USD/JPY Price Analysis: Bounces off a dip below 50-DMA as Treasury yields recover

- USD/JPY reverses half the previous sell-off amid a rebound in the US Treasury yields.

- The pair recaptures 110.00, as the rebound from the 50-DMA extends.

- Bulls looks to test the 21-DMA at 110.54 once again amid risk-on mood.

USD/JPY is reversing more than half of Thursday’s slide in the American session, having recaptured the 110.00 level amid an upbeat market mood.

The shift in the risk sentiment has rescued the US returns on the market, in turn, driving the USD/JPY pair as high as 110.26.

As of writing, the major is adding 0.38% on the day, trading at 110.20, having hit a daily low of 109.73.

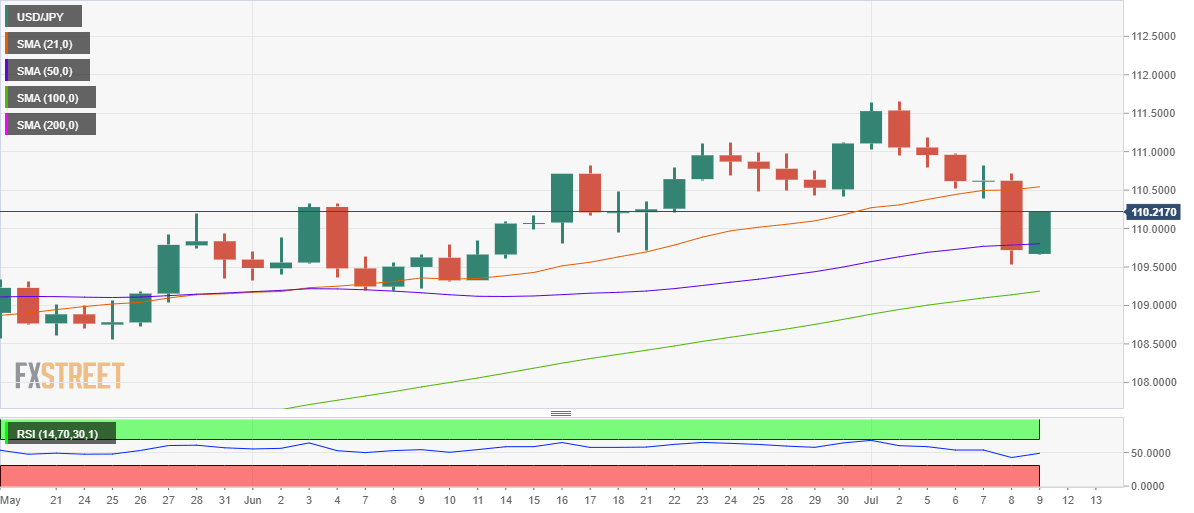

From a near-term technical perspective, the spot has managed to recover ground above the 50-Daily Moving Average (DMA) at 109.80.

This coincides with the uptick in the 14-day Relative Strength Index (RSI) at 48.43, edging higher towards the central line.

However, with the momentum indicator still lying beneath the 50 level, a test of the 21-DMA upside barrier at 110.54 appears elusive.

USD/JPY daily chart

On the downside, a daily closing below the 50-DMA critical support could reignite the downtrend, opening floors towards the 109.50 psychological level.

The line in the sand for the USD/JPY buyers appears at 109.16, which is the ascending 100-DMA.

USD/JPY additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.