USD/CHF drops as US credit downgrade weighs on sentiment

- USD/CHF trades 0.5% lower near 0.8330 amid sharp Dollar selling pressure.

- Moody's downgraded the US credit rating to 'AA1' from 'AAA', citing fiscal deterioration.

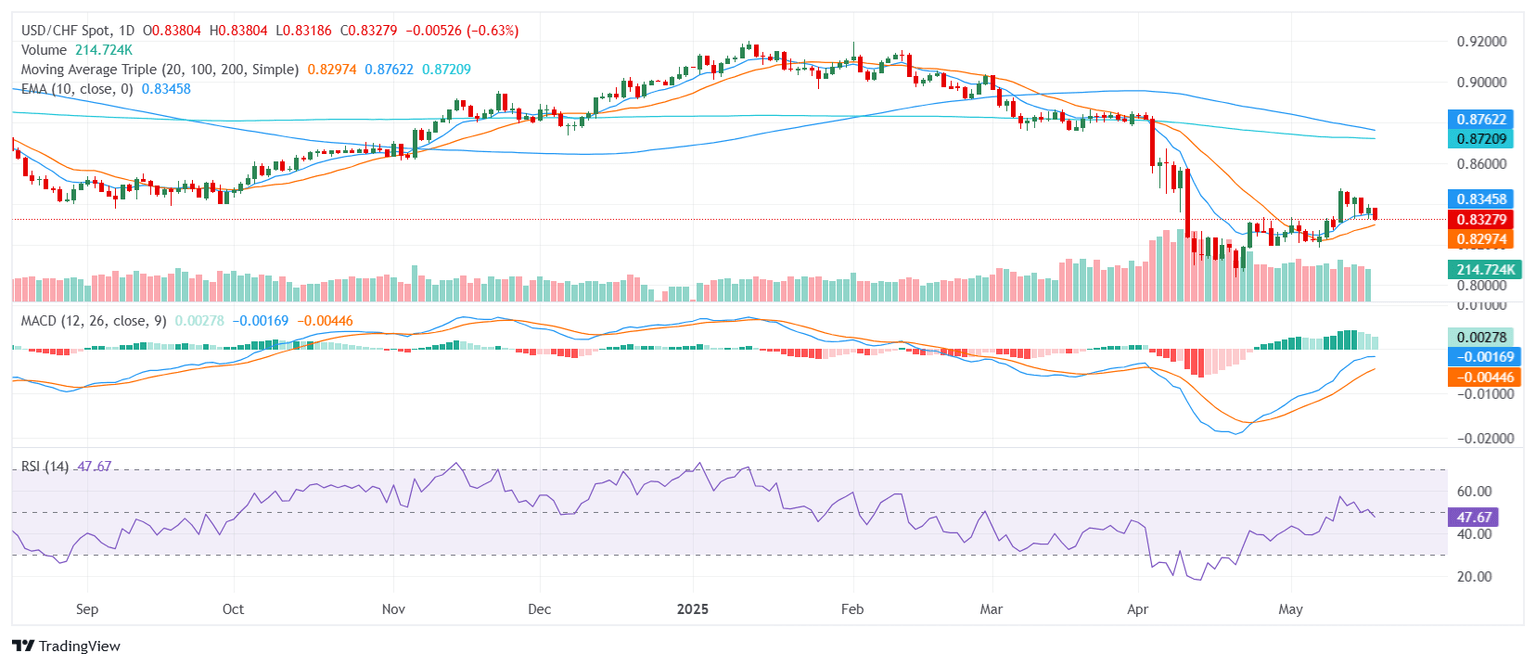

- Technical levels show immediate support around 0.8300, with resistance at 0.8380 and 0.8430.

The USD/CHF pair is trading 0.5% lower around 0.8330 during North American trading hours on Monday, reflecting a sharp drop in US Dollar sentiment after Moody's downgraded the United States' long-term credit rating from AAA to AA1. This marks a significant hit to the US Dollar's perceived stability, further pressuring the Greenback amid ongoing fiscal challenges.

The US Dollar is facing significant headwinds following Moody's decision to downgrade the US long-term issuer and senior unsecured ratings. The agency cited the $36 trillion debt pile and declining fiscal metrics as key reasons for the cut, reflecting growing concerns about the sustainability of US finances. The downgrade has pushed 10-year US Treasury yields up to nearly 4.52%, as investors demand higher compensation for the perceived risk of holding US debt.

Meanwhile, Fed officials struck a cautious tone on Monday. Fed Vice Chairman Philip Jefferson highlighted the risks to both jobs and inflation, suggesting a "wait and see" approach to future rate decisions given the current economic uncertainty. New York Fed President John Williams echoed these sentiments, noting that recent US data remains strong but that uncertainties around trade continue to pose risks. Atlanta Fed President Raphael Bostic also signaled that inflation is not moving toward target as quickly as anticipated, reinforcing the view that further rate cuts may be limited this year.

On the Swiss side, the Swiss National Bank (SNB) is expected to maintain a dovish stance as trade tensions remain elevated, potentially adding to the appeal of the safe-haven Swiss Franc. However, the broader market focus remains on the US fiscal outlook and the potential impact of higher borrowing costs on the global economy.

Technical Analysis

From a technical perspective, USD/CHF has broken below key support levels, reflecting the broader bearish trend. Immediate support is now seen around 0.8300, followed by 0.8270 and 0.8220. On the upside, resistance is likely to emerge around 0.8380, followed by the 0.8430 zone, which marks a significant barrier for further recovery.

The Relative Strength Index (RSI) remains in bearish territory, suggesting continued downside pressure, while the Moving Average Convergence Divergence (MACD) is pointing lower, reinforcing the negative outlook. The 20-day Simple Moving Average (SMA) has also turned lower, providing further resistance to any potential recovery.

With Moody's downgrade adding to the negative sentiment around the US Dollar, USD/CHF is likely to remain under pressure in the near term. Traders will be closely watching US economic data and further Fed commentary for signs of a potential policy shift, while the Swiss Franc's safe-haven appeal may provide additional downside risk for the pair.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.