USD/INR drifts higher as Donald Trump win pressures Asian FX

- The Indian Rupee trades softer in Monday’s early Eueopan session.

- Foreign equity inflows drag the INR lower, but lower crude oil prices and likely RBI intervention could cap its downside.

- Investors brace for India’s October CPI inflation report, which is due on Tuesday.

The Indian Rupee (INR) edges lower to an all-time low on Monday. The local currency remains vulnerable amid the sustained outflows from local stocks and expectations of a stronger Greenback and higher US bond yields after Donald Trump won the US election.

On the other hand, the decline in crude oil prices might help limit the INR’s losses as India is the world's third-largest oil consumer. Additionally, the routine intervention by the Reserve Bank of India (RBI) to sell USD might prevent the INR from significant depreciation in the near term. Traders will keep an eye on India’s October Consumer Price Index (CPI), which is due on Tuesday. On the US docket, the CPI inflation report will be released on Wednesday.

Daily Digest Market Movers: Indian Rupee trades softer amid multiple headwinds

- Foreign investors have withdrawn more than $1.5 billion from Indian equities so far in November, adding to the $11 billion outflow in October.

- "The pace of foreign equity outflows remains the primary factor determining the trajectory of the USD/INR. However, it is still premature to expect foreign equity outflows from India to end,” noted Societe Generale.

- The Indian CPI inflation is expected to rise to 5.80% YoY in October from 5.49% in September.

- The preliminary University of Michigan's Consumer Sentiment Index improved to 73.0 in November from 70.5 in October, better than the market expectation of 71.0. This figure is the highest in seven months.

- Minneapolis Fed President Neel Kashkari said the US economy has remained remarkably strong as the Fed progressed in beating back inflation, but the US central bank was still “not all the way home,” per Bloomberg.

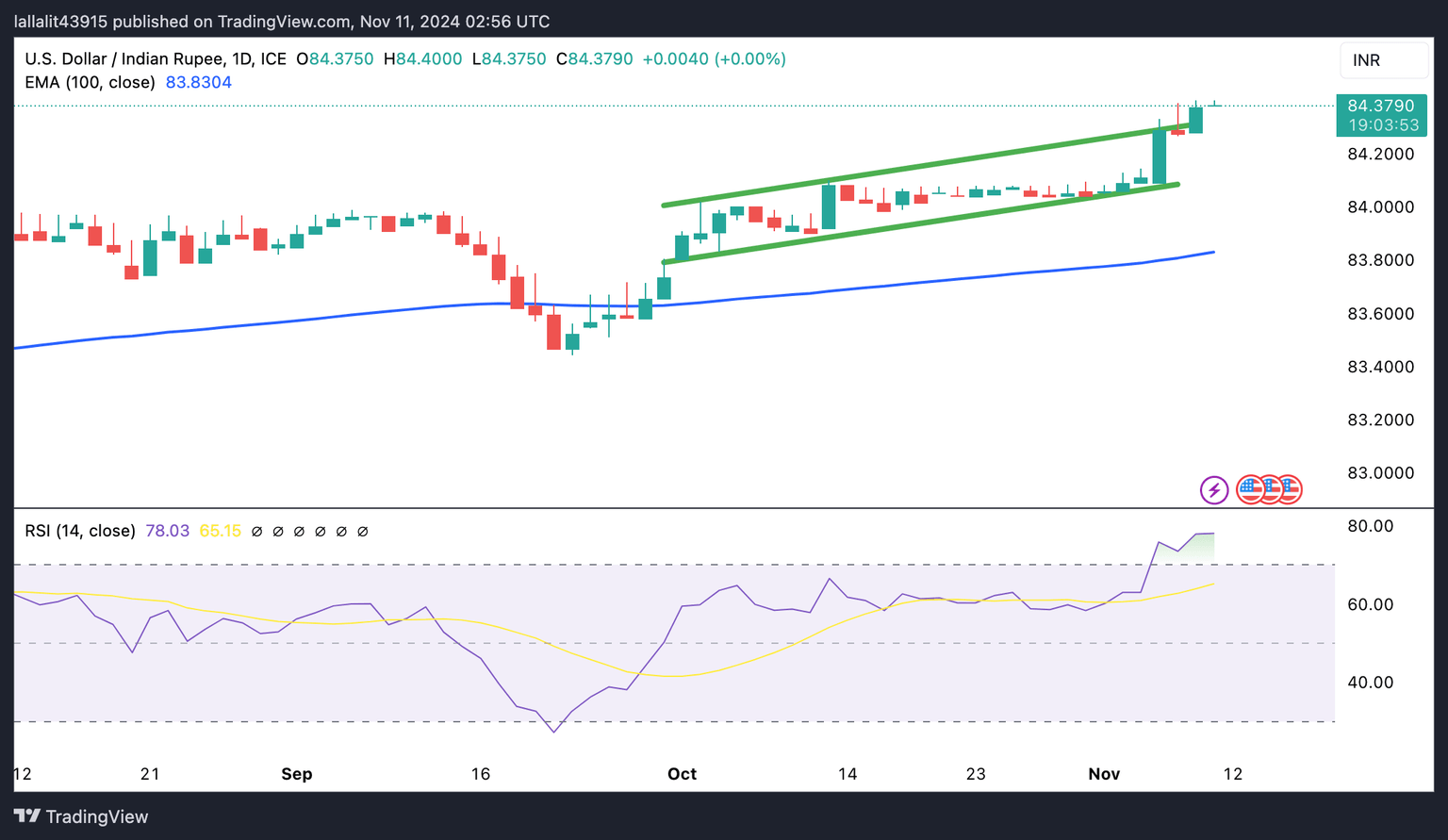

Technical Analysis: USD/INR’s constructive outlook remains in place, eyes on overbought RSI

The Indian Rupee trades on a soft note on the day. The bullish outlook of the USD/INR pair remains in play, with the pair holding above the key 100-day Exponential Moving Average (EMA) on the daily timeframe. However, additional consolidation should not be ruled out before positioning for any short-term USD/INR appreciation as the 14-day Relative Strength Index (RSI) is over the midline near 77.75, indicating an overbought condition.

A sustained buying momentum could take USD/INR to the next upside barrier at 84.50. Further north, the next hurdle emerges at the 85.00 psychological level.

On the downside, a move below the lower limit of the trend channel and the high of October 11 in the 84.05-84.10 zone could pave the way for a selloff to 83.83, the 100-day EMA. The additional downside level to watch is 83.46, the low of September 24.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.