Here is what you need to know on Monday, January 23

Equity markets are set for a flat opening in the United States after a fairly quiet European session. Large parts of Asia are off for Chinese New Year and Friday’s strong close on Wall Street has led to a cautious session. With earnings season really kicking in later this week investors are cautious. Also, we are now in the Federal Reserve blackout period before the next FOMC meeting and later this week we get the Gross Domestic Product and inflation data releases, further helping the risk-neutral sentiment.

The US Dollar remains under pressure down to 102 now for the Dollar Index. Gold price meanwhile also lower to $1,924 and Oil is steady at $82.20.

European indexes, CAC and Eurostoxx are lower by -0.3% while FTSE and DAX are flat.

US futures are lower, Nasdaq and S&P -0.2% and Dow -0.1%.

Wall Street top news

ECB Kazimir speaks of two more 50bps rate hikes.

Disney (DIS) Avatar grosses over $2 billion.

Reuters top news

Baker Hughes Co: (BKR) The oilfield services company missed fourth-quarter profit estimates.

Abbott Laboratories: (ABT) The drugmaker's Michigan plant, which was at the center of the U.S. baby formula shortage last year, faces a criminal investigation by the Justice Department, the Wall Street Journal reported on Friday.

Apple Inc: (AAPL) The company wants India to account for up to 25% of its production from about 5%-7% now, the trade minister told a conference, as the iPhone maker continues to move its manufacturing away from China.

Goldman Sachs Group Inc: (GS) The bank's asset management arm will significantly reduce the $59 billion of alternative investments that weighed on the bank's earnings, an executive told Reuters.

Nokia Oyj: (NOK) The company said it has signed a new cross-license patent agreement with Samsung.

PayPal Holdings Inc: (PYPY) Germany's cartel office regulator said it had initiated proceedings against the payment company in Europe over the possibility that it hindered competition.

Salesforce Inc: (CRM) Activist investor Elliott Management has made a multi-billion dollar investment in the cloud-based software firm, according to people familiar with the matter.

Spotify Technology SA: (SPOT) The company is planning layoffs as soon as this week to cut costs, Bloomberg News reported on Sunday.

Western Digital Corp: (WDC) The memory chip maker and Japan's Kioxia Holdings are in advanced talks for a possible merger which will involve a dual-listing, Bloomberg News reported on Friday.

Upgrades and downgrades

Upgrades

Monday, January 23, 2023

|

COMPANY |

TICKER |

BROKERAGE FIRM |

RATINGS CHANGE |

PRICE TARGET |

|---|---|---|---|---|

|

Advanced Micro |

AMD |

Barclays |

Equal Weight>>Overweight |

$70>>$85 |

|

Qualcomm |

QCOM |

Barclays |

Equal Weight>>Overweight |

$120>>$150 |

|

Seagate Tech |

STX |

Barclays |

Equal Weight>>Overweight |

$50>>$70 |

|

Skyworks |

SWKS |

Barclays |

Equal Weight>>Overweight |

$95>>$125 |

|

Sotera Health |

SHC |

JP Morgan |

Underweight>>Neutral |

$6>>$18 |

|

Shopify |

SHOP |

Deutsche Bank |

Hold>>Buy |

$40>>$50 |

|

AssetMark |

AMK |

JP Morgan |

Neutral>>Overweight |

$24>>$32 |

Downgrades

Monday, January 23, 2023

|

COMPANY |

TICKER |

BROKERAGE FIRM |

RATINGS CHANGE |

PRICE TARGET |

|---|---|---|---|---|

|

Applied Materials |

AMAT |

Barclays |

Equal Weight>>Underweight |

$80>>$90 |

|

Ingredion |

INGR |

Barclays |

Overweight>>Equal Weight |

$105>>$110 |

|

KLA Corporation |

KLAC |

Barclays |

Equal Weight>>Underweight |

$260>>$325 |

|

Tapestry |

TPR |

Barclays |

Overweight>>Equal Weight |

$43 |

|

Warner Music Group |

WMG |

Barclays |

Overweight>>Equal Weight |

$35 |

|

Range Resources |

RRC |

The Benchmark Company |

Buy>>Hold |

|

|

SentinelOne |

S |

Deutsche Bank |

Buy>>Hold |

$20>>$15 |

|

Workday |

WDAY |

Deutsche Bank |

Buy>>Hold |

$215>>$195 |

|

Veeco Instruments |

VECO |

Barclays |

Overweight>>Equal Weight |

$19>>$20 |

Source: WSJ.com

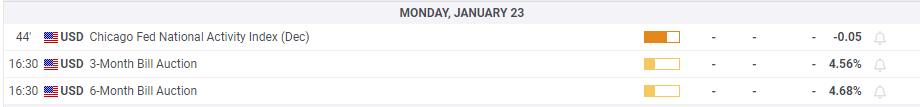

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.