USD/JPY rises back above 128.50 on broad US Dollar strength, ahead of the BoJ’s meeting

- The USD/JPY traded below 128.00 for the first time since June 2022.

- USD/JPY traders are bracing for the Bank of Japan’s monetary policy meeting on Wednesday.

- USD/JPY Price Analysis: Downward biased; it could test 125.00 in the near term.

The USD/JPY recovered after hitting an eight-month low around 127.21, reclaiming 128.00 and advancing sharply toward 128.40 on a thin liquidity North American session. An absent US economic docket on the observance of Martin Luther King Jr. day keeps traders leaning on what the US/Japanese calendar presents ahead. At the time of writing, the USD/JPY is trading at 128.55.

US Dollar remains bid, a tailwind for the USD/JPY

US equity futures continue to trade with losses on low volumes. However, with Q4 earnings crossing newswires, equities might continue to lead global investors’ moods. Expectations around the Bank of Japan’s (BoJ) Wednesday’s monetary policy decision continue to mount after tweaking its Yield Curve Control (YCC) at December’s meeting, which expanded the band of the 10-year Japanese Government Bonds (JGBs) from 0.25% to around 0.50%. The BoJ is the only central bank that has not raised rates, though further tightening is likely in the months ahead.

Deutsche Bank (DB) analysts expect the BoJ to continue its easing stance, but they believe that the Outlook Report will update the bank’s inflation forecast to 2% for 2022-2024. Additionally and abandonment of the YCC by the end of Q2 of 2023 is expected.

A day after the BoJ’s decision, the Japanese economic docket will feature the National Consumer Price Index (CPI), with core CPI (excluding food) estimated at 3.9% YoY vs. 3.7% in November, and excluding food and energy is foreseen at 3.1%.

Elsewhere, the US economic calendar will feature the US Empire State Manufacturing Survey, alongside Fed speaking and the Beige book, as the US Central Bank prepares for the year’s first monetary policy. On Wednesday, US Retail Sales and PPI will get a look, while Initial Jobless Claims and Housing data will be revealed on Thursday.

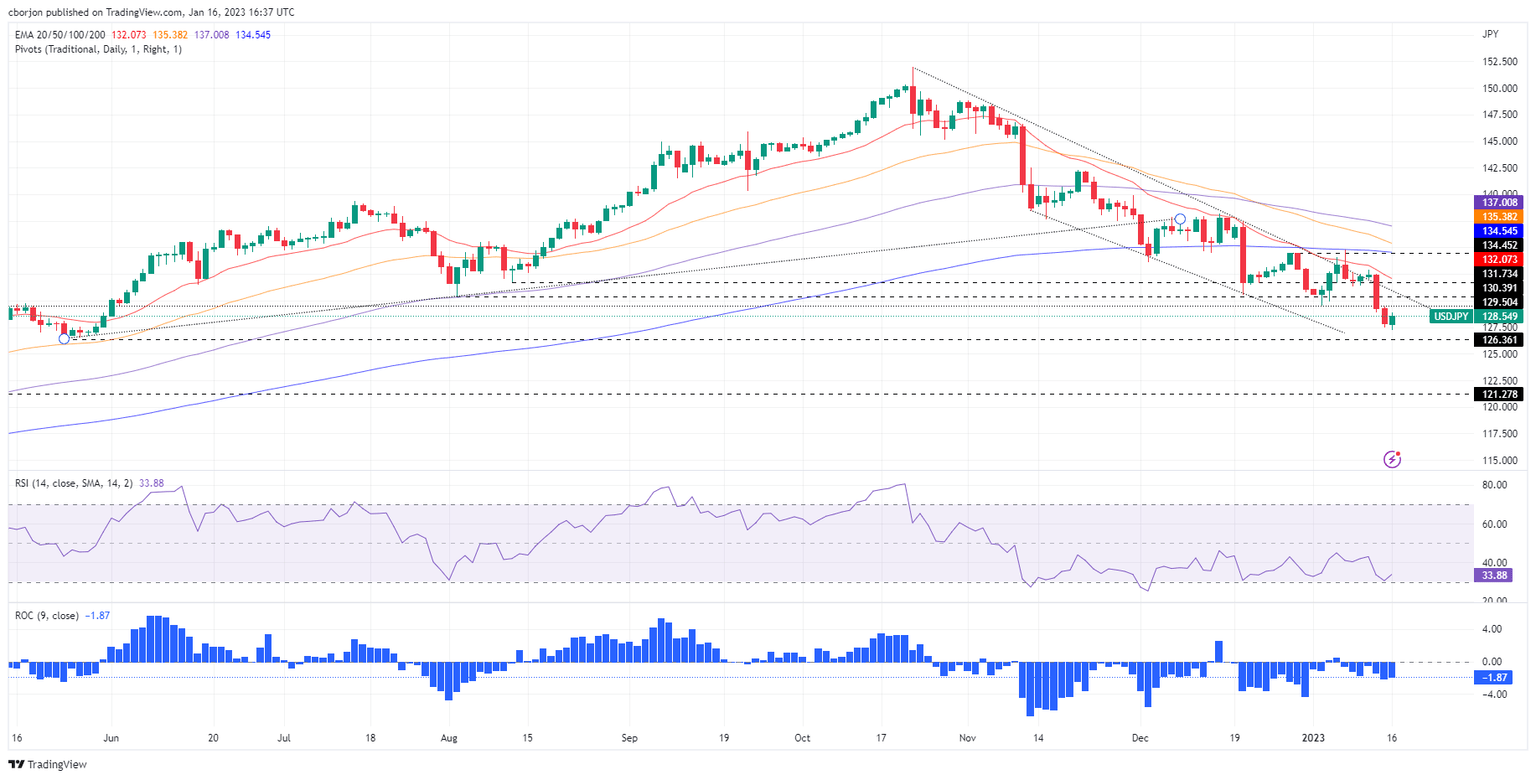

USD/JPY Price Analysis: Technical outlook

Despite the ongoing correction, the USD/JPY daily chart portrays the pair’s downward biased, threatening to erase last Friday’s gains. As long as the exchange rates persist beneath 132.87, the last higher-high achieved for the USD/JPY, the USD/JPY should be poised to test the May 24 swing low of 126.36, followed by the 125.00 figure, ahead of the March 31 pivot low of 121.28.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.