2020 US Elections: Trump loss, split Congress is what markets want, most likely scenario out of four

- A return to normality under Biden with a Republican Senate would be welcomed by markets.

- Rising chances of a Democrat clean sweep would send stocks tumbling.

- A Trump victory with the current split would make investors shrug off the elections.

- The highly unlikely clean Republican sweep could trigger a rally.

Making America normal again – that seems to be the message conveyed by Joseph R. Biden, the presumptive Democratic nominee for President. The well-known former Vice President has vast experience and will likely provide a steady hand on the wheel. His lack of charisma is well-compensated with the impression of a decent man – that will make the right choices in the face of crisis.

Biden is a middle-of-the-road Democrat, one that tries to improve the economy as he did after the Great Financial Crisis under Barrack Obama. A resumption of steady growth under his presidency is likely.

Trump trouble

Incumbent President Donald J. Trump has failed the tests of unifying the nation amid protests against racial discrimination and coronavirus. He lost the popular vote by around 2.8 million voters in 2016 and made no efforts to win over those who did not support him.

Elections are first and foremost a referendum on the incumbent, and this is of higher significance for this attention-hungry president. Trump downplayed coronavirus as late as early March, seeing it as the Democrats' hoax – focusing on his reelection rather than the health of the people he is supposed to lead.

The self-centered approach of a person born rich and gone bankrupt several times – the opposite of the American dream – may work for entertainment but not for leading the world's richest country forward.

Trump, who refused to reveal his tax returns and potential conflicts of interest, clashed with allies and praised autocrats, fracturing the multilateral order America has created. Another four years for the incumbent could further damage foreign relations – hitting trade and the economy hard.

He gets good marks only on the economy, and that may fade away quickly. Even after a second wave has materialized – with Republican Texas reimposing restrictions, Trump refuses to lead by an example by wearing a mask and also rejects taking any responsibility.

The president's obsession with the winner image may become dangerous – he may attempt clinging to power even if he loses.

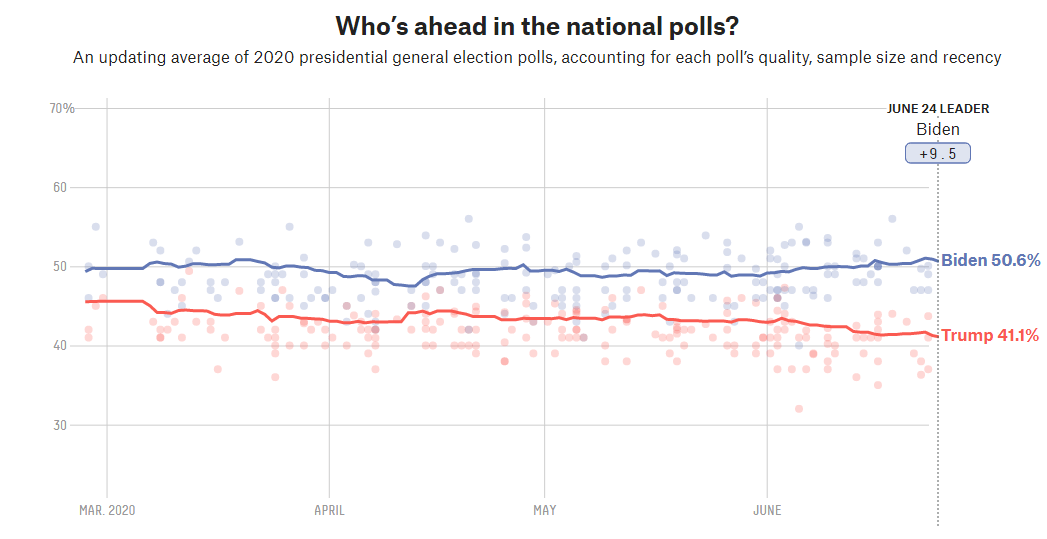

Biden has a substantial lead of around 9.5 over Trump, which is now the underdog. Trump is also behind in all battleground states.

Source: FiveThirtyEight

Socialist Democratic Revolution?

While investors may prefer Biden's normality over Trump's erraticism, they have good reasons to fear the former VP's primary rivals – Bernie Sanders and Elisabeth Warren. Both high-profile Senators have been veering the party to the left, with Sanders pushing for healthcare reforms that spook pharmaceuticals and Warren being the leading voice on curbing the financial sector.

Partially inspired by Trump's populist takeover of the GOP – often adopting conspiracy theories – the Democratic Party's radical left has been gaining ground. Alexandra Ocasio Cortez (AOC), a young and charismatic Representative, wants a substantial increase in taxes.

Democrats control the House and Republicans have a majority in the Senate. Despite the clashes, bipartisan cooperation worked well in providing fiscal relief to the coronavirus crisis – but prevented any long-term changes.

The Republican clean sweep in 2016 is what triggered the market rally – investors saw the opportunity to undo regulation. The ruling party successfully passed a tax cut – Trump's only legislative win.

The opposite could happen if Democrats sweep all levers of power. A unified government could undo tax cuts and slap new regulations, sending markets lower. The GOP is defending 23 Senate seats and the Democrats only 12. Most incumbents will likely be reelected, leaving the composition of Congress unchanged.

However, many states allow people to mark their preferred presidential choice at the top of the voting ticket, and the rest of the choices then go to the same party. That means that Republicans that want Trump out could find themselves voting out their Republican Senator.

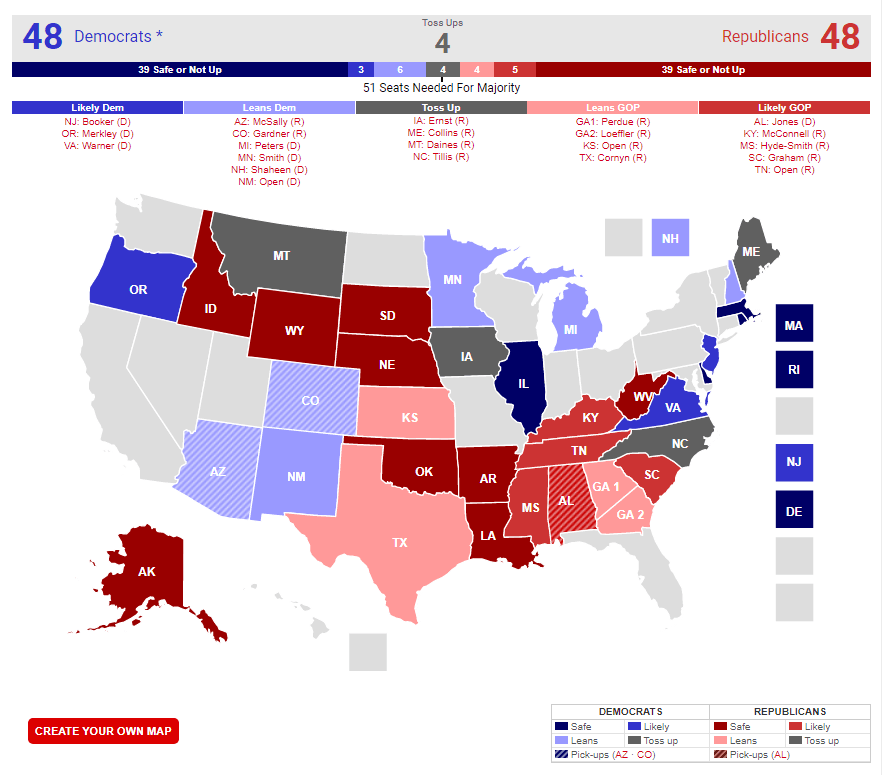

The battle for the Senate is currently tied, with both parties clinging to or winning 48 seats each – and four are up for grabs.

Source: Real Clear Politics

It is essential to note that in case of a 50-50 tie in the upper chamber, the Vice President serves as a tie-breaker. That raises the chances the Biden's running mate – yet to be named – will be the tipping point supporting laws that markets disapprove of.

Elections are held on November 3, leaving long months for everything to change in both directions several times. At the time of writing, investors are focused on coronavirus, monetary response, and fiscal response. However, significant changes in opinion polls may get noticed sooner than later.

Here are four scenarios for the run-up to the vote – markets will react strongly on election day but also move constantly as the clock ticks toward November 3.

1) President Biden, Republican Senate

As mentioned earlier, a return to the normal president in the White House but preventing any radical changes to America's capitalism would serve as a relief to markets. It would likely allow them to advance on higher prospects of closer trade ties with the world and fiscal support.

While Biden's current lead suggests Democrats have a chance to win the Senate, it could prove a high watermark for the challenger and his party. Therefore, the scenario of a split government is the most likely one.

A sub-case of this likely scenario would be that Trump refuses to concede, claiming fraud. That would cause a constitutional crisis that would plunge the country into chaos. However, that has a low probability and if he follows such a dangerous path, other Republicans may push him out, calming markets.

2) Clean sweep for Democrats

Seeing Sanders and AOC setting policy is the nightmare scenario for investors, and would send stocks plunging if it becomes more real. Not only banks and pharma would suffer, but broader equities.

The probability is medium, and it depends more on how Trump underperforms than anything else. His advisers may help him regain some of the lost Republican supporters.

3) Trump wins, split Congress

In this scenario, Trump edges out another electoral college victory – probably with a greater popular vote loss. Some voters would likely rage, but Democrats would accept the outcome. This option basically preserves that status quo and would cause markets to shrug off the results.

While Trump would likely continue damaging international relations, he would be unable to move any legislation forward.

4) Clean Republican sweep

This scenario has the lowest probability. Contrary to the Senate – where large and small states have an equal voice – the House is a better representation of the country. Despite Republican gerrymandering, Democrats' lead among Americans will likely be reflected in the vote for the House, as expressed in the 2018 mid-terms.

Nevertheless, if voters break toward Trump "big-league" as the president says, the voting tickets may boost GOP representatives down the ticket and provide a repeat of the 2016 scenario. While investors may fear Trump's international tirade, they may find solace in Republican lawmakers' ability to push through their agenda.

Conclusion

The most likely scenario is Biden defeating Trump but Republicans retaining the Senate. That would please markets unless the incumbent refuses to go quietly. The second-likely scenario is a clean sweep by Democrats, which would trigger a sell-off. Lower down the line, Trump may win reelection with no change in Congress, resulting in no material move. The least likely scenario is a repeat of 206.

More

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.