WTI Price Analysis: Bulls target $41 mark, API data in focus

- WTI looks to regain ground above $40 amid favorable technicals.

- US oil holds higher within a potential bull pennant pattern.

- Key support at $39.50 to keep the buyers hopeful ahead of API data.

WTI (futures on NYMEX) is trying hard to extend Monday’s rally amid cautious market mood, as investors remain caught between the US stimulus hopes and a lack of coronavirus updates on US President Donald Trump.

Oil traders look forward to the US crude stockpiles data due to be published by the American Petroleum Institute (API) later on Tuesday.

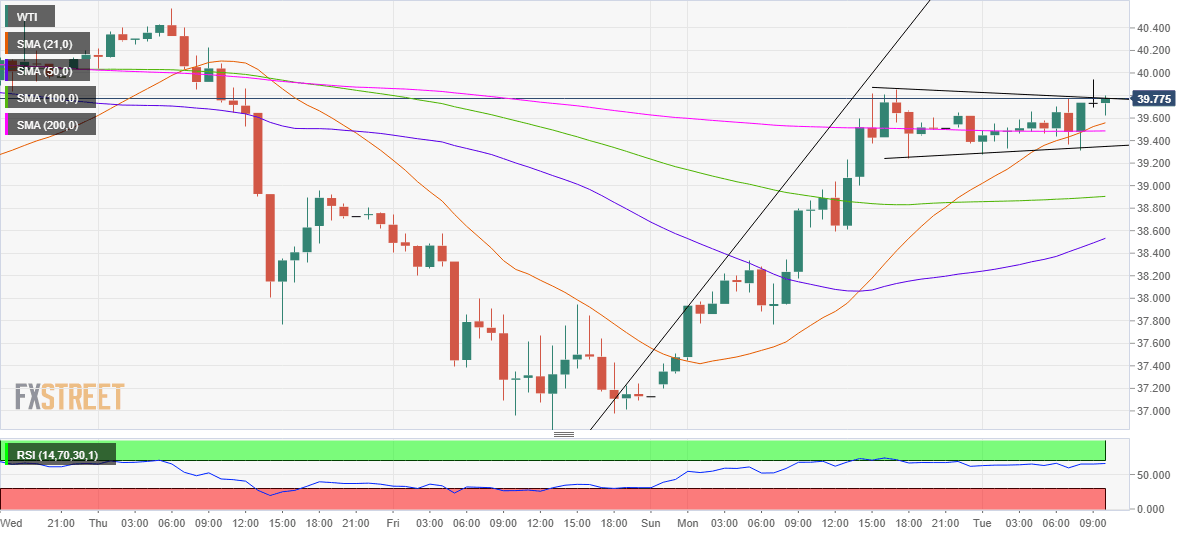

Meanwhile, looking at the hourly technical chart of the WTI barrel, the price is on the verge of a bull pennant breakout, teasing the upper barrier at 39.77.

An hourly close above the latter would validate the bullish formation, opening doors for a move towards 41.00.

However, the October 1 high at 40.57 could challenge the bulls on its way north. The hourly Relative Strength Index (RSI) lies in the bullish region while probing the overbought zone, backing the case for the additional upside.

Alternatively, acceptance below 39.50, the confluence of the 21 and 200-hourly Simple Moving Averages (HMA) could limit the downside attempts.

The next robust cushion is seen at the rising trendline support at 39.34, below which the horizontal 100-HMA at 38.90 could come into play.

WTI hourly chart

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.