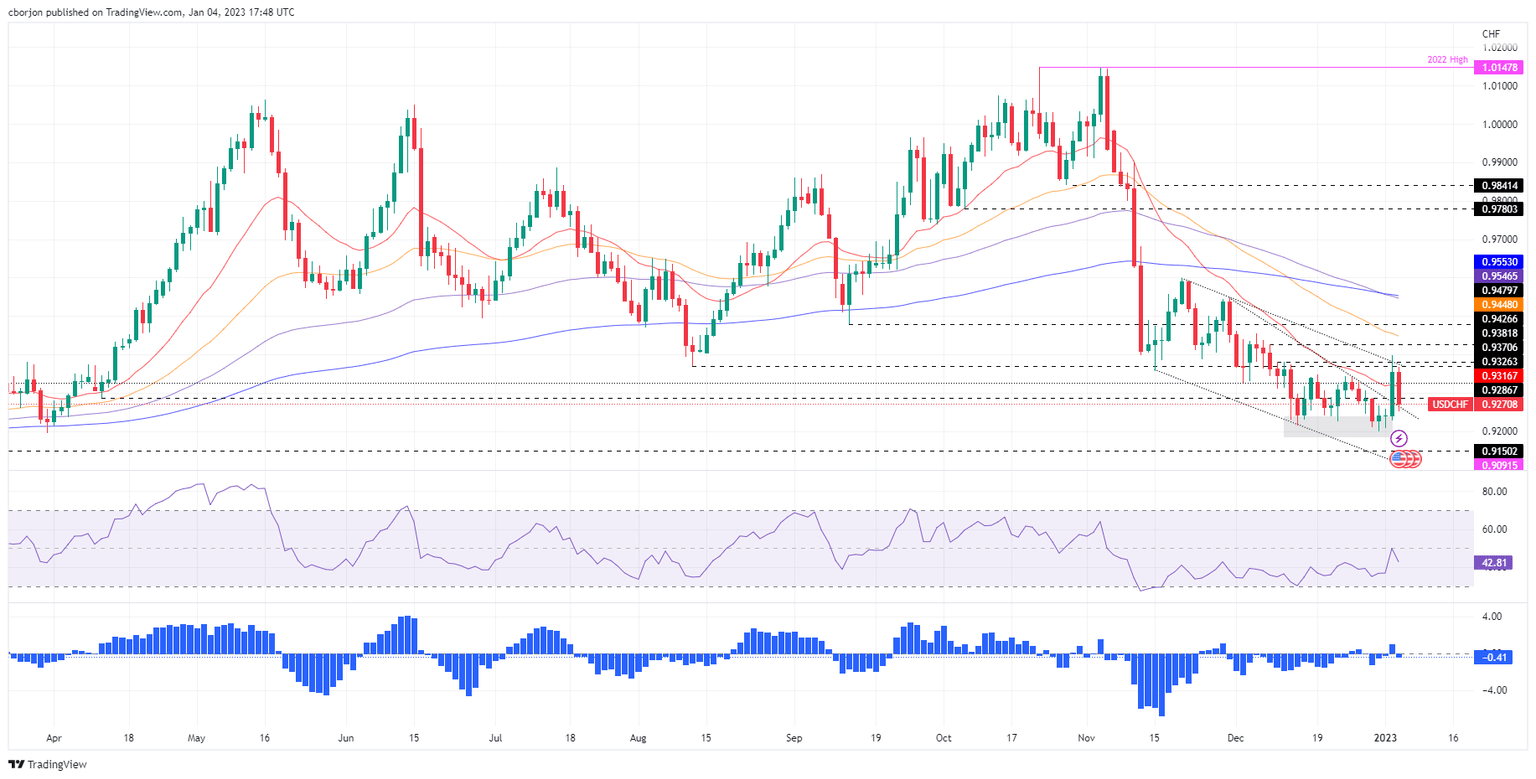

USD/CHF Price Analysis: Drops below 0.9300 ahead of FOMC minutes

- USD/CHF failed to crack above 0.9400, exacerbating a fall beneath 0.9300.

- US Dollar weakness and the confluence of technical levels around 0.9370s stalled the USD/CHF rally.

- A daily close above 0.9250 could lift the USD/CHF back again, towards 0.9300.

The USD/CHF struggles to clear the 0.9370 barrier, dives below the 20-day Exponential Moving Average (EMA), and the 0.9300 figure as the US Dollar (USD) weakens. The USD/CHF is trading at 0.9279, below its opening price by 0.80%.

USD/CHF Price Analysis: Technical outlook

After reaching a weekly high at around 0.9398 on Wednesday, the USD/CHF shifted gears and snapped three days of gains. The USD/CHF dived below the 20-day EMA, which sits at 0.9317, extending its fall toward its daily lows of 0.9253, but solid support around the latter spurred a slight jump to the current exchange rates.

The Relative Strength Index (RSI) failed to crack its midline and remained at bearish territory, exacerbating today’s fall. The Rate of Change (RoC) flashes sellers gathering some momentum. However, the top trendline of a falling wedge, a bullish chart pattern that emerged in the USD/CHF daily chart, stalled the drop. Therefore, the USD/CHF might remain range-bound.

The USD/CHF key support levels would be the 0.9250 figure, followed by the 0.9200 mark. As an alternate scenario, the USD/CHF first resistance would be 0.9300, followed by the weekly high of 0.9398, ahead of the 0.9400 mark.

USD/CHF Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.