one-time jump in the price level. However, inflation is like toothpaste. It’s easy to get it out, but it’s difficult to get it back in again.

To use another metaphor, if you wait with your actions until you see the whites of the eyes of a tiger, you can be eaten (sorry for being monothematic today!). This was exactly the Fed’s strategy with the inflationary tiger for most of 2021. Yes, the US central bank accelerated tapering of quantitative easing in December, but it remains behind the curve (or, to continue the metaphor, it’s still holding the tiger by the tail).

What does it all mean for the gold market? High inflation should support gold prices. The expectations of a more hawkish Fed probably prevent a big rally, but ultra-low real interest rates are supportive of the yellow metal.

However, what is one of my biggest worries for the next year (except for the perspective of being eaten by hungry neighbors) is how gold will react to the peak in inflation. Although inflation will stay elevated, it won’t rise indefinitely. When it peaks, real interest rates could go up, negatively affecting the yellow metal.

Of course, one would say that the peak of inflation would be accompanied by a more dovish Fed, so disinflation doesn’t have to hurt gold, just as rising inflation didn’t make it shine. However, this is not so simple, and if inflation stays above 5%, the Fed could still feel obligated to act and bring inflation to its 2% target. Anyway, US monetary policy (together with fiscal policy) will be tighter compared to 2020 and to other major countries, which (together with a likely peak in inflation) creates a rather challenging macroeconomic environment for gold in 2022 (at least until worries about the negative consequences of the Fed’s tightening cycle emerge).

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Arkadiusz Jóźwiak

Comparic

Active on Forex since 2012. Started with commodities, now he is an active Forex trader.