USD/MXN drops but remains above 17.0000 amidst a hot US PPI reading

- The Mexican Peso (MXN) advances against the US Dollar, despite overall US Dollar strength.

- Banxico’s decision to hold rates at 11.25% boosted the Mexican Peso.

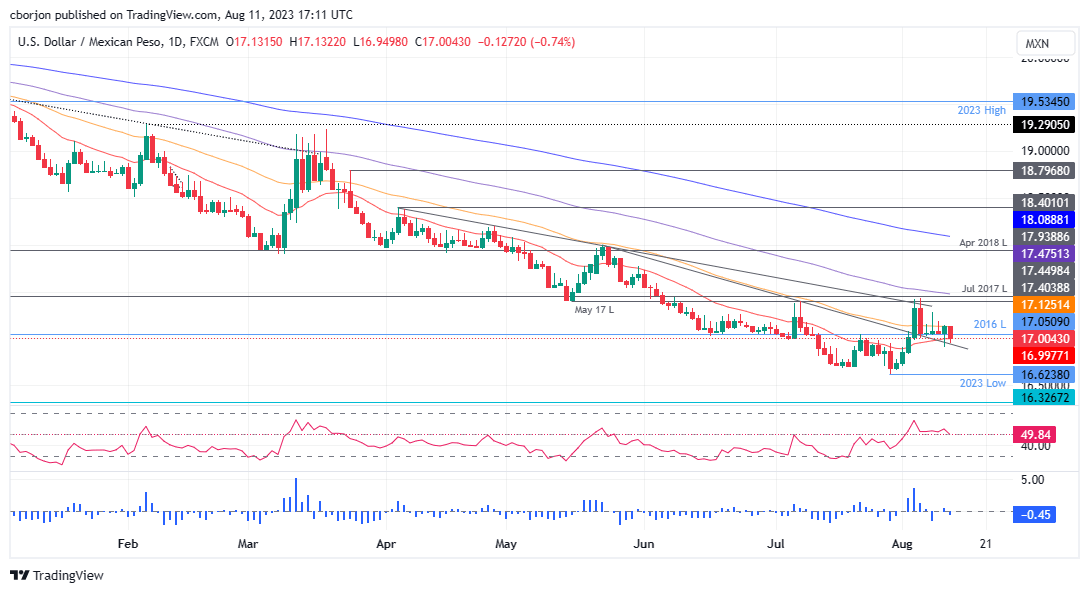

- USD/MXN may stabilize near current levels, potentially reaching 17.5000 if surpassing 17.4100. A daily close below 17.0000 could indicate an extended downward trend.

The Mexican Peso (MXN) appreciates against the US Dollar (USD), bucking the trend of Latin American currencies weakening on Friday after the Bank of Mexico (Banxico) kept rates unchanged, even though an uptick in US factory inflation boosted the USD. Nevertheless, the USD/MXN extends its losses and trades above the 17.0000 figure for seven straight days.

Banxico’s decision to maintain rates propels the MXN as it defies the Latin American currency trend on Friday

A risk-off impulse keeps the Greenback in the driver’s seat except for the MXN, with the emerging market currency posting solid gains of 0.87% as the USD/MXN extends its losses past 17.0000. On Thursday, Banxico decided unanimously to hold rates at 11.25%, as the central bank underscored the inflationary outlook as remaining “very complex” and suggested a similar approach as the Federal Reserve, keeping rates higher for longer. Although inflation is converging towards Banxico’s 3% plus or minus 1% range, with July CPI at 4.79%, the central bank continues to display a hawkish message. Meanwhile, analysts estimate Banxico’s first rate cut towards the end of the year.

That favored USD/MXN downside, accelerated by soft US consumer inflation data. USD/MXN gained some traction above 17.0000 after the US Department of Labor reported on the Producer Price Index (PPI) for July came at 0.3% MoM above forecasts of 0.2%, while annual numbers increased from 0.2% to 0.8%. Core PPI readings which exclude volatile items to gather a better reading of inflation, climbed 0.3% MoM, exceeding estimates and the prior’s month -0.1% slide, while annually based, exceeded estimates but was unchanged, compared to June’s 2.4%.

The University of Michigan Consumer Sentiment poll, revealed that US consumer sentiment slightly deteriorated. Still, Americans remain optimistic that inflation would get lowered after the US Federal Reserve (Fed) increased 525 bps its borrowing costs, with inflation expected to dive below 3% on a five-year horizon.

In the meantime, the US Dollar Index (DXY), which measures the buck’s performance against a basket of six currencies, rises 0.20%, at 102.866, underpinned by US Treasury bond yields climbing, with the US 10-year benchmark note sitting at 4.160%, gains five basis point.

Given the backdrop, the USD/MXN would remain subdued, at around current exchange rates, unless the pair breaks above 17.4100, which could see the pair finding acceptance at around 17.5000. Otherwise, further downside is expected, if USD/MXN prints a daily close below 17.0000.

USD/MXN Price Analysis: Technical outlook

From a technical standpoint, the USD/MXN is trading within the 17.00-17.30 range, with neither buyers nor sellers taking control of the USD/MXN pair direction. The USD/MXN spot price remains above the 20-day Exponential Moving Average (EMA) at 16.9946, which could pave the way for further upside, but buyers must lift the exchange rate above the May 17 swing low of 17.4039 to challenge the 100-day EMA at 17.4746, and the 17.5000 mark. Conversely, a daily close below 17.00 could expose the USD/MXN to further selling pressure, with sellers eyeing 16.6238, the YTD low.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.