USD/INR edges lower ahead of Fed’s Powell speech, US PMI data

- The Indian Rupee strengthens in Tuesday’s early European session.

- The Fed’s dovish stance and lower crude oil prices support the INR, but renewed US Dollar demand might cap its upside.

- India’s Manufacturing PMI rose to a 14-month high in June.

- Investors brace for Fed’s Powell speech and ISM US PMI data later on Tuesday.

The Indian Rupee (INR) gains traction on Monday as the dovish remarks from the US Federal Reserve (Fed) and rising fiscal worries undermine the Greenback. Additionally, a decline in Crude oil prices provides some support to the INR. It’s worth noting that India is the world's third-largest oil consumer, and lower crude oil prices tend to have a positive impact on the INR value.

The latest data released on Tuesday showed that the HSBC India Manufacturing Purchasing Managers Index (PMI) arrived at 58.4 in June versus 58.4 in May. This figure came in line with the market consensus. The local currency remains firm after the Indian PMI data.

Nonetheless, renewed strong US Dollar (USD) demand by both foreign and domestic banks might cap the upside for the Indian currency. Muted domestic portfolio inflows might weigh on the local currency’s downside. Foreign investors net pulled about $0.5 billion from local stocks and bonds over the April-June quarter.

Looking ahead, investors will keep an eye on India’s HSBC Manufacturing Purchasing Managers Index (PMI) report for June, which is due later on Tuesday. On the US docket, Fed Chair Jerome Powell's speech will be in the spotlight. Also, the ISM Manufacturing PMI and JOLTS Job Openings will be released later on the same day.

Daily digest market movers: Indian Rupee climbs as US Dollar stays tepid

- The HSBC survey showed “Companies also welcomed one of the fastest increases in external orders in over 20 years of survey history. Goods producers lifted input buying to the greatest extent in 14 months, which supported a further expansion in stocks of purchases.”

- Indian officials will extend their Washington visit to try to reach an agreement on a trade deal with US President Donald Trump's administration and address lingering concerns on both sides, per Reuters.

- "There was dollar buying by nationalized banks, likely on behalf of RBI. Oil companies and importer dollar demand also kept the rupee in a small range," said Anil Bhansali, head of treasury, Finrex Treasury Advisors.

- India's fiscal deficit for April-May was 131.6 billion rupees ($1.5 billion), or 0.8% of the estimate for the financial year ending.

- The Indian economy continues to expand at a robust pace, supported by strong macroeconomic fundamentals and prudent policy measures, according to the Reserve Bank of India’s (RBI) Financial Stability Report (FSR) on Monday.

- The markets are pricing in nearly 92.4% chance of one quarter-point Fed rate reduction, up from 70% a week earlier, according to CME FedWatch tool.

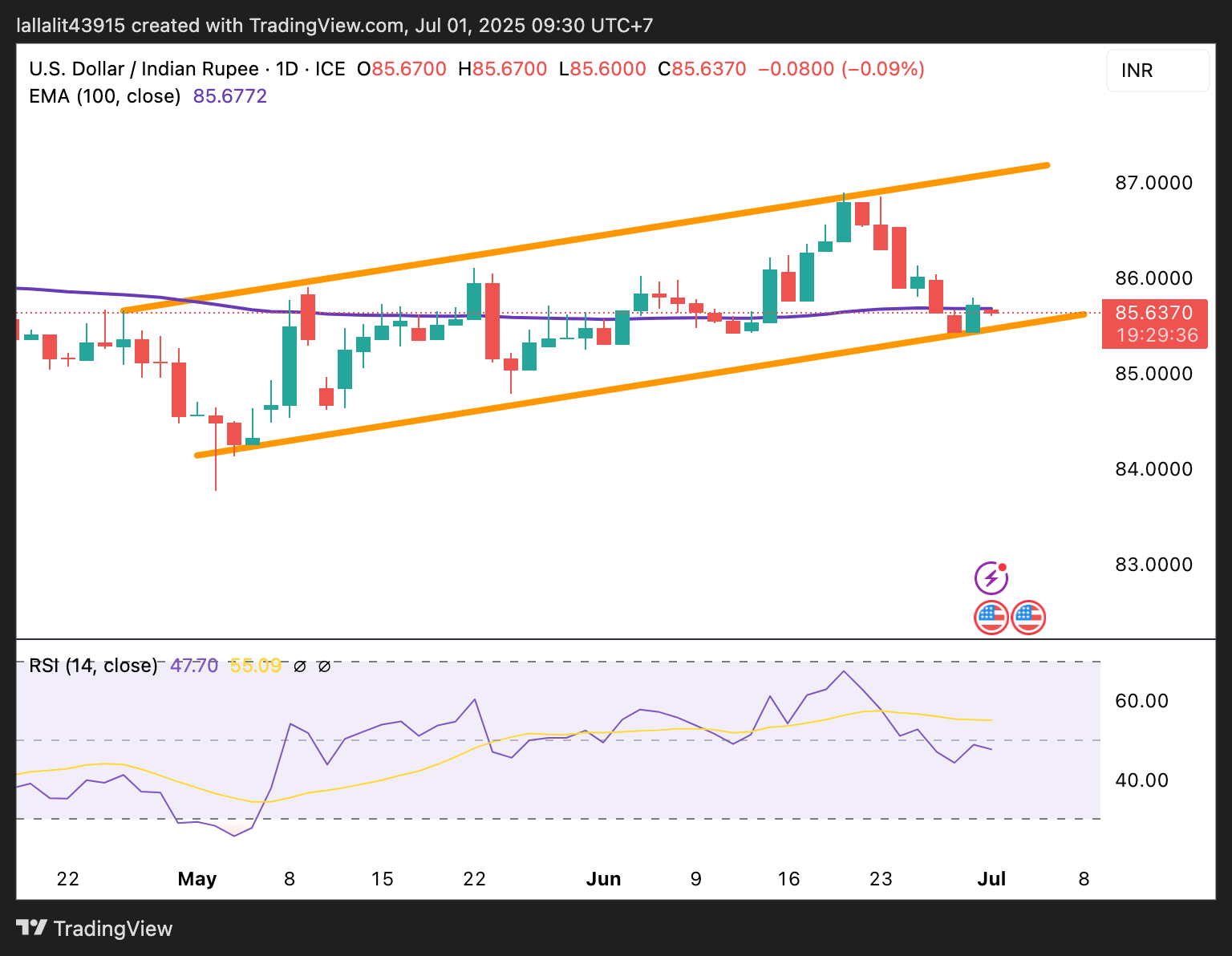

Technical Analysis: USD/INR resumes its downside bias

The Indian Rupee trades stronger on the day. The USD/INR pair resumes its downside journey as the price crosses below the key 100-day Exponential Moving Average (EMA) on the daily timeframe. Additionally, the 14-day Relative Strength Index (RSI) stands below the midline near 46.80, suggesting bearish vibes stay in play in the near term.

In the bearish event, the first support level for USD/INR is located at 85.50, the lower limit of the ascending trend channel. A break below the mentioned level could allow the downtrend to continue to 84.78, the low of May 26. The additional downside filter to watch is 84.25, the low of May 6.

The first upside barrier for the pair emerges at 85.67, the 100-day EMA. Sustained trading above this level could pave the way to 86.13, the high of June 25. Further north, the next hurdle to watch is 86.79, the high of June 20.

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.