USD/CAD trades with losses amid US Dollar weakness

- The Loonie sets a second consecutive day of losses.

- The US Dollar lost appeal after the debt-ceiling agreement on Sunday.

The USD/CAD, at the time of writing, is trading at 1.3590, below its opening price by 0.15 % during the American session. Following the debt ceiling agreement announcement on Sunday, market’s sentiment turned positive and weakened the US Dollar while American traders enjoyed a long weekend on Memorial Day. On the other hand Canada's economic calendar has nothing relevant to offer and the Canadian Dollar benefits from the positive market environment.

Wall Street future’s rise amid US debt-ceiling agreement

US President Joe Biden and Republican House Speaker Kevin McCarthy jointly declared that they have come to a consensus on extending the debt ceiling, on Sunday. Under the proposed deal, the government would be permitted to borrow funds without raising the limit; instead, the limit would be temporarily suspended until 2025. However, the proposal still needs to be approved by Congress, but U.S. officials are optimistic about its passage. As a reaction, Wall Street futures cheered on the announcement and edged higher, applying pressure on the US Dollar.

Levels to watch

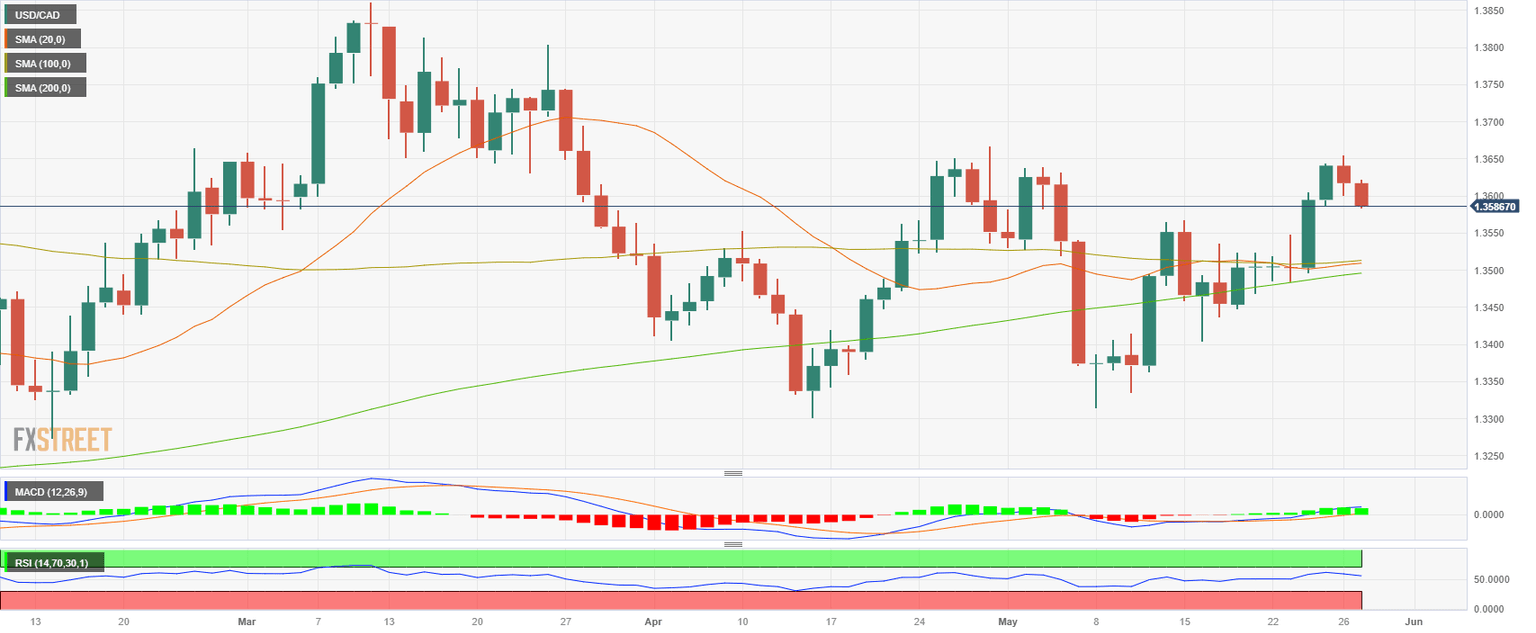

According to the daily charts, the USD/CAD holds a neutral to bearish outlook for the short term. However, indicators remain in positive territory and the convergence of the 20 and 100-day Simple Moving Averages (SMA) at the 135.00 area suggests that more upside may be in store for the pair.

The 1.3580 zone is the immediate support level for the USD/CAD. A break below this level could pave the way towards the mentioned convergence at the 1.3500 level. Furthermore, the 1.3620 zone is key for USD/CAD to gain further traction. If cleared, we could see a more pronounced move towards the monthly high at 1.3650 and the psychological mark at 1.3700.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.