USD/JPY Price Analysis: Trends upward for third-straight day, buyers eye 162.00

- USD/JPY gains over 0.30%, buoyed by Powell's stance against rate cuts without clear disinflation.

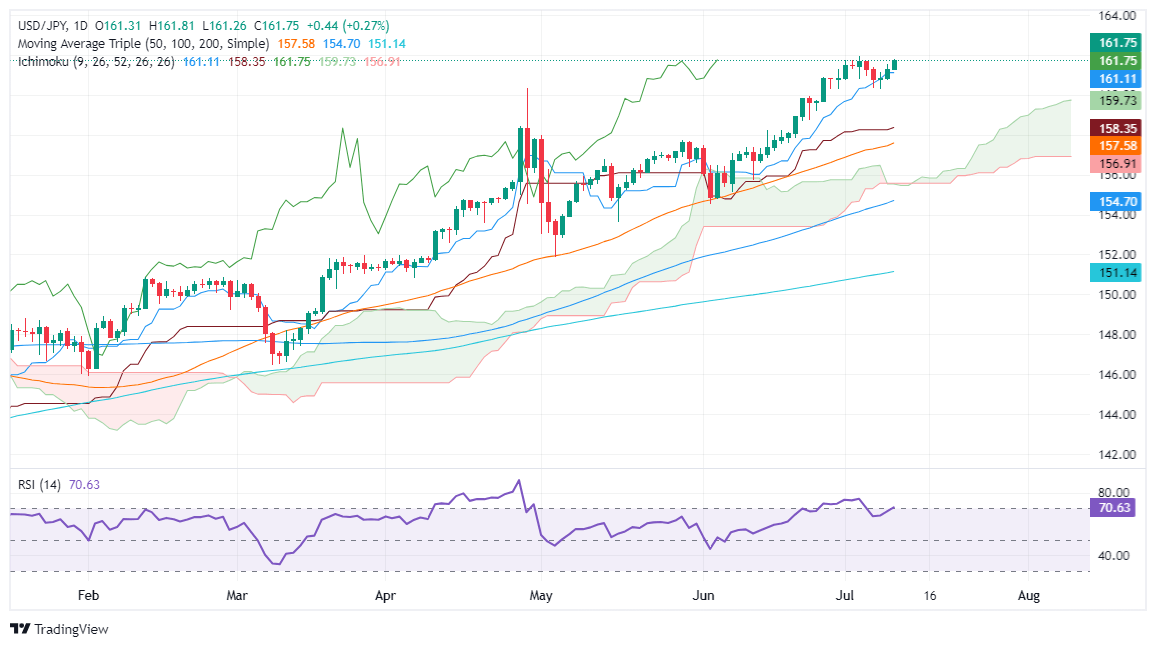

- Technicals hint at resistance near the 162.00 mark; RSI approaches overbought territory.

- Support levels to monitor: 161.10 (Tenkan-Sen), 160.73 (July 9 low), 160.26 (July 8 low) if bears take over.

The USD/JPY stretched its advance to three consecutive days and registered gains of more than 0.30% due to Fed Chair Jerome Powell sticking to the script. He said that lowering the fed funds rate is not an option unless there is progress in the disinflation process. The pair trades at 161.77, approaching the year-to-date (YTD) high of 161.95.

USD/JPY Price Analysis: Technical outlook

From a technical standpoint, the USD/JPY uptrend remains intact, though sellers could emerge at around the psychological 162.00 resistance level.

The momentum indicates a buyer-dominated market; the Relative Strength Index (RSI) hovers near overbought conditions. This could hinder the bulls' drive to lift the USD/JPY exchange rate or pave the way for consolidation.

If USD/JPY decisively clears 162.00, the next resistance would be 163.00, and the November 1986 high of 164.87.

Conversely, if bears stepped in and dragged prices below the Tekan-Sen at 161.10, it could exacerbate a deeper pullback. The next support would be the July 9 low of 160.73, followed by the latest cycle low of July 8 low of 160.26. If those two levels are surpassed, the USD/JPY could be set for a drop to 160.00 and below.

USD/JPY Price Action – Daily Chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.