USD/CAD Price Forecast: Holds ground above 1.3500, next barrier appears at nine-day EMA

- USD/CAD could test the immediate barrier at the nine-day EMA at 1.3521 level, followed by the 14-day EMA at 1.3546 level.

- The momentum indicator MACD shows a convergence below the signal line, suggesting a weakening of the bearish trend.

- The psychological level of 1.3500 appears as the immediate support for the pair.

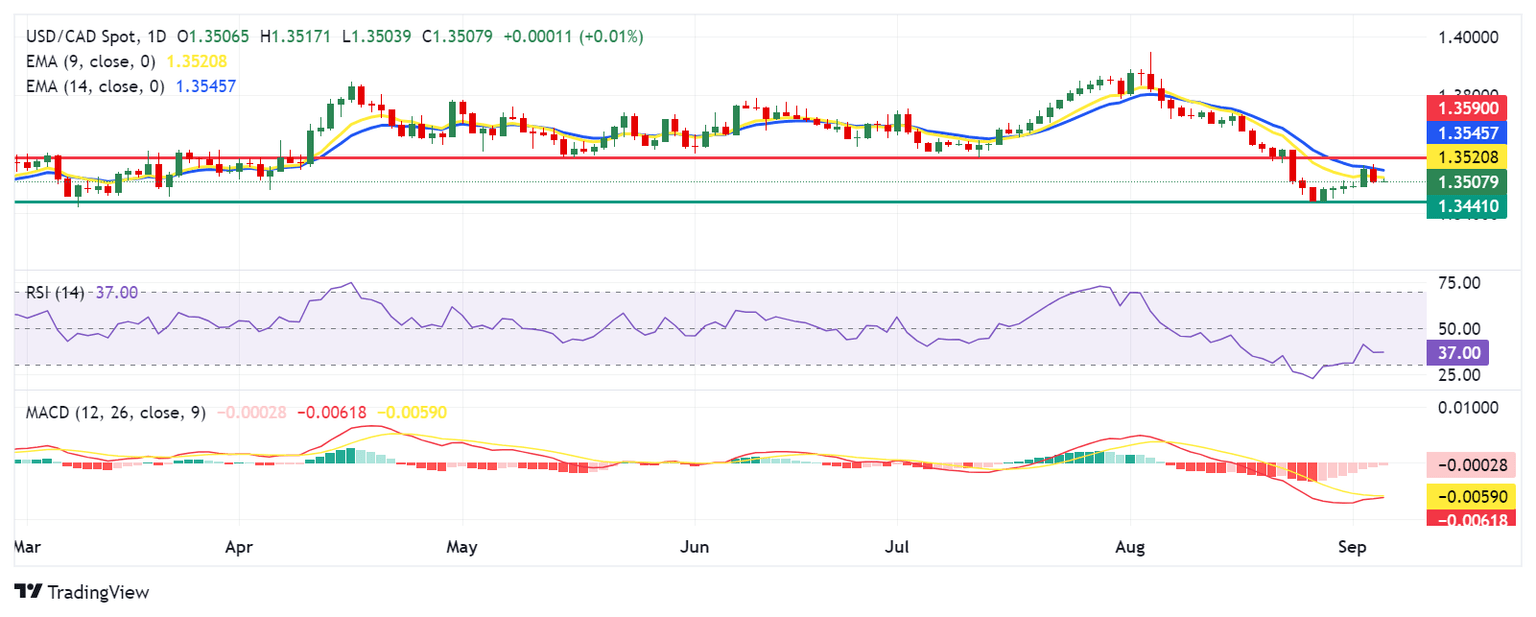

USD/CAD moves sideways around 1.3510 during European hours on Thursday. Analysis of the daily chart indicates a bearish bias for the USD/CAD pair, as the nine-day Exponential Moving Average (EMA) is positioned below the 14-day EMA.

Additionally, the 14-day Relative Strength Index (RSI) remains near the 30 level, confirming the overall bearish trend in play but also suggesting a potential correction soon.

The momentum indicator Moving Average Convergence Divergence (MACD) suggests a downward trend for the USD/CAD pair, as the MACD line is positioned below the centreline. However, the MACD line may crossover above the signal line, suggesting a potential weakening of the bearish trend.

On the downside, the USD/CAD pair tests the psychological level of 1.3500. A break below this level could reinforce the bearish bias and push the pair to navigate the region around the seven-month low at 1.3441, recorded on August 28.

In terms of resistance, the immediate barrier appears at the nine-day EMA at 1.3521 level, followed by the 14-day EMA at 1.3546 level. A breakthrough above these EMAs could weaken the bearish bias and lead the pair to test the "throwback support turns into a pullback resistance" level at 1.3590, followed by the psychological level of 1.3600.

USD/CAD: Daily Chart

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.15% | -0.16% | -0.09% | 0.00% | -0.07% | -0.06% | -0.05% | |

| EUR | 0.15% | 0.00% | 0.10% | 0.17% | 0.08% | 0.13% | 0.10% | |

| GBP | 0.16% | -0.00% | 0.09% | 0.19% | 0.08% | 0.13% | 0.09% | |

| JPY | 0.09% | -0.10% | -0.09% | 0.11% | 0.00% | 0.02% | 0.04% | |

| CAD | -0.00% | -0.17% | -0.19% | -0.11% | -0.07% | -0.05% | -0.07% | |

| AUD | 0.07% | -0.08% | -0.08% | -0.01% | 0.07% | 0.03% | 0.02% | |

| NZD | 0.06% | -0.13% | -0.13% | -0.02% | 0.05% | -0.03% | -0.02% | |

| CHF | 0.05% | -0.10% | -0.09% | -0.04% | 0.07% | -0.02% | 0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.