USD/MXN nearby two-week lows below 18.40 on an upbeat mood

- USD/MXN prints losses below 18.40 spurred on risk appetite despite higher UST bond yields.

- US recession risks had risen, according to Minnesota’s Fed President Kashkari.

- USD/MXN Price Analysis: To continue its downtrend below 18.7968.

The USD/MXN tumbles to fresh two-week lows in the North American session at 18.3259, and sellers are taking a respite, exchanging hands slightly above the week’s lows. Investors shrugging off banking crisis woes shifted sentiment positively. Therefore, risk-perceived currencies in the FX space are printing gains. The USD/MXN trades at 18.3902.

USD/MXN touched fresh weekly lows, despite a deficit in Mexican Trade Balance

Wall Street is opening the week with gains. A light economic docket in the United States (US) keeps traders focused on the developments around global banks. News emerged that First Citizens BancShares, Inc. agreeing to buy SVB Financial Group spurred an uptick in sentiment, which sent the USD/MXN sliding to its new weekly lows. Nevertheless, US Treasury bond yields are recovering, capping the USD/MXN drop.

US Treasury bond yields are rising, with the 10-year benchmark note rate at 3.473%, gaining almost ten basis points. However, the greenback has failed to follow suit with UST bond yields, with the US Dollar Index registering losses of 0.14%, at 102.973.

Meanwhile, money market futures expect the US Federal Reserve (Fed) to hold rates unchanged at the May meeting, as shown by the CME FedWatch Tool. Odds are at 63.8%, vs. 38.2% chances of a 25 bps rate hike.

During the weekend, Minnesota’s Fed President Neil Kashkari said that the risks for a recession have increased after the banking system crisis.

On the Mexican front, the Balance of Trade for February missed estimates of a $0.9B surplus and printed a deficit of $1.84B. However, the figures showed some improvement after January’s $4.125B deficit. Exports were reduced by 2.80% YoY in February, blamed on crude oil exports dropping 19.2%, while Imports grew at a 4.1% YoY pace.

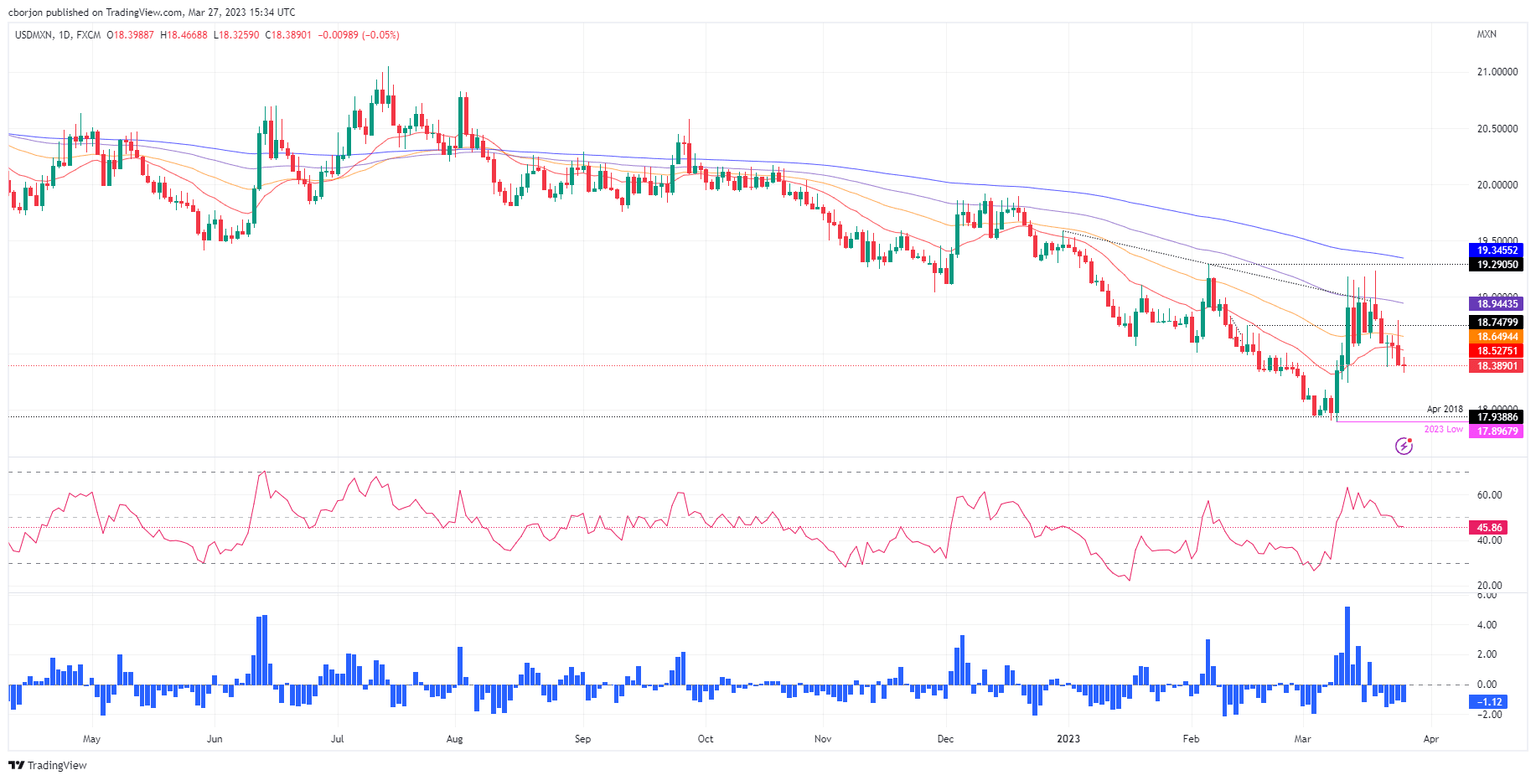

USD/MXN Technical analysis

USD/MXN remains neutral to downward biased, capped by the 20-day Exponential Moving Average (EMA) at around 18.5290, slightly above the psychological 18.50 figure. Oscillators remained in bearish areas, with the Relative Strength Index (RSI) below 50, while the Rate of Change (RoC) stayed below the neutral line. Therefore, further downside is warranted, but the market mood could spur a reversal.

Hence, the USD/MXN first support would be the weekly low at 18.3259. A breach of the latter will expose the March 13 low at 18.2369, followed by the YTD low at 17.8967. On the other hand, if the USD/MXN reclaims 18.50, that could open the door for further gains. But as long as the USD/MXN stays below 18.7968, the pair will remain tilted to the downside.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.