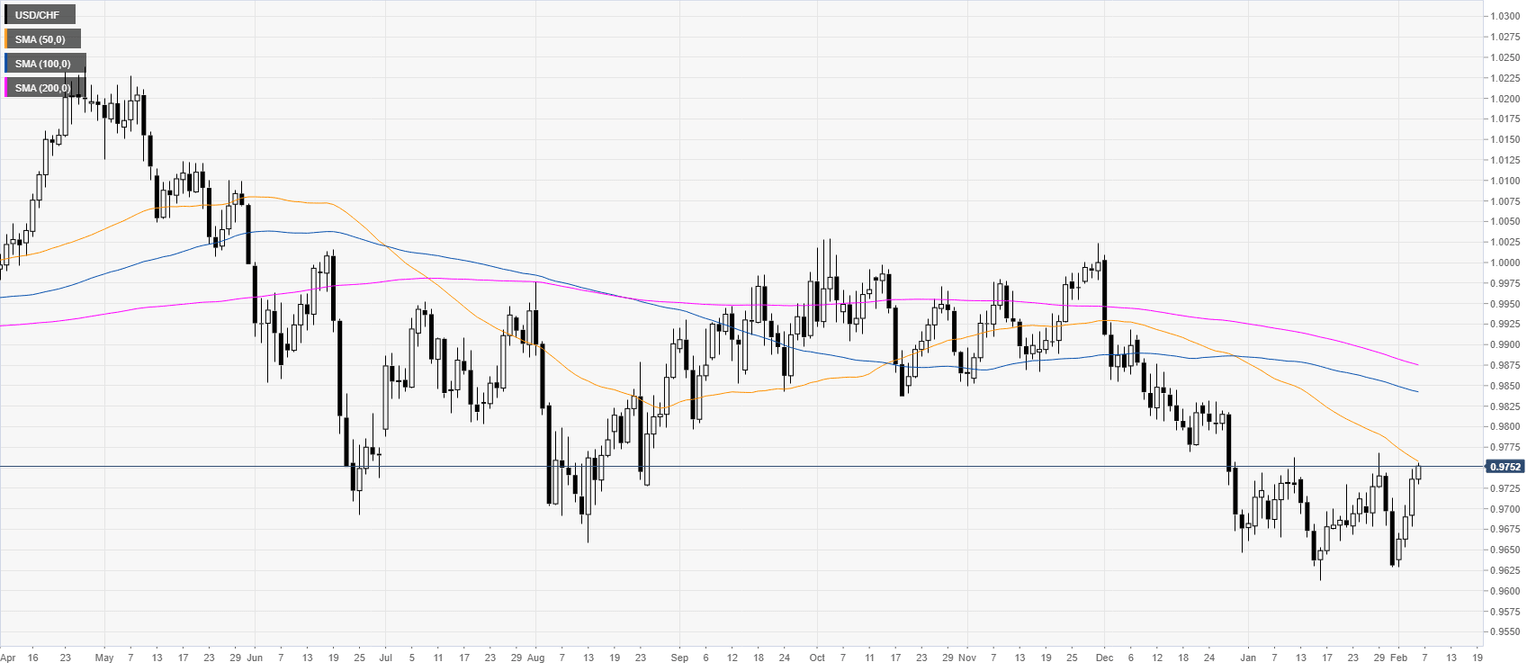

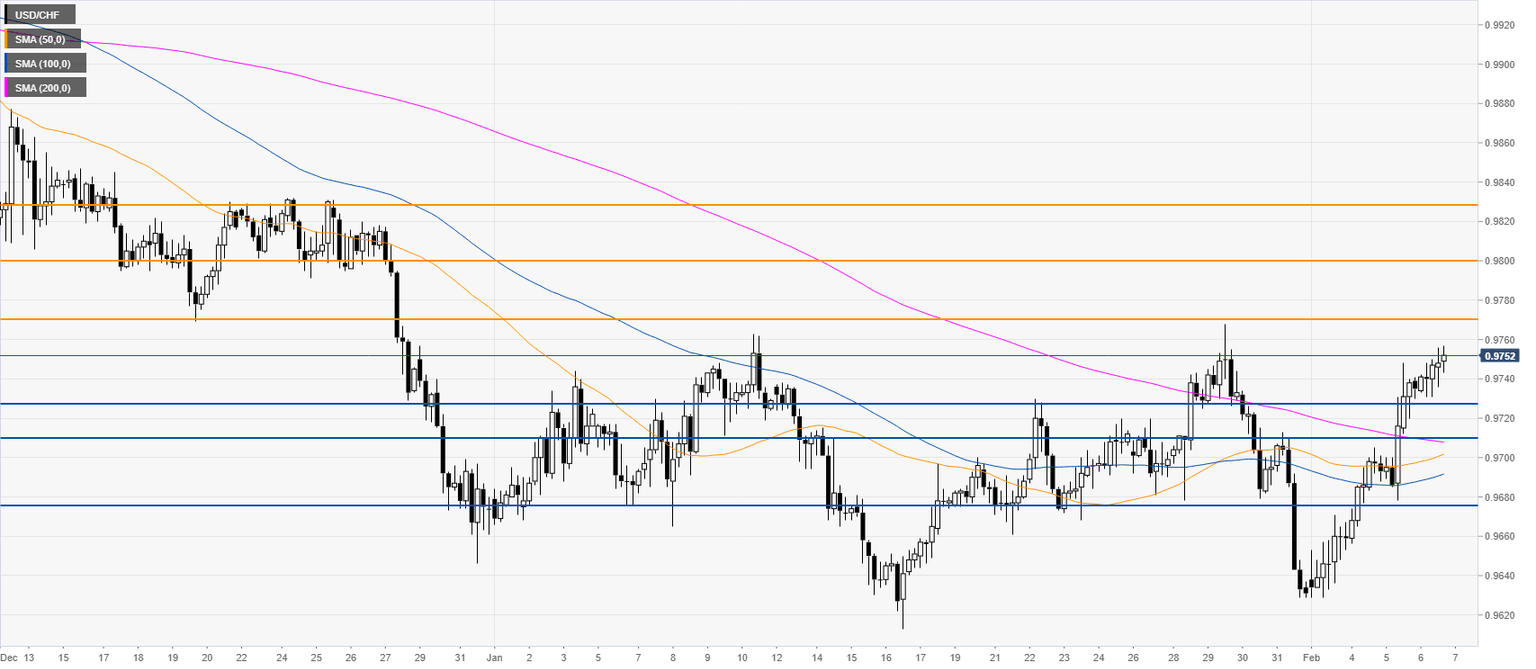

USD/CHF Price Analysis: Greenback approaching January highs vs. Swiss franc

- USD/CHF created a strong bullish recovery while nearing the 2020 highs.

- The level to beat for bulls is the 0.9770 resistance.

USD/CHF daily chart

USD/CHF four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst