USD/CHF Price Analysis: Flat with sellers struggling to print eight-year lows beneath 0.8300

- USD/CHF starts flat, and technical indicators suggest a possible upward correction.

- Sellers target the USD/CHF below 0.8300; overbought RSI hints at fading selling pressure.

- Resistance awaits at 0.8700, followed by key Fibonacci levels.

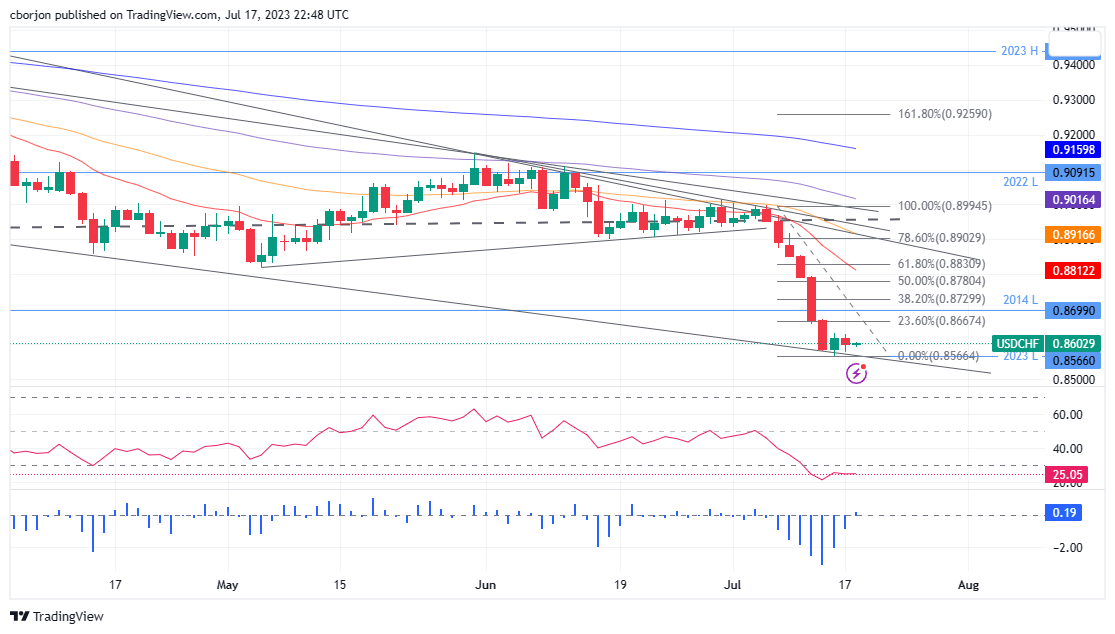

USD/CHF begins the Asian session almost flat, following Monday’s losses of 0.20% after printing a year-to-date (YTD) low of 0.8566 last Friday. Technical indicators turned flat alongside an overextended downtrend, which could pave the way for an upward correction. At the time of writing, the USD/CHF exchanges hands at 0.8605, up 0.03%.

USD/CHF Price Analysis: Technical outlook

From a daily chart perspective, the USD/CHF downtrend remains intact, with sellers eyeing a drop below the YTD low, exposing the pair to a new eight-year low below 0.8300. The Relative Strength Index (RSI) is in bearish territory but turned flat after reaching an overbought extreme level at 21.42, while the three-day Rate of Change (RoC) began to turn neutral, portraying that selling pressure faded, opening the door for a correction.

In that event, the USD/CHF first resistance would be the 0.8700 psychological level, followed by key resistance Fibonacci (Fibo) levels, with 38.2% and 50% Fibo, each at 0.8730 and 0.8780. Once those levels are cleared, the 0.8800 figure would be up next.

On the downside, the USD/CHF first support would be 0.8600, followed by the YTD low of 0.8566 and the 0.8500 psychological level.

USD/CHF Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.