USD/INR trades with mild gains amid geopolitical risks

- The Indian Rupee edges lower in Tuesday’s early European trading hours.

- Outflows from Indian equities, higher oil prices and a stronger US Dollar undermine the INR.

- Traders await Fedspeak ahead of the RBI rate decision.

The Indian Rupee (INR) weakens on Tuesday amid the selling pressure from foreign funds and weak tone in the domestic markets. Additionally, the rise in crude oil prices and escalating geopolitical tensions between Israel and Iran contribute to the INR’s downside.

Traders will keep an eye on the speeches from the US Federal Reserve’s (Fed) Raphael Bostic, Phillip Jefferson and Susan Collins on Tuesday. Any dovish comments from the Fed officials could weigh on the Greenback and cap the downside for the local currency. On Wednesday, the Reserve Bank of India (RBI) interest rate decision will take center stage.

Daily Digest Market Movers: Indian Rupee looks weak amid global challenges

- "We expect the rupee to trade with a negative bias on selling pressure from foreign funds and a weak tone in the domestic markets. Escalating tensions between Israel and Iran may further pressurize the rupee," said Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas.

- India's foreign exchange reserves rose $12.588 billion to a new all-time high of $704.885 billion for the week ended September 27, the Reserve Bank of India said on Friday.

- India's Trade Minister Piyush Goyal said on Monday it is time for the INR to appreciate on the back of inflows in debt and equity markets.

- Federal Reserve Bank of St. Louis President Alberto Musalem stated on Monday that he supports more interest rate cuts as the economy moves forward on a healthy path. However, he emphasized that it is appropriate for the Fed to be cautious and not overdo easing monetary policy, per Reuters.

- Minneapolis Fed President Neel Kashkari said on Monday that the Fed welcomed the strong September jobs report, which indicates the firm economy. Kashkari added that the balance of risks shifted from "high inflation towards maybe higher unemployment.

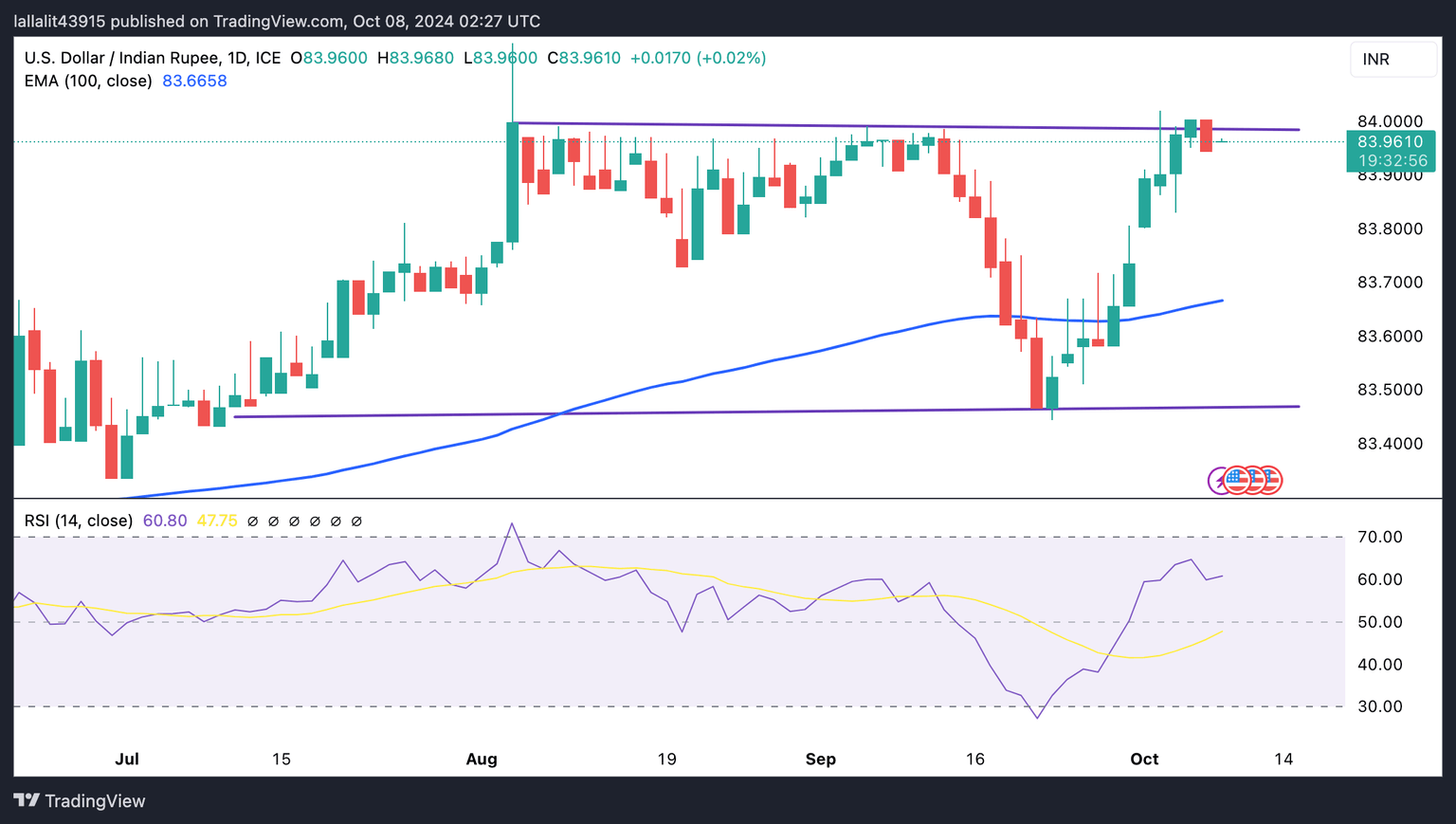

Technical Analysis: USD/INR’s constructive outlook prevails

The upper boundary of the rectangle and psychological mark near 84.00 act as a key resistance level for USD/INR. Any follow-through buying above this level could attract some buyers to the all-time high of 84.15, followed by 84.50.

On the downside, the first downside target to watch is 83.80, the low of October 1. Sustained bearish momentum could pave the way to the 100-day EMA at 83.66. The next contention level is seen at 83.00, representing the round mark and the low of May 24.

RBI FAQs

The role of the Reserve Bank of India (RBI), in its own words, is '..to maintain price stability while keeping in mind the objective of growth.” This involves maintaining the inflation rate at a stable 4% level primarily using the tool of interest rates. The RBI also maintains the exchange rate at a level that will not cause excess volatility and problems for exporters and importers, since India’s economy is heavily reliant on foreign trade, especially Oil.

The RBI formally meets at six bi-monthly meetings a year to discuss its monetary policy and, if necessary, adjust interest rates. When inflation is too high (above its 4% target), the RBI will normally raise interest rates to deter borrowing and spending, which can support the Rupee (INR). If inflation falls too far below target, the RBI might cut rates to encourage more lending, which can be negative for INR.

Due to the importance of trade to the economy, the Reserve Bank of India (RBI) actively intervenes in FX markets to maintain the exchange rate within a limited range. It does this to ensure Indian importers and exporters are not exposed to unnecessary currency risk during periods of FX volatility. The RBI buys and sells Rupees in the spot market at key levels, and uses derivatives to hedge its positions.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.