USD/JPY Price Forecast: 20-EMA acts as key barrier

- USD/JPY surrenders early gains as the US Dollar struggles to extend its recovery.

- US President Trump has signaled that the EU increase efforts for quick trade negotiations.

- 10-year Japan Government bond yields soar to near 1.52%, prompting strength in the Japanese Yen.

The USD/JPY pair gives back its initial gains and falls to near 144.20 during European trading hours on Wednesday. The asset faces pressure as the US Dollar (USD) struggles to extend Tuesday’s strong recovery move.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, falls back from the intraday high of 99.85 and flattens around 99.50.

The Greenback recovered strongly on Tuesday as United States (US) President Donald Trump signaled that the European Union (EU) is increasing efforts for trade negotiations. I have just been informed that the EU has called to quickly establish meeting dates. This is a positive event, and I hope that they will," Trump wrote in a post on Truth.Social.

Meanwhile, some strength in the Japanese Yen (JPY) due to rising Japanese Government Bond Yields has also weighed on the pair. 10-year JGB yields surge by 3% to near 1.52% as Japan’s Ministry of Finance signaled that it will consider tweaking the composition of its bond program, which could involve cuts to its super-long bond issuance, Reuters reported.

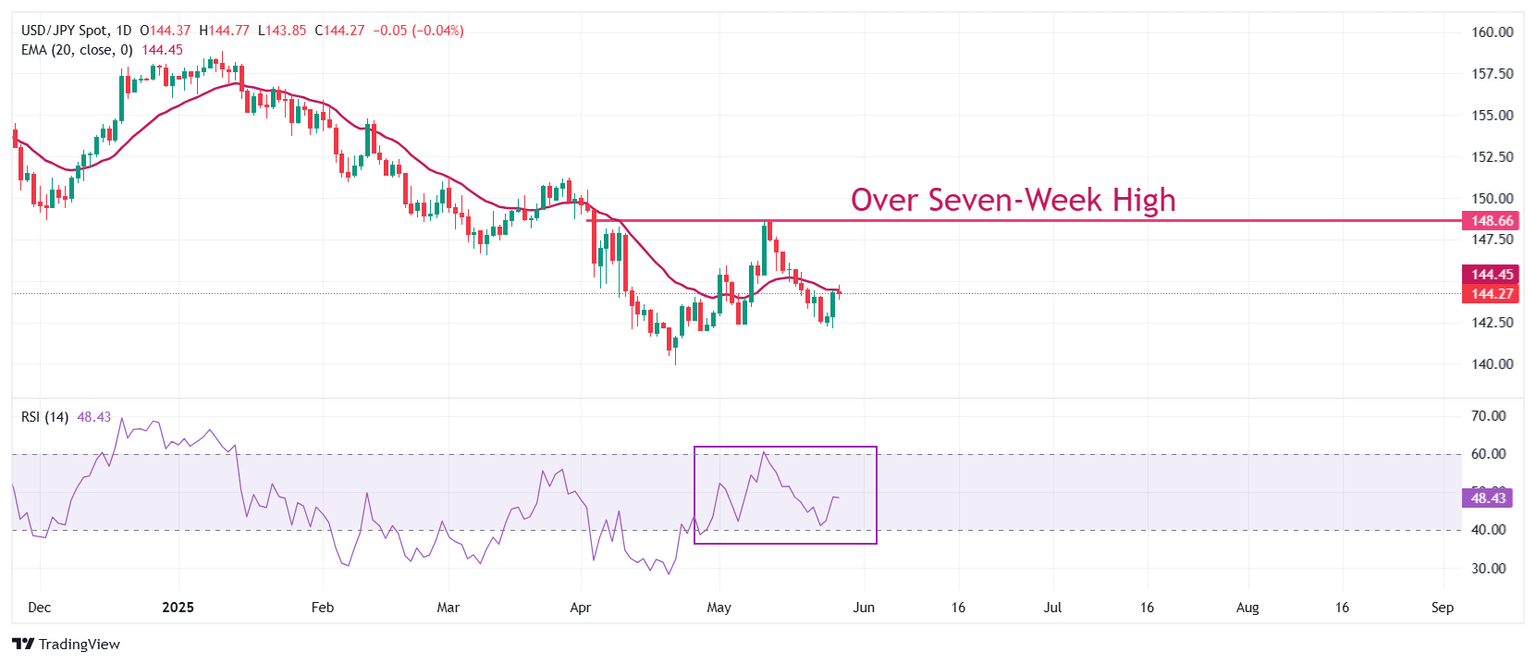

USD/JPY struggles to break above the 20-day Exponential Moving Average (EMA), which is currently around 144.45, indicating that the near-term trend remains uncertain.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, suggesting a sideways trend.

An upside move in the pair towards the psychological level of 150.00 and the March 28 high of 151.21 would come if it breaks above an over eight-week high of 148.65.

The asset would face more downside towards the April 22 low of 139.90 and the 14 July 2023 low of 137.25 if it breaks below the May 7 low of 142.42.

USD/JPY daily chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.