USD/JPY Price Analysis: Bears are on the prowl

- USD/JPY's line in the sand is 134.50 currently and bulls need to commit at this juncture.

- The bears will be looking for a weekly close below 134.50.

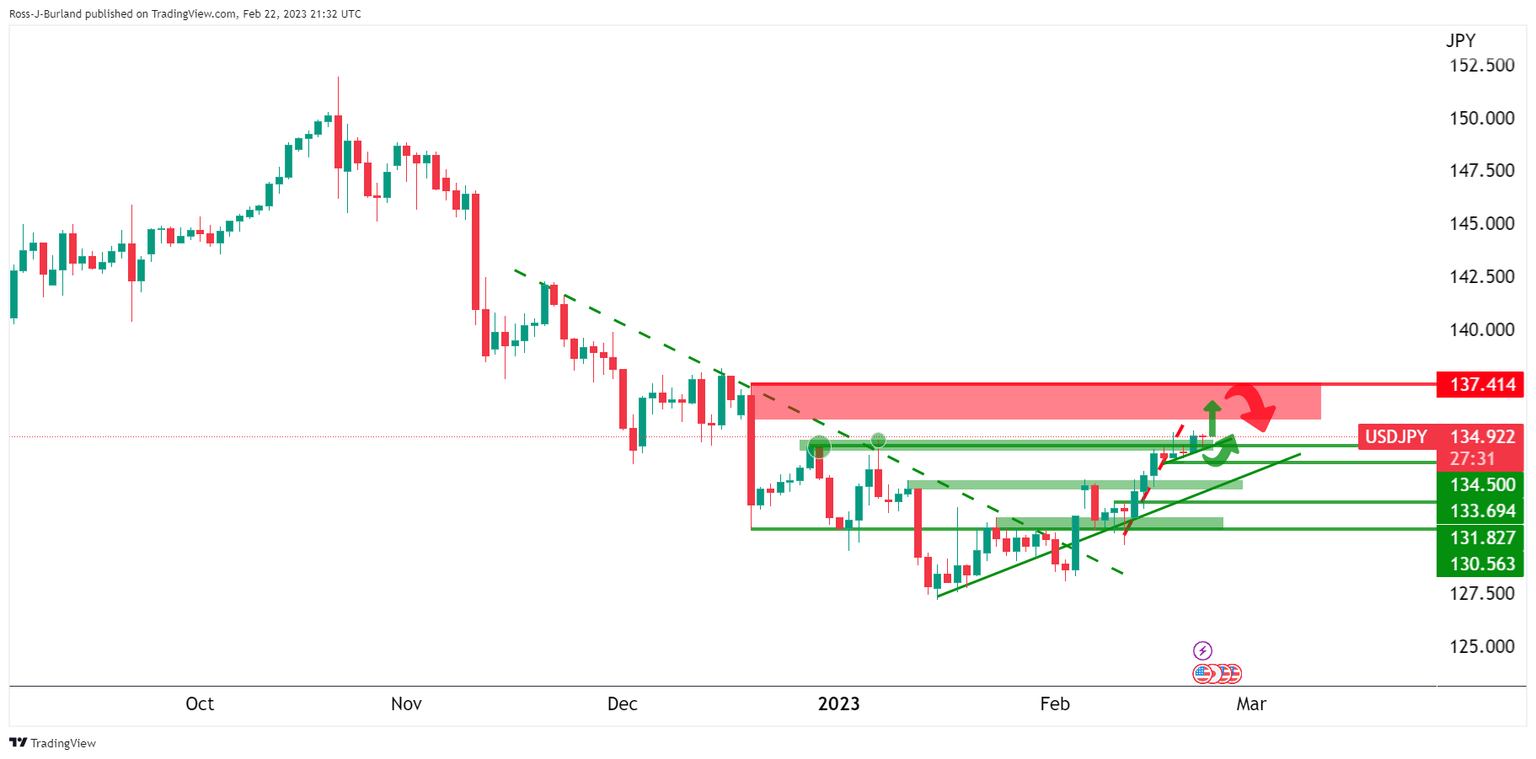

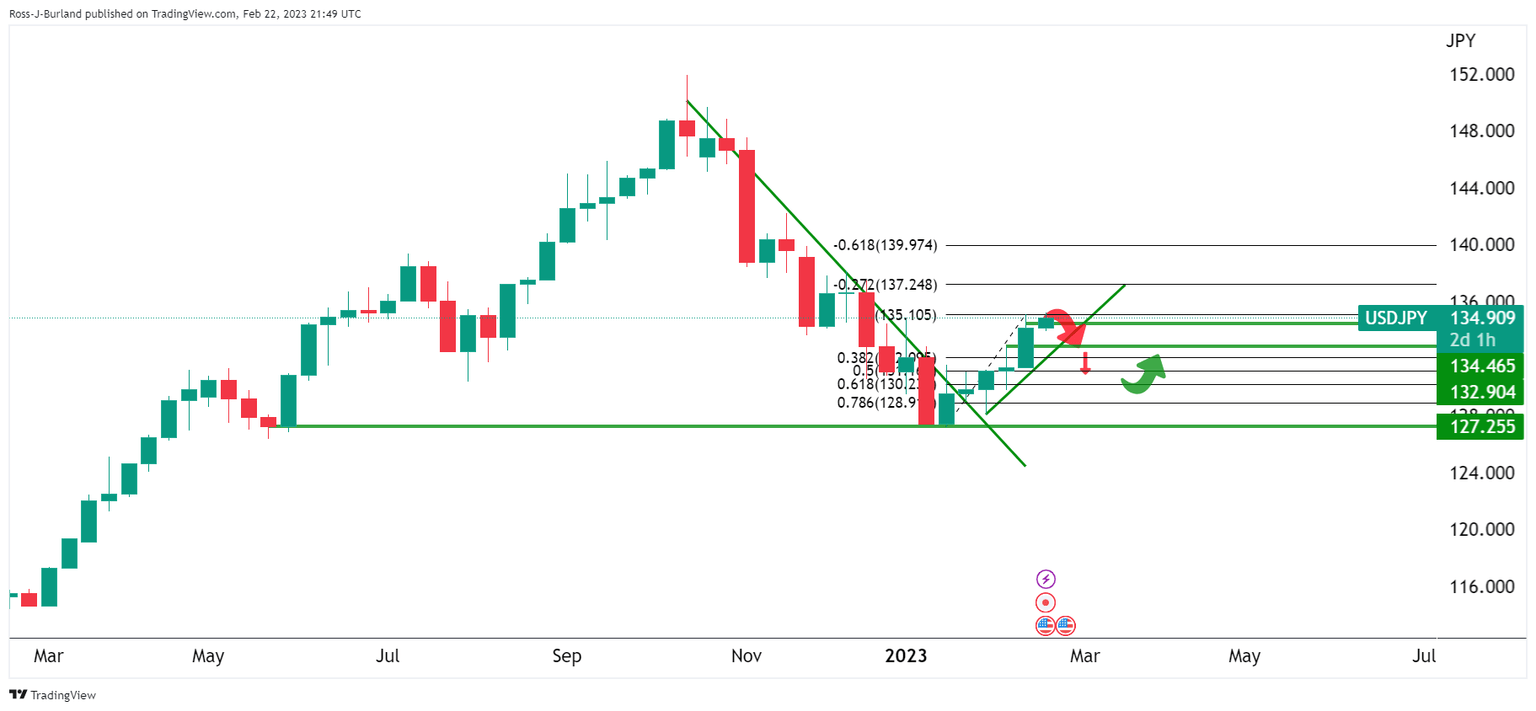

USD/JPY is holding in bullish territories while on the front side of the meanwhile bullish tren's dynamic support as illustrated on the daily chart above. There are prospects of a move towards the 137.40/50 for the foreseeable future while the support structure holds up.

USD/JPY daily chart

On the other hand, bears will be keen on a retest of the bull's commitments at 134.50 and should they break below with little fight from the bulls, then we could be looking at a very different scenario for the days and possibly weeks ahead:

The daily and weekly charts outline a bearish scenario if the bears really go to town on support and manage to get a weekly close below 134.50 this week or even next week.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.