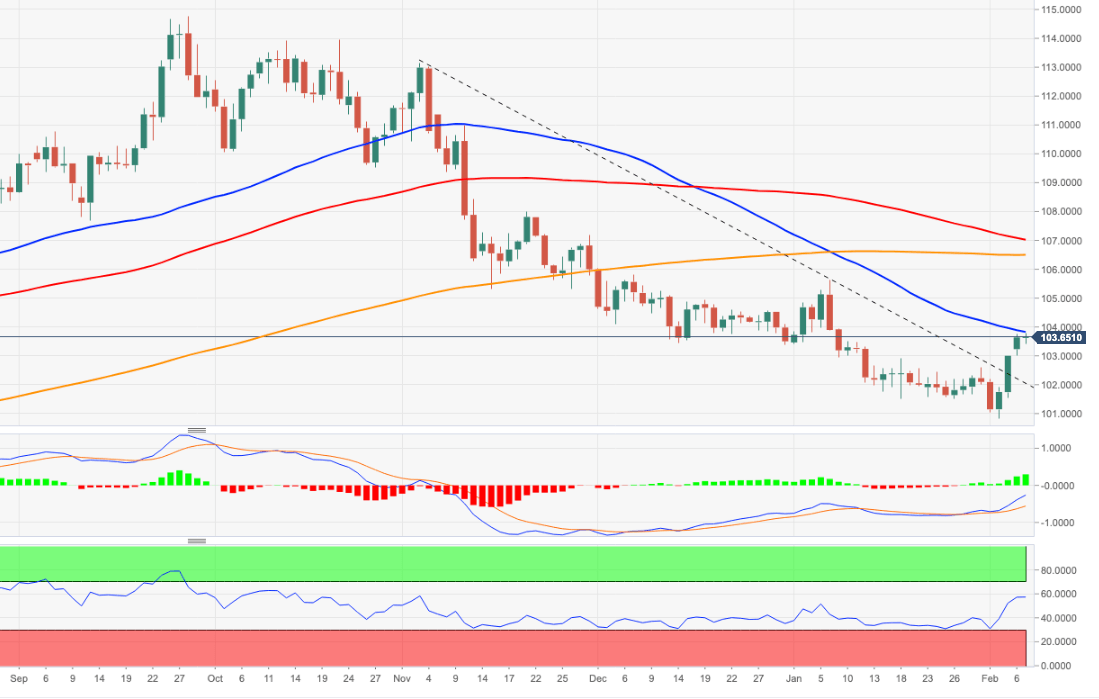

USD Index Price Analysis: Further upside targets the 2023 high at 105.60

- The index adds to the ongoing rebound and approaches 104.00.

- Gains could now accelerate to the 105.60 region in the near term.

The dollar’s march north remains unabated on Tuesday and encourages DXY to challenge the 55-day SMA near 103.80.

In the near term, further gains appear in the pipeline while above the 3-month support line near 101.90. That said, the next target of note now emerges at the 2023 peak at 105.63 recorded on January 6.

In the longer run, while below the 200-day SMA at 106.45, the outlook for the index remains negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.