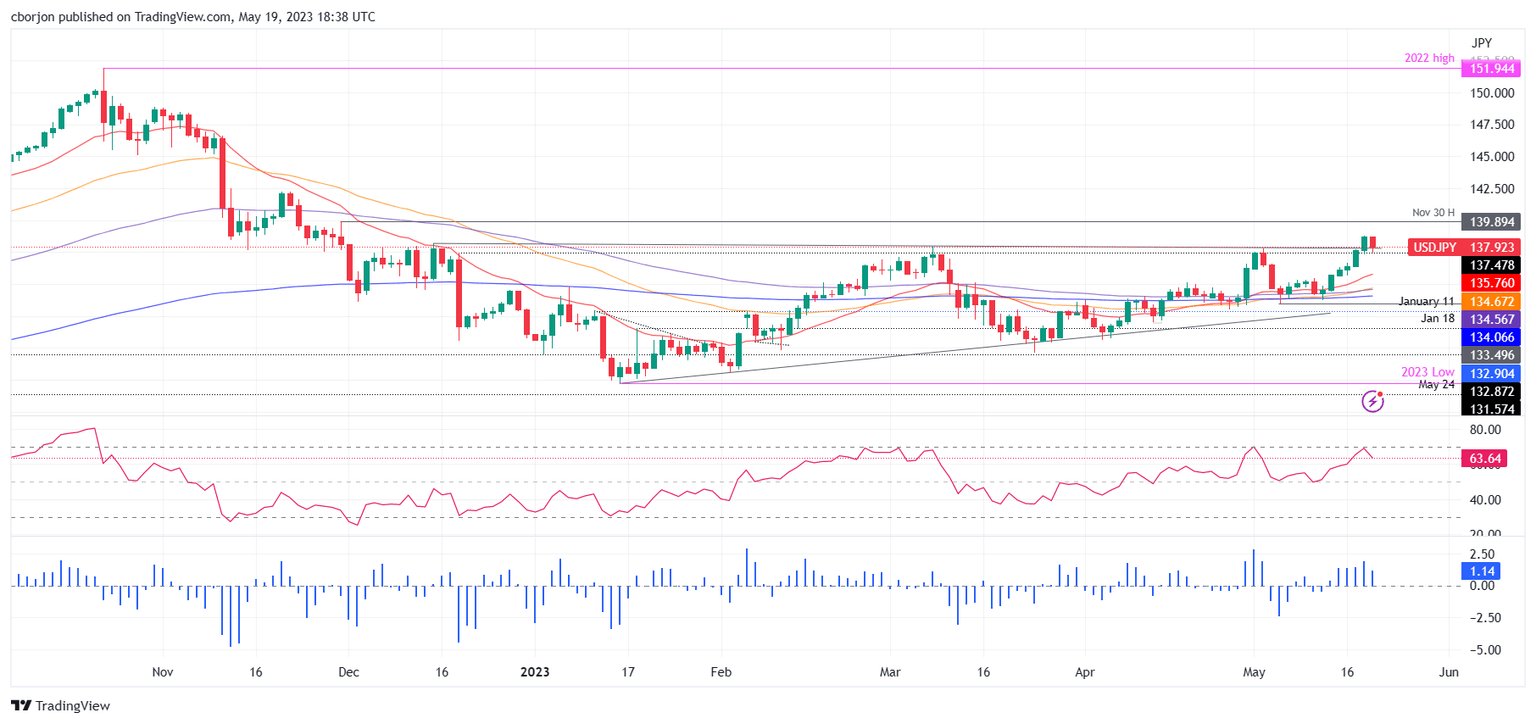

USD/JPY Price Analysis: Slumps from weekly highs as bearish-engulfing candle pattern looms

- USD/JPY trades with losses, ending its five-day gain amid a falling US Dollar and risk-averse mood.

- A daily close below 138.17 could drive the pair further down, with 138.00 as the primary support.

- USD/JPY needs to retake the 138.00 level to regain upward momentum, with resistances at 138.17 and 139.00.

USD/JPY forms a bearish-engulfing candlestick pattern, snapping five days of gains, down almost 0.60%, after hitting a weekly high of 138.74. Risk-off and a weaker US Dollar (USD), weighed on the USD/JPY pair. At the time of writing, the USD/JPY is trading at 137.90, below its opening price.

USD/JPY Price Analysis: Technical outlook

The USD/JPY remains upward biased, but a bearish candlestick formation could open the door for further losses. The Relative Strength Index (RSI) indicator remains in bullish territory but aims lower, which could put a lid on the USD/JPY fall. However, if USD/JPY achieves a daily close below the December 15 daily low of 138.17, that would exert downward pressure on the pair.

In that outcome, the USD/JPY first support would be 138.00. A breach of the latter will expose the May 18 daily low of 137.28, followed by the May 17 swing low at 136.30.

The USD/JPY must claim the 138.00 figure for a bullish resumption. Once done, the next resistance would be the December 15 high of 138.17, followed by the 139.00 figure. A rally above the latter will expose the November 30 high at 139.89, before challenging the 140.00 figure.

USD/JPY Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.