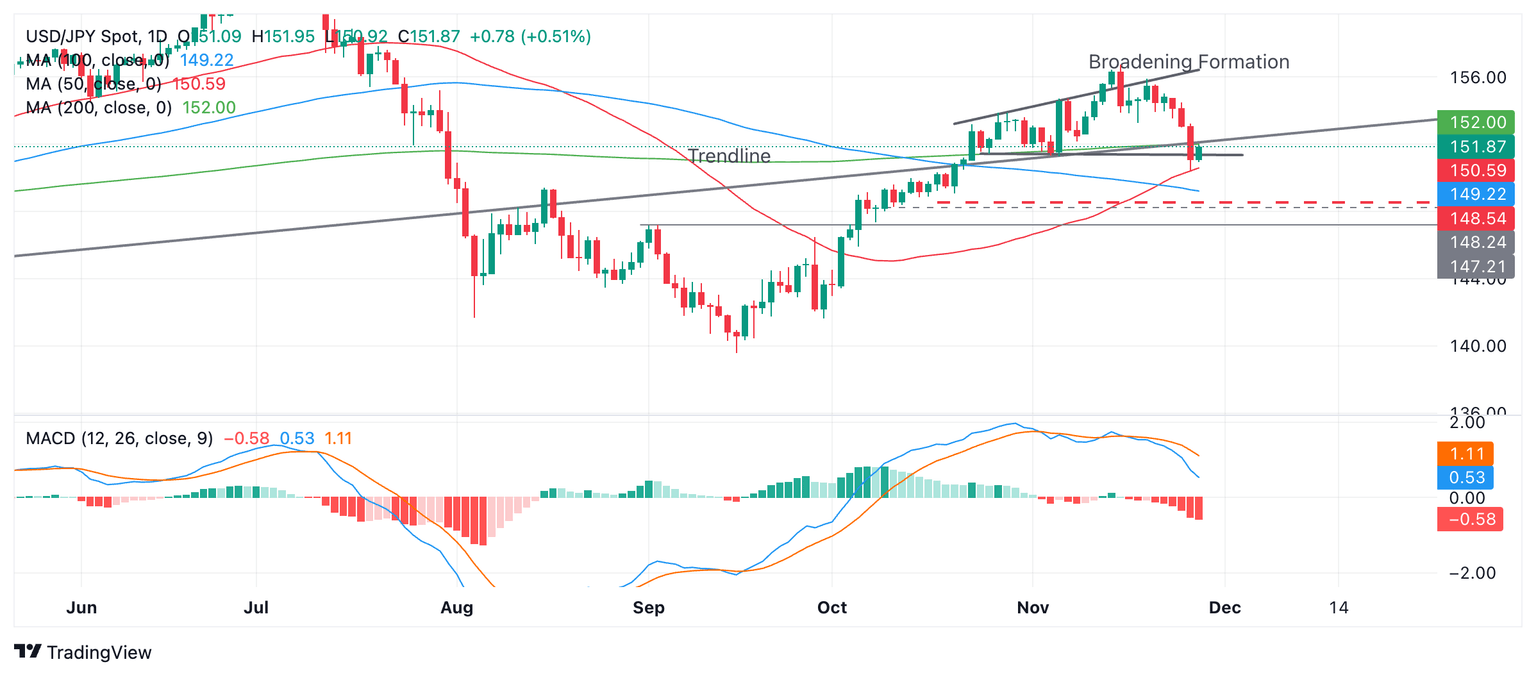

USD/JPY Price Prediction: Falls to base of Broadening Formation, threatens breakdown

- USD/JPY has fallen to the base of a bearish price pattern.

- The pair has bounced but remains vulnerable to further downside.

USD/JPY has fallen to the base of a bearish Broadening Formation price pattern and the 50-day Simple Moving Average (SMA) just below at 150.59, and bounced.

USD/JPY Daily Chart

A break below the 150.46 November 27 low would cement the breakdown from the pattern and probably lead to more downside toward 148.54, the downside target for the pattern, followed by 148.24 the September 2, key swing high.

The (blue) Moving Average Convergence Divergence (MACD) momentum indicator recently crossed below the red signal line and they are diverging – a bearish indication.

It is possible the pattern may not have finished forming yet in which case it could be in the process of beginning a new up leg within the boundary lines. This could either rally about half way up before pettering out, or all the way up to the top of the pattern in the 156.00s. It is still too early to say whether either of these outcomes is likely to be the case.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.