USD/JPY Price Analysis: Holds ground above 149.00 aligned to high since November

- USD/JPY experiences upward support due to the US economic data.

- Momentum indicators suggest a predominant bullish sentiment in the market.

- The psychological level at 148.00 could emerge as a key support aligned with the 14-day EMA.

USD/JPY hovers slightly below the high since November, trading around 149.10 psychological level during the Asian session on Wednesday. Market caution is bolstering the US Treasury yields, which supports the US Dollar (USD) against the Japanese Yen (JPY).

Bank of Japan (BoJ) policy meeting minutes showed that policymakers were in favor of maintaining current monetary easing to hit the price target, while several members emphasized the downside risks to Japan's economy.

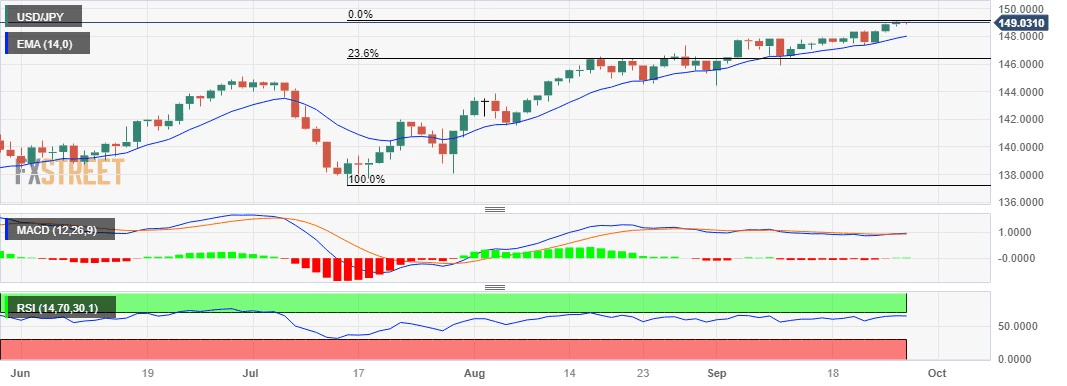

The upward momentum is potentially bullish as the 14-day Relative Strength Index (RSI) continues to stay above the 50 level. The psychological level at 150.00 could act as resistance.

A firm break above that level could inspire the USD/JPY bulls to explore the area around October’s high at 151.94 level.

On the downside, The USD/JPY pair could meet key support around the 148.00 psychological level lined up with a 14-day Exponential Moving Average (EMA) at 148.01.

If the USD/JPY pair collapses below the latter, the bears could navigate the region around the psychological level at 147.00, following the 23.6% Fibonacci retracement at 146.36.

The Moving Average Convergence Divergence (MACD) line remains above the centerline and the signal line. This setup indicates that the momentum in the USD/JPY's price is potentially strong, suggesting bullish sentiment.

USD/JPY: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.