Will Starbucks’ (SBUX Stock) coffee brewing brew more profits? [Video]

![Will Starbucks’ (SBUX Stock) coffee brewing brew more profits? [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Agriculture/Coffee/coffee-beans-44253278_XtraLarge.jpg)

Starbucks Corporation (SBUX) is a multinational conglomerate that specializes in coffee products, a global coffeehouse chain and other bakery products. Its coffee products range from freshly brewed coffee to ready-to-drink and single-serve coffee. Starbucks has become very successful at branding itself as the go-to specialty coffee retailer. SBUX is listed on NASDAQ and is component of Nasdaq 100 and S&P 500 under Consumer Discretionary.

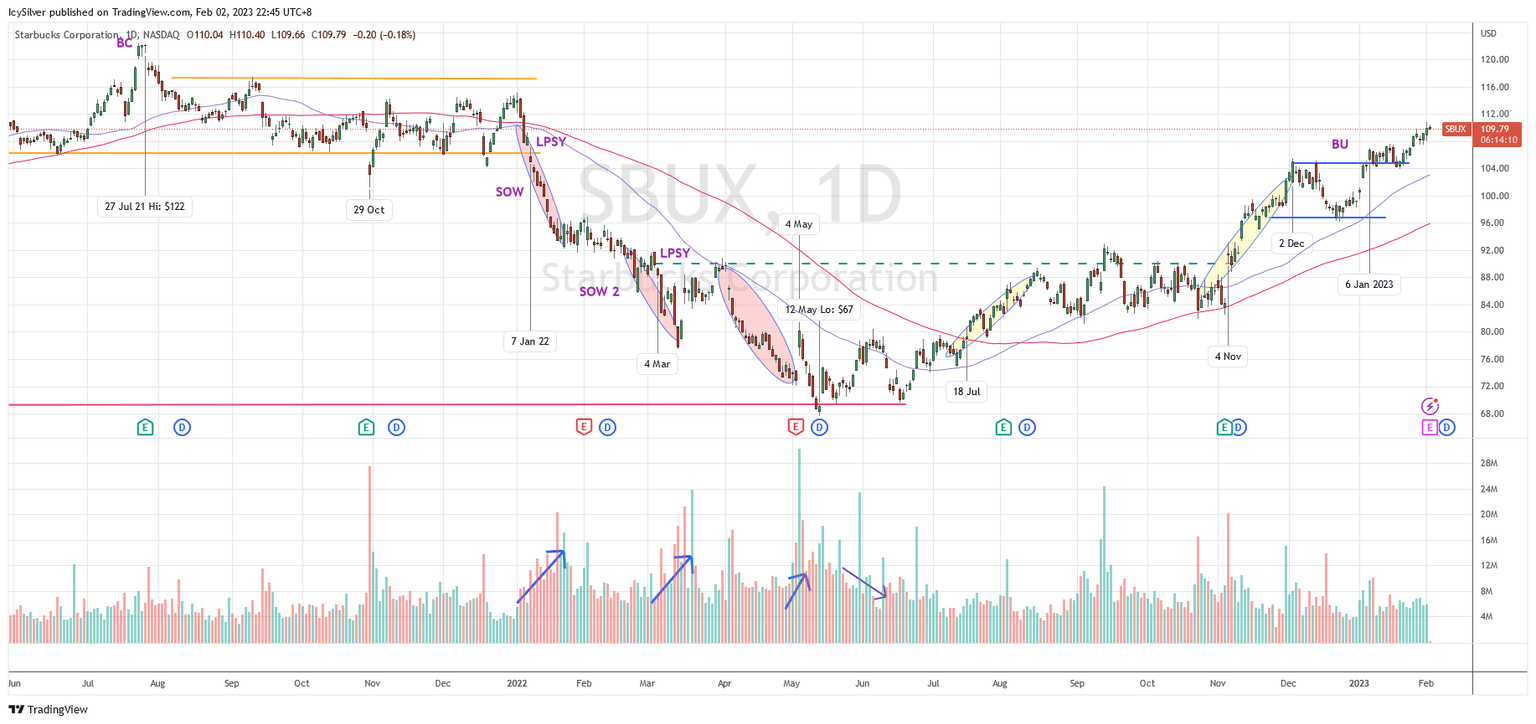

SBUX price had a last leg up to hit $122 in late July 2022. The price then retraced and bounced between $106 and $117. The first hint of weakness appeared with a gap down on 29 Oct with a big spike in volume, suggesting presence of supply. The confirmation came on 7 Jan 2022 as Wyckoff last point of supply (LPSY) when the price broke below $106 and completed the Wyckoff distribution phase. This was followed by Wyckoff sign of weakness (SOW) to around $92 accompanied by an increase in volume.

The weak rally off the support at 92 suggested weakness ahead. A selling climax was formed in Mar 2022 followed by an automatic rally. The rally hit $92 but reacted with a SOW as a lower low test. The 4 May bar gaps up with a huge spike of volume. However, the reaction broke the long term support of $70 as a spring-like action. Nevertheless, the volume subsequently decreased suggesting exhaustion of supply. This is further confirmed by higher lows, suggested no follow through to the downside.

Around 18 July, the price started Wyckoff sign of strength (SOS) rally and stayed committed at the higher end of the range between $82 and $90 for the next few weeks. This was the Wyckoff change of character, which changed the downward bias to a trading range. The price broke above $90 on 4 Nov with earning results as catalyst, signaling another SOS rally ahead. This suggests completion of a Wyckoff accumulation phase. The rally continued until 2 Dec then ranged between $96 and $105 in a Wyckoff back up (BU) manner. On 6 Jan 2023, the price managed to break above and committed above $105.

Bias

Bullish. According to the Wyckoff method, SBUX has completed the accumulation phase and is now in the mark up phase. It will likely rally up to challenge the previous high of $122.

If the price breaks below $105, it will then retest the support around $96.

SBUX was discussed in detail in my weekly live group coaching on 17 Jan 2023 before the market opened. The improving market breadth (with many stocks similar to SBUX) could suggest a new bull run as discussed in the video below.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.