USD/MXN Price Analysis: Pares the biggest daily loss in a year around 18.60

- USD/MXN remains sidelined near one-week-old ascending support line after falling the most since March 2022.

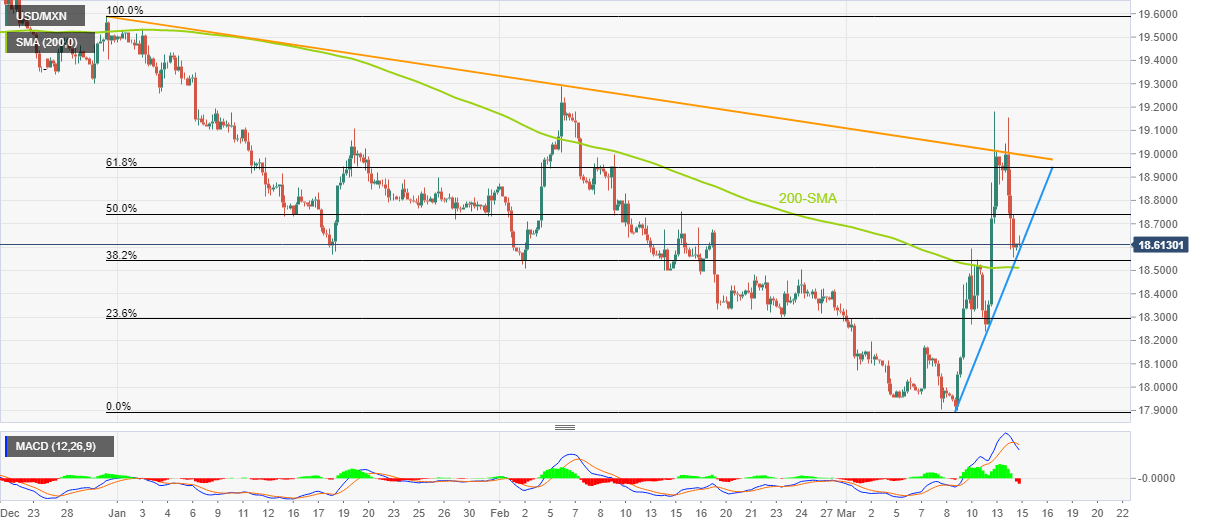

- Clear U-turn from 2.5-month-old descending resistance line, bearish MACD signals keep sellers hopeful.

- 200-SMA acts as an extra filter towards the south.

USD/MXN holds lower ground near 18.61 as bears poke one-week-old ascending support line during early Wednesday. In doing so, the Mexican Peso (MXN) pair justifies the bearish MACD signals, as well as the quote’s U-turn from a downward-sloping resistance line from December 30, 2022.

It’s worth noting that the 200-SMA level surrounding 18.50 acts as additional support, other than the aforementioned trend line of near 18.60.

In a case where USD/MXN remains weak past 18.50, the odds of witnessing a slump towards the weekly low near 18.20 and then to the March 07 peak of 18.17 can’t be ruled out.

Should the MXN pair manage to conquer the 18.17 support, the bears can quickly approach the 18.00 psychological magnet before eyeing the monthly low of 17.90, also the lowest levels since October 2018.

On the contrary, USD/MXN recovery could initially aim for the 50% and 61.8% Fibonacci retracement level of the pair’s declines from late December 2022 to early March 2023, respectively near 18.75 and 18.95 in that order.

However, the pair buyers remain off the table unless successfully cross the multi-day-old resistance line, around the 19.00 round figure.

Overall, USD/MXN is likely to remain bearish even as the downside room appears limited.

USD/MXN: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.