USD/CAD Price Forecast: Aims to hold 50% Fibonacci retracement at 1.3890

- USD/CAD corrects to near 1.3890 after failing to extend nine-day winning streak.

- Criminal charges against Fed Chair Powell have weighed on the US Dollar.

- Rising Canadian jobless rate to keep the Canadian Dollar under pressure.

The USD/CAD pair falls after failing to extend the nine-day winning streak on Monday. The Loonie pair corrects to near 1.3890 during the day as the US Dollar (USD) retraces, following criminal charges against Federal Reserve (Fed) Chair Jerome Powell.

During the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.22% lower to near 98.90. The DXY corrects after posting a fresh monthly high near 99.26 on Friday.

On Friday, the United States (US) Justice Department sent a subpoena to the Fed against Chair Jerome Powell over his comments in his Senate testimony last June, which concerned “multiyear renovation of historic buildings at an estimated cost of $2.5 billion”.

Fed’s Powell has responded that these charges are not about his “testimony or the renovation project but a pretext”.

Meanwhile, the Canadian Dollar (CAD) is broadly under pressure as the Unemployment Rate has increased to 6.8% from estimates of 6.6% and the prior reading of 6.5%. Rising jobless rate could prompt expectations that the Bank of Canada (BoC) will restart its monetary-easing campaign soon.

USD/CAD technical analysis

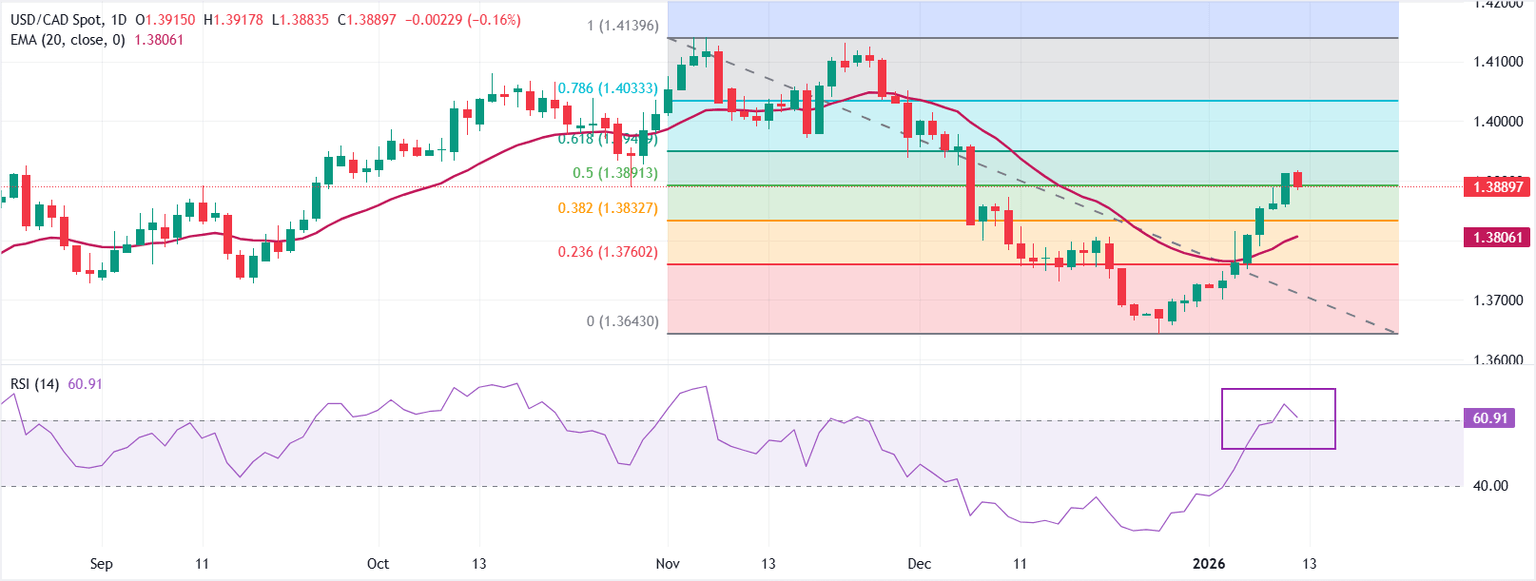

USD/CAD trades lower at around 1.3890 on Monday. The 20-day Exponential Moving Average (EMA) has turned higher to 1.3806, with price holding above it and reinforcing a near-term recovery bias.

The 14-day Relative Strength Index (RSI) at 61 shows firm positive momentum after rebounding from oversold territory.

Measured from the 1.4140 high to the 1.3643 low, the 50% Fibonacci retracement at 1.3891 acts as immediate resistance. Above it, the 61.8% retracement at 1.3950 would cap the next push.

Failure to clear nearby resistance would keep the rebound contained, with pullbacks set to find initial support at the rising 20-day EMA near 1.3806.

(The technical analysis of this story was written with the help of an AI tool.)

Economic Indicator

Unemployment Rate

The Unemployment Rate, released by Statistics Canada, is the number of unemployed workers divided by the total civilian labor force as a percentage. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labor market and a weakening of the Canadian economy. Generally, a decrease of the figure is seen as bullish for the Canadian Dollar (CAD), while an increase is seen as bearish.

Read more.Last release: Fri Jan 09, 2026 13:30

Frequency: Monthly

Actual: 6.8%

Consensus: 6.6%

Previous: 6.5%

Source: Statistics Canada

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.