Why did Pinterest’s shares surge 16% last Friday?

-

Activist investor group Elliott Investment Management has reportedly taken a ~9% stake in Pinterest to become the group’s largest shareholder.

-

Elliott Investment Management could push Pinterest to boost its ad revenue in global markets.

Pinterest’s (NYSE:PINS) shares closed up 16.2% on Friday on the New York Stock Exchange after the Wall Street Journal reported after market hours on Thursday that activist investor Elliott Investment Management has built a stake in the digital pinboard platform.

Top-level departures

The news came just two weeks after the company, which has been struggling with declining monthly active user numbers, announced that founder and CEO Ben Silbermann, has stepped down from the top job after more than a decade at the helm.

Silbermann, 39, co-founded Pinterest with Paul Sciarra and the company’s former Chief Design and Creative Officer Evan Sharp in 2010. He was succeeded by Bill Ready, formerly from Google.

The Information reported in late January that Pinterest had lost at least seven senior executives — in roles ranging from creator marketing to corporate development — at the time.

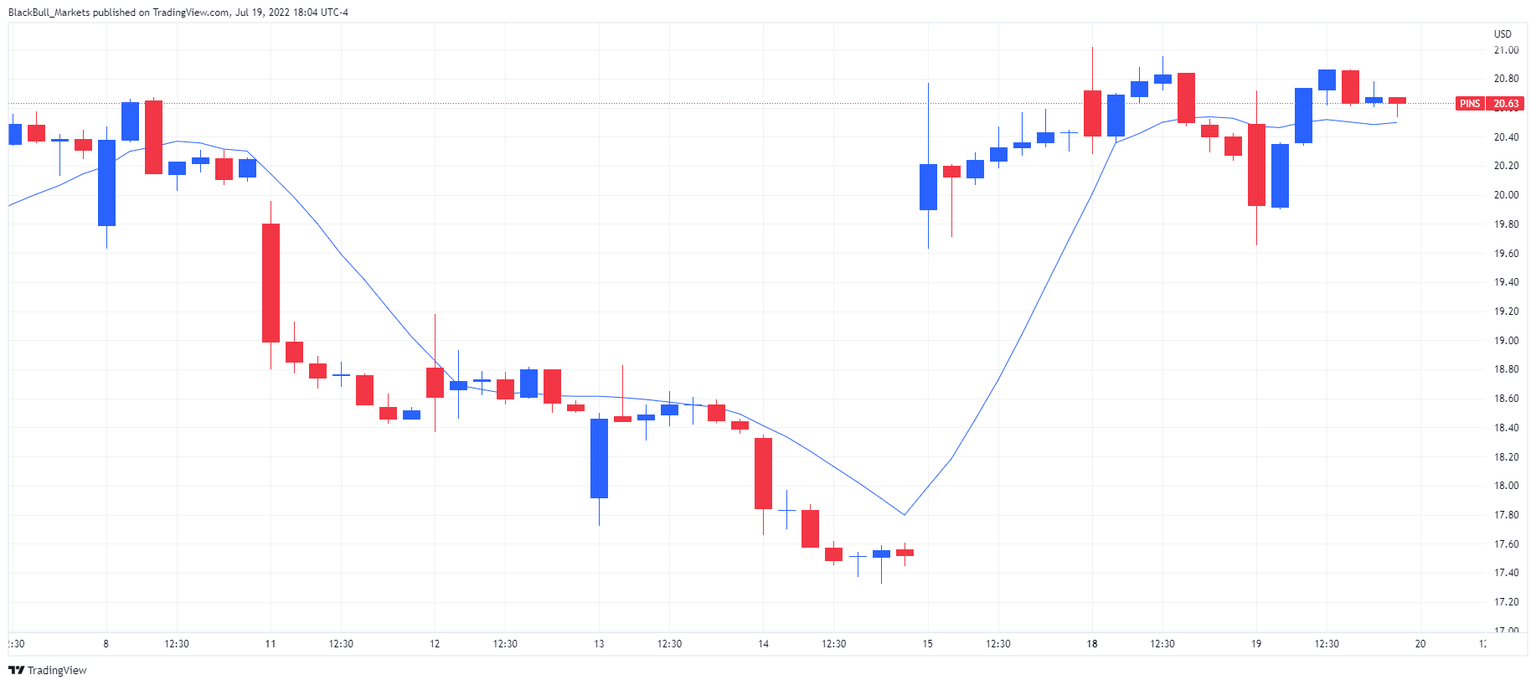

NYSE: PINS 1H

Losses mount on shrinking user base

The CEO change came as Pinterest booked another quarterly loss in the first quarter of 2022. Net loss totaled $5.3 million in the three months ended March 31, down from $21.7 million a year earlier, while revenue surged 18% year over year to $574.9 million.

Still, the company continues to suffer from declining user numbers. Its global monthly active users (MAUs) in the first quarter narrowed 9% from a year ago to 433 million, falling short of estimates. In 2021, the company’s MAUs shrank 6% from 2020 to 431 million.

TikTok wannabes

Pinterest has employed various measures to bring back users to its platform including attempting to be like TikTok. The platform launched a video-first feature called “Idea Pins” in May 2021, allowing users to post short-form videos. It follows the launch of a “watch feature” in October 2021 that was similar to TikTok’s feature in which users scrolled through short videos.

Pinterest is not the only app to attempt to be like TikTok. Even Meta Platforms’ (NASDAQ:META) Facebook and Instagram apps have introduced “Reels” to their platforms as the short-form video trend gains more momentum. Alphabet’s (NASDAQ:GOOGL) YouTube also introduced “Shorts” in late 2020 to keep up with the trend.

Elliott stepping in

With Elliott Investment Management reportedly taking a more than 9% stake in Pinterest to become the group’s largest shareholder, the activist investor could prompt Pinterest to speed up the restructuring of the platform’s business strategy.

Elliott is known for being an aggressive activist investor and among the most notable changes it helped carry out was the 2021 departure of Jack Dorsey as CEO of Twitter (NYSE:TWTR), the company he co-founded.

Elliott has also pushed for the spinoff of certain assets from eBay (NASDAQ:EBAY), leading to the divestment of StubHub in 2019 and Classifieds in 2020.

The WSJ report, which cited people familiar with the matter, said Elliott has been in talks with Pinterest over the past several weeks, although the subject of their discussions could not be determined.

Kenneth Squire, chief investment strategist at shareholder activism research firm 13D Monitor, said Elliott’s investment “is a sign of confidence in Ready’s ability to pursue several opportunities to better monetize the company’s user base.”

Elliott Investment Management could push Pinterest to boost its ad revenue in global markets where they are getting 10 to 20 cents per month per user. The platform could also increase its revenue by bolstering its e-commerce service.

“Given their expertise and history, we would expect Elliott to look for a board seat here, like they did at eBay and Twitter,” Squire said.

Squire expects the shakeup of Pinterest to be amicable as Elliott has gained a lot of respect from shareholders and directors in the tech sector since it shook things up at Twitter and eBay.

Pinterest’s shares are down 44% year-to-date as of Friday, and down 71% from a year earlier.

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.