WTI looks to test 21-DMA amid potential return of Iranian supply

- WTI sellers fight back control on Thursday, 21-DMA support in focus.

- The US oil hit by a likely return of Iranian supply, as nuclear talks progress.

- WTI needs to find acceptance above $66.00 to revive upbeat momentum.

WTI (futures on NYMEX) is meandering in daily lows near $65.50, feeling the pull of gravity amid concerns over increased supply if the sanctions on Iranian oil exports are lifted amid progress in the nuclear talks.

Meanwhile, oil demand concerns from India, the world’s third-largest oil consumer, continue to weigh on the black gold. Further, WTI also bears the brunt of the Fed’s tapering expectations, which keeps the sentiment around the US dollar buoyed.

However, the downside appears cushioned amid the arrival of the summer driving season in the US and Europe, which could likely bump up oil’s demand.

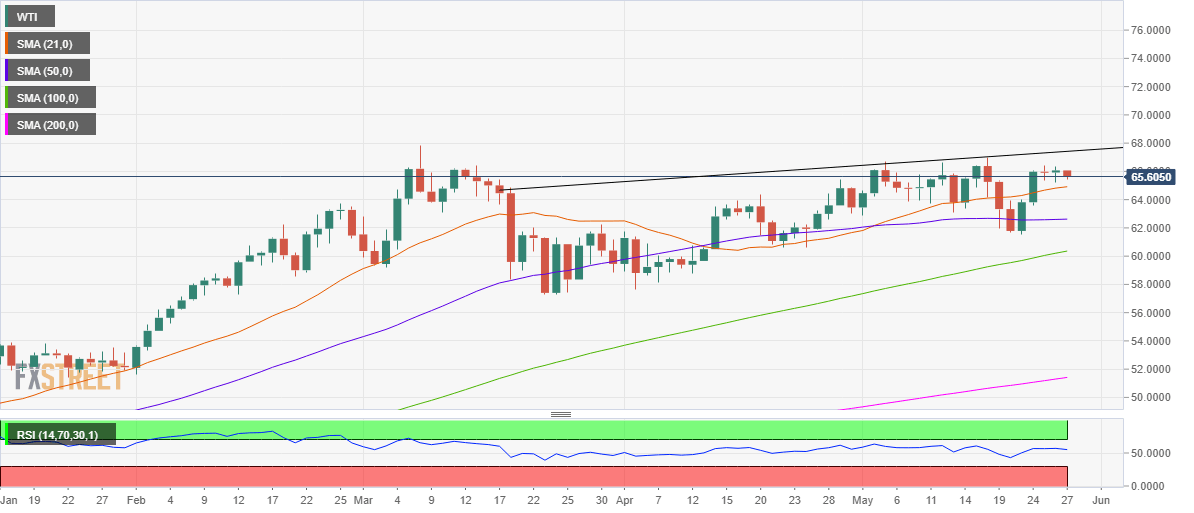

From a near-term technical perspective, the risks remain tilted to the downside, as oil looks to test the 21-daily moving average (SMA) at $64.91.

Defending this support is critical for the bulls, as a break below it could trigger a sharp drop towards the 50-DMA at $62.62.

WTI daily chart

However, with the 14-day Relative Strength Index (RSI) still holding above the central line, the 21-DMA support is likely to hold.

WTI needs to find acceptance above the recent tops near $66.40 for any meaningful recovery.

Going forward, a three-month-long rising trendline resistance at $67.41 is expected to act as a tough barrier.

WTI additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.