USD Index treads water around 103.00 ahead of Nonfarm Payrolls

- The index exchanges gains with losses around 103.00.

- US yields trade in a cautious note ahead of key data.

- US Nonfarm Payrolls, Unemployment Rate take centre stage.

The USD Index (DXY), which tracks the greenback vs. a bundle of its main competitors, navigates without clear direction around the 103.00 neighbourhood at the end of the week.

USD Index looks at key data, Fed

The index maintains the cautious trade around 103.00 ahead of the publication of the US jobs report for the month of June later in the NA session.

So far, and in light of recent solid prints from US fundamentals, investors continue to anticipate a quarter-point interest rate hike by the Federal Reserve at the July 26 gathering.

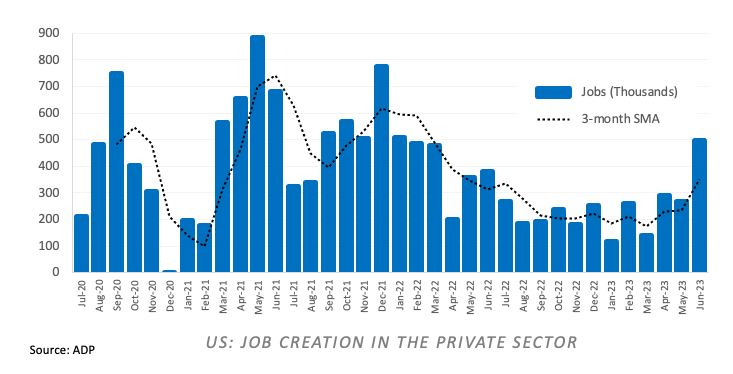

Indeed, the latter results from the industrial sector, the ISM Services PMI and monthly ADP figures more than doubling initial estimates all did nothing but emphasize the resilience of the US economy and underpin the resumption of the tightening campaign by the Fed following June’s skip, in line with unabated hawkish narrative from Fed’s rate setters.

In the US data space, Nonfarm Payrolls and the Unemployment Rate for the month of June will be in the spotlight later in the European afternoon.

What to look for around USD

The index hovers around the 103.00 region amidst rising investors’ prudence prior to the release of the US monthly report on the labour market.

Meanwhile, the likelihood of another 25 bps hike at the Fed's upcoming meeting in July remains high, supported by the continued strength of key US fundamentals such as employment and prices.

This view was further bolstered by comments from Fed Chief Powell at the June FOMC event, who referred to the July meeting as "live" and indicated that most of the Committee is prepared to resume the tightening campaign as early as next month.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 2023/early 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is up 0.03% at 103.14 and the breakout of 103.54 (weekly high June 30) would open the door to 104.65 (200-day SMA) and then 104.69 (monthly high May 31). On the downside, the next support aligns at 101.92 (monthly low June 16) followed by 100.78 (2023 low April 14) and finally 100.00 (round level).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.