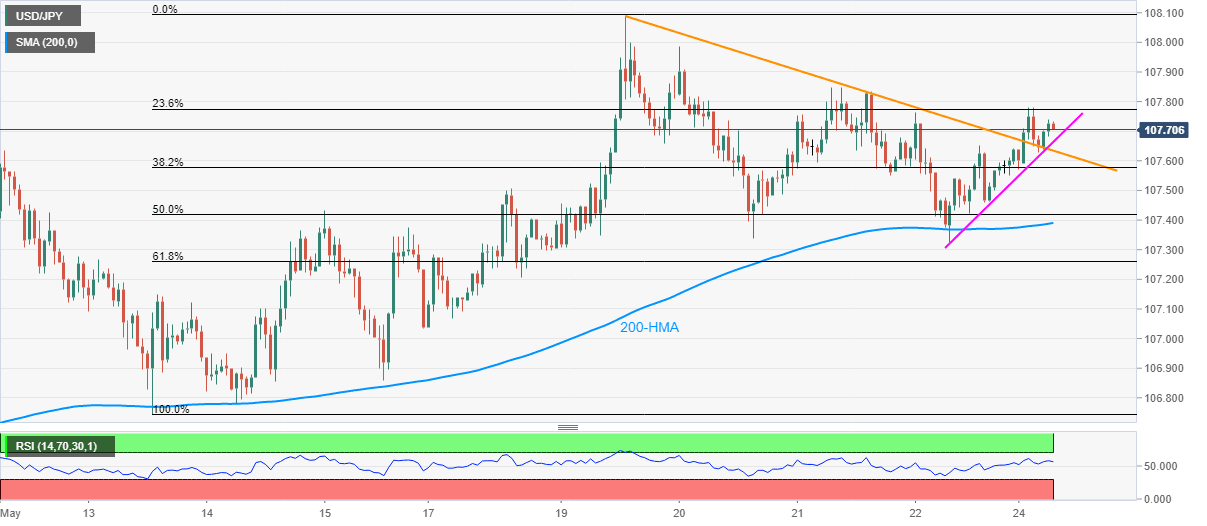

USD/JPY Price Analysis: Keeps mild gains above previous resistance line, 200-HMA

- USD/JPY bounces off immediate support line to print three-day winning streak.

- Thursday’s high appears on the bulls’ radar as immediate resistance.

- 107.00 could lure the bears below 200-HMA.

USD/JPY rises to 107.73, up 0.08% on a day, while heading into the European session on Monday. That said, the yen pair recently took a U-turn from a four-day-old resistance-turned-support line.

As a result, buyers are currently aiming for Thursday’s high near 107.85 as immediate resistance ahead of the previous week’s top near 108.10.

Though, it should be noted that the pair’s ability to cross 108.10 on a successful basis can push the bulls towards 109.00 and then to April month peak nearing 109.40.

Meanwhile, sellers will wait for entries below the said resistance, now support, around 107.60, while targeting a 200-HMA level of 107.40 and then to 107.00 round-figure.

If at all the quote remains weak below 107.00, the mid-month low near 106.85 will return to the charts.

USD/JPY hourly chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.