USD/CNH Price Analysis: Inside key SMA envelope near $6.46, Fed Chair Powell eyed

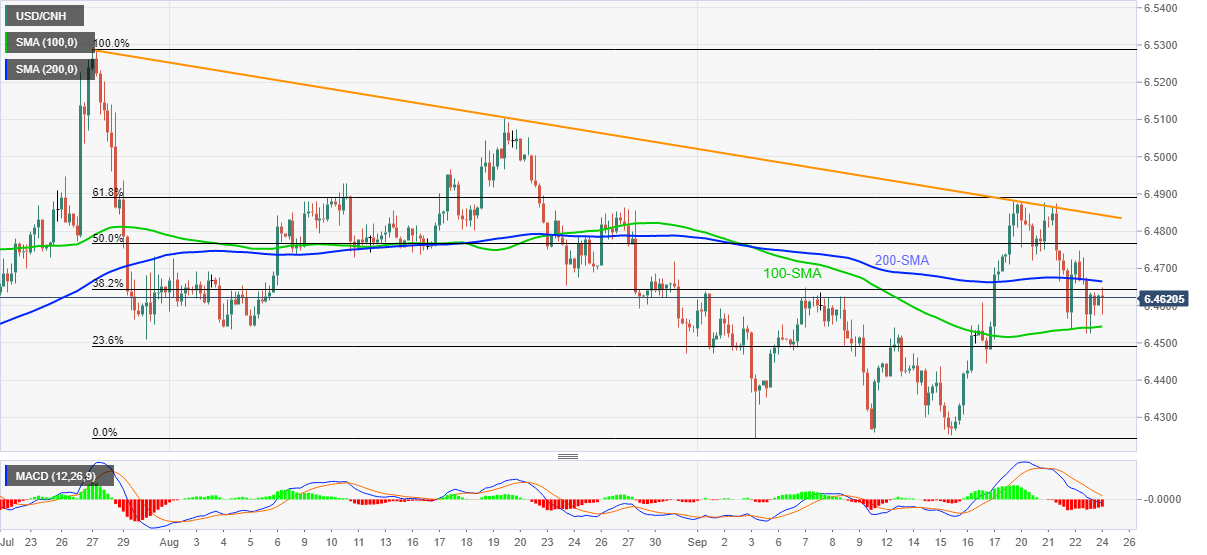

- USD/CNH remains indecisive between 100 and 200 SMAs.

- Bearish MACD, failures to cross two-month-old falling trend line favor bears.

- Heavy Fedspeak, Evergrande news awaited for fresh impulse.

USD/CNH fades bounce off weekly low around $6.4620 during early Friday.

In doing so, the offshore Chinese currency (CNH) pair remains trapped inside an envelope comprising 100 and 200-SMA. It’s worth noting that the bearish MACD and sustained trading below a descending resistance line from late July keep sellers hopeful.

However, markets wait for news from Evergrande and a slew of Fed speakers, including Chairman Jerome Powell, restricts the pair moves.

Given the brighter odds for the sellers, the pair’s one more attempt to refresh the monthly low of $6.4244 can’t be ruled out. However, the 100-SMA level of $6.4540 needs to be broken for that.

It’s worth noting that the USD/CNH bulls have multiple hurdles to cross, other than the 200-SMA level of $6.4665, making it harder to return.

To name a few resistances, 50% Fibonacci retracement of July-September downside, near $6.4770, follows the 200-SMA hurdle while preceding the stated resistance line figures of $6.4845. Additionally, 61.8% Fibonacci retracement level of $6.4890 and the $6.4900 act as extra filters to the north.

USD/CNH: Four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.