WTI: Good news from Trump's doctors help bulls avoid head-and-shoulders breakdown

- Trump's health progress pushes greenback lower and powers gains in WTI.

- Oil's rise has saved the day for the bulls, according to technical charts.

West Texas Intermediate (WTI), the North American oil benchmark, is flashing green at press time, as the US dollar is facing selling pressure. The haven demand for the greenback looks to have weakened in response to President Trump's doctors' comments that he could be discharged from coronavirus hospital as soon as Monday.

A barrel of WTI is currently trading at $37.84, representing a 1.9% gain on the day. Meanwhile, the dollar index, which gauges the greenback's value against majors, is down over 0.10% at 93.70.

Trump's health update has eased political uncertainty and is pushing the higher. The S&P 500 futures are now up more than 0.6% on the day.

As such, the anti-risk greenback is losing ground, and making dollar-denominated commodities like oil look attractive. Stocks came under pressure in the second half of last week after Trump said he and the first lady have tested positive for coronavirus. The dollar rallied on Friday, snapping a four-day losing trend and pushing oil down by 4.3%.

However, market optimism about Trump's health could be premature. That's because Trump's fluctuating oxygen levels and a steroid drug treatment suggest that the President is suffering a more severe case of Covid-19.

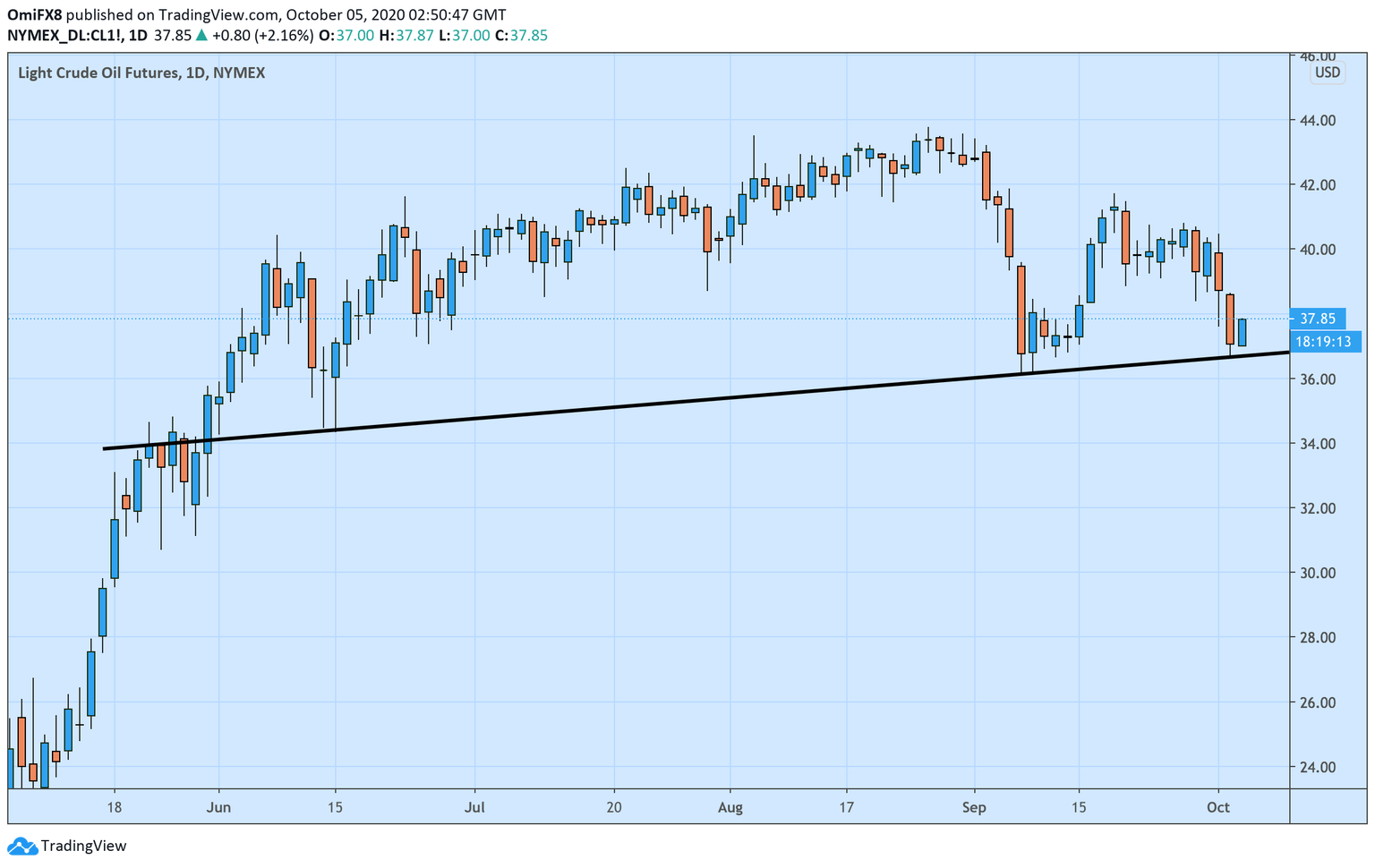

For now, the risk reset has saved the day for oil bulls. The daily chart shows the black gold has bounced from the head-and-shoulders neckline support at $36.70.

A close below that level would confirm a bullish-to-bearish trend change and create room for a sell-off to $29.88 (target as per the measured move method).

Daily chart

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.