USD/CHF down as soft US data and China slowdown hit sentiment

- The USD/CHF is trading lower, hovering near the week’s lows, as recession fears and weak Chinese PMIs weigh on sentiment.

- US GDP contracted in Q1, PCE inflation cooled, and traders now question the Fed’s next move amid Trump’s renewed criticism of Powell.

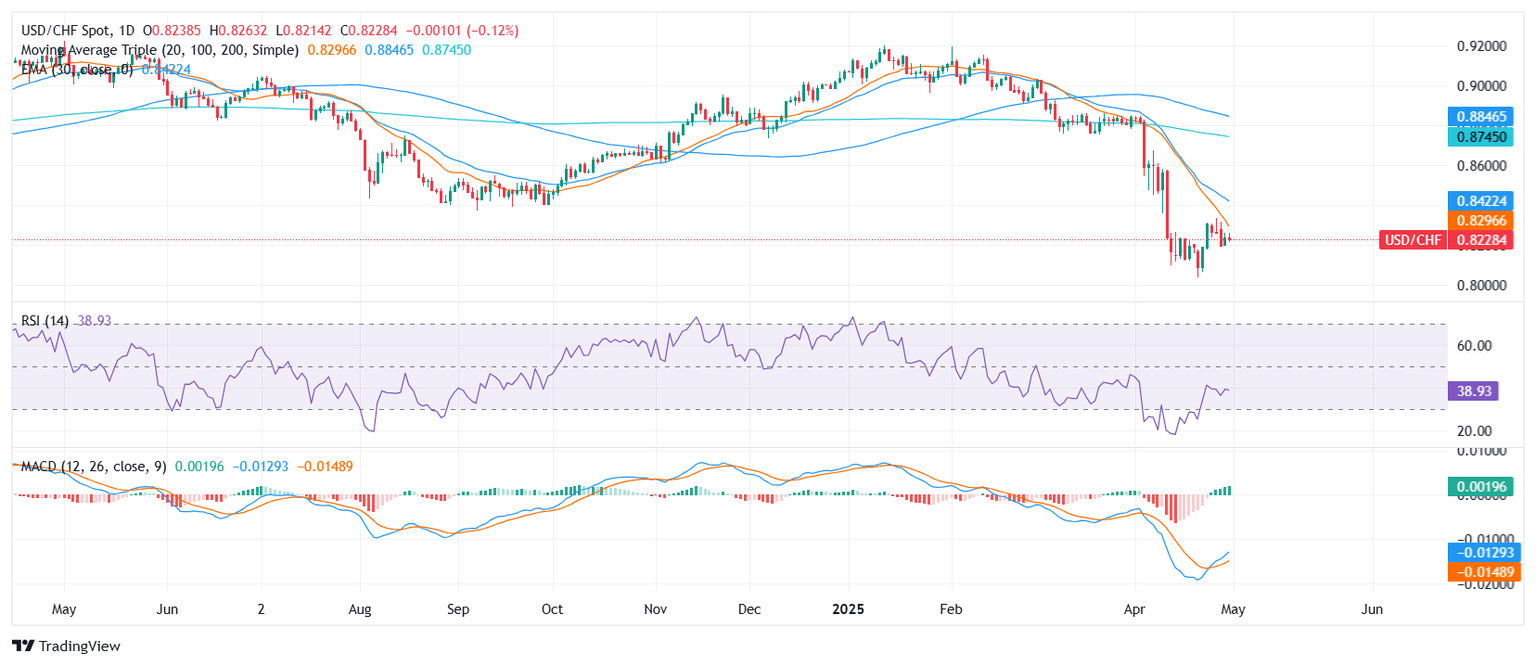

- Technical indicators remain bearish, with USD/CHF capped by moving average resistance and downside risks toward 0.8120 and 0.8070.

The USD/CHF is trading with losses, staying close to its recent lows after a wave of soft US data and deteriorating macro signals from China triggered broad risk-off flows in the market. Sentiment was already fragile heading into Wednesday, and the release of a disappointing US GDP print intensified concerns over the health of the US economy. At the same time, weak Chinese manufacturing and services PMIs revealed the first clear signs of stress from the trade war escalation, increasing fears of global economic deceleration. The US Dollar is broadly under pressure, struggling to gain any momentum despite month-end flows.

On the macro front, US GDP contracted by 0.3% in the first quarter of 2025, a stark reversal from the 2.4% growth seen in Q4 2024 and well below market expectations. The downturn reflected weaker consumer spending, a drop in government expenditure, and a widening trade deficit. Meanwhile, core PCE inflation came in at 2.3% year-on-year, down from February’s 2.5%, in line with consensus but continuing the cooling trend in price pressures. Personal income and spending surprised modestly to the upside, but failed to support the Dollar. President Trump’s renewed attacks on Fed Chair Powell, during a Detroit rally, added fuel to market uncertainty, as the President claimed to “know more about rates than Powell” and pushed for more aggressive easing.

Compounding the bearish bias, China’s April manufacturing PMI fell sharply to 49.0, its lowest level since 2023, and the export component dropped to 44.7. Non-manufacturing activity also slowed, with services and construction readings edging closer to stagnation. This confirmed a severe export shock and raised the likelihood of additional stimulus measures from Beijing. Traders reacted swiftly, selling USD across the board while demand for traditional safe havens like the Swiss Franc strengthened. Meanwhile, Chinese gold ETFs saw their largest outflows in 264 sessions, and Copper prices collapsed as CTA-driven liquidations escalated into thin liquidity ahead of holidays in Asia.

USD/CHF Technical Analysis

From a technical perspective, momentum signals are clearly bearish for the USD/CHF. The Relative Strength Index (RSI) is below 40, confirming weakening upside momentum, while the MACD remains in negative territory, suggesting continued selling pressure. The pair is trading below its 10-day and 20-day EMAs, reinforcing the downside bias. Strong resistance is seen near 0.8280 and 0.8340, while immediate support lies around 0.8120, with a deeper move targeting 0.8070 and potentially 0.8000 in a bearish continuation scenario.

Markets now shift focus to Friday’s Nonfarm Payrolls report, which will offer fresh insights into US labor market strength and shape expectations for the Fed’s May 7 policy decision. Until then, sentiment remains fragile and tilted against the US Dollar.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.