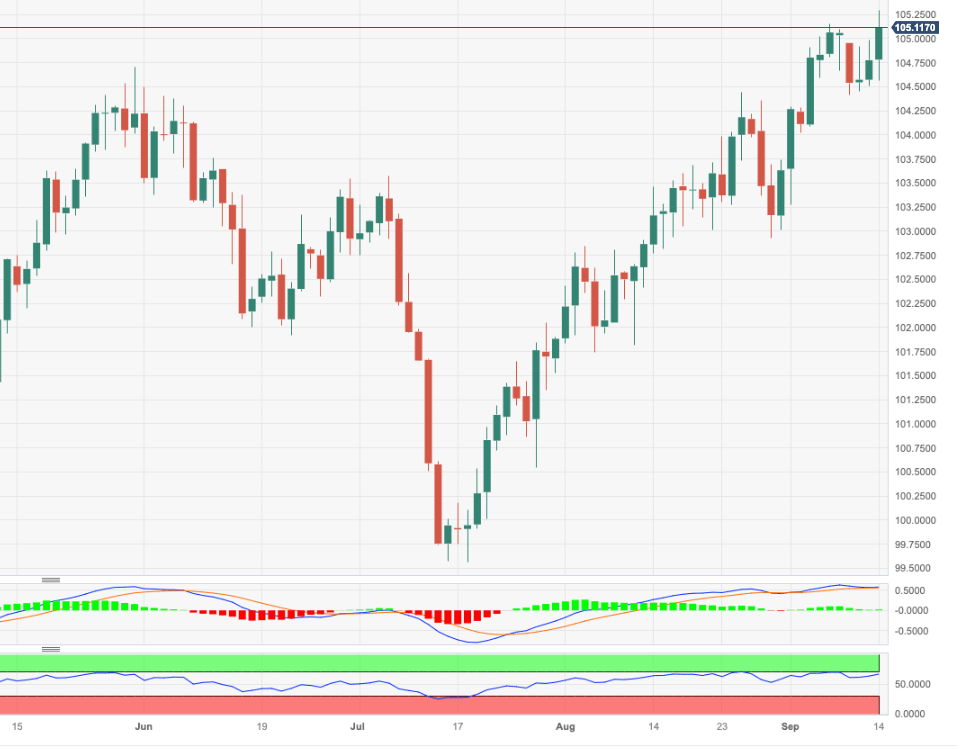

USD Index Price Analysis: Further upside targets the 2023 peak

- DXY climbs to fresh highs near 105.30 on Thursday.

- The continuation of the upward bias now looks at the 2023 top.

DXY adds to Wednesday’s advance and clinch new six-month tops north of 105.00 the figure on Thursday.

The continuation of the multi-week rally appears well and sound and a breakout of the monthly high of 105.28 (September 14) should encourages the index to retest the 2023 peak of 105.88 (March 8), just before the round level of 106.00.

While above the key 200-day SMA, today at 103.02, the outlook for the index is expected to remain constructive.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.