USD/CAD Price Forecast: Seems vulnerable; could test 200-day SMA near 1.4000 mark

- USD/CAD struggles to capitalize on a modest Asian session uptick to levels beyond 1.4100.

- Recovering risk sentiment and Fed rate cut bets weigh on the USD and cap spot prices.

- A fresh leg down in Oil prices could undermine the Loonie and help limit further losses.

The USD/CAD pair attracts some sellers following an Asian session uptick to levels just above the 1.4100 mark and drops to a fresh daily low in the last hour amid a modest US Dollar (USD) downtick. Spot prices currently trade around the 1.4075-1.4070 area and seem vulnerable to weaken further.

The optimism led by US President Donald Trump’s announcement of a 90-day delay on reciprocal tariffs remains supportive of a strong recovery in the global risk sentiment. This, along with bets for multiple interest rate cuts by the Federal Reserve (Fed) in 2025, keeps the USD bulls on the defensive. Meanwhile, Crude Oil prices struggle to capitalize on the previous day's bounce from a four-year low, which might cap gains for the commodity-linked Loonie and act as a tailwind for the USD/CAD pair.

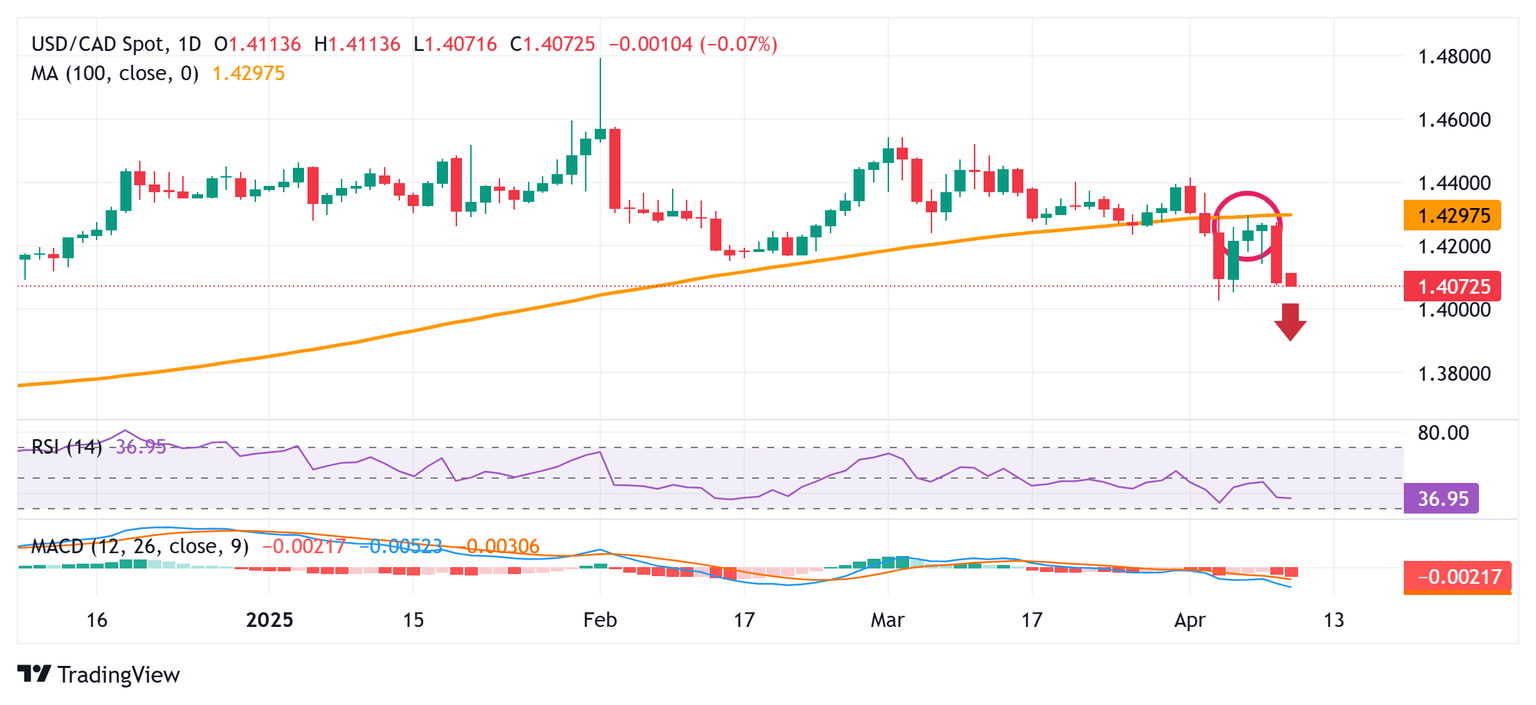

Meanwhile, spot prices this week repeatedly failed to move back above the 100-day Simple Moving Average (SMA) support breakpoint. The subsequent downfall and bearish oscillators on the daily chart validate the negative outlook for the USD/CAD pair. Hence, some follow-through weakness below the weekly trough around the 1.4060-1.4055 region and the 1.4030-1.4025 zone or the year-to-date low, towards the 200-day SMA near the 1.4000 psychological mark, looks like a distinct possibility.

A convincing break below the latter will be seen as a fresh trigger for bearish traders and set the stage for an extension of the recent downward trajectory witnessed over the past two months or so. However, investors might refrain from placing aggressive bets and opt to wait for the release of the US consumer inflation figures, which might provide fresh cues about the Fed's rate-cut path and influence the USD price dynamics.

In the meantime, momentum beyond the Asian session high, around the 1.4110 area, might still be seen as a selling opportunity and remain capped near the 1.4175-1.4180 region. This is closely followed by the 1.4200 round figure, above which a fresh bout of a short-covering move could allow the USD/CAD pair to aim back towards challenging the 100-day SMA, pegged just ahead of the 1.4300 mark. A sustained strength beyond the said handle might shift the near-term bias in favor of bullish traders.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

BRANDED CONTENT

Choosing a broker that aligns with your trading needs can significantly impact performance. Our list of the best regulated brokers highlights the best options for seamless and cost-effective trading.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.