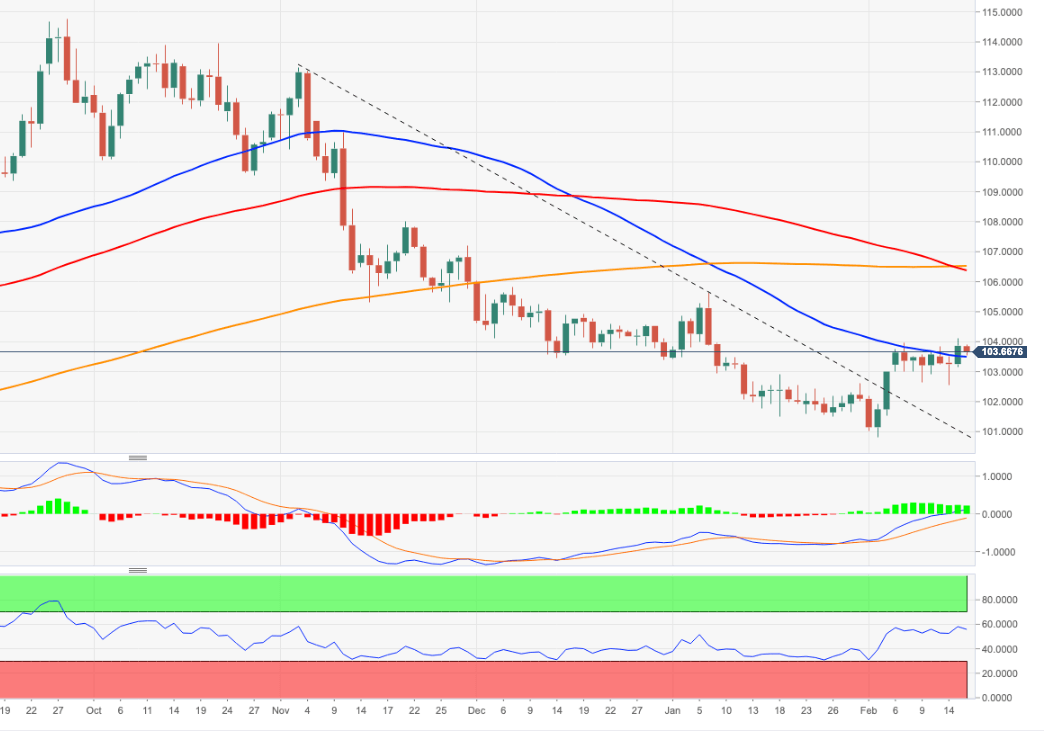

USD Index Price Analysis: Above 104.00 comes the YTD high near 105.60

- The index keeps the choppiness well and sound below 104.00.

- A move beyond the monthly high at 104.11 exposes extra gains.

DXY sees its recent marked uptick to new monthly highs past the 104.00 mark somewhat trimmed on Thursday.

The ongoing price action leaves the door open to the continuation of the consolidative note for the time being. Occasional bouts of strength, however, should face the February high at 104.11 (February 15) as the immediate hurdle, while the trespass of this level could open the door to a potential challenge of the 2023 top at 105.63 (January 6) in the relatively near term.

In the longer run, while below the 200-day SMA at 106.44, the outlook for the index remains negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.