USD/CAD Price Analysis: Technical set up remains in favor of bears

- USD/CAD looks to extend Monday’s decline.

- Bearish bias remains intact while below 21-DMA.

- Daily RSI points south in the bearish territory.

USD/CAD has recovered losses but remains well below the 1.3100 level in the European session, with the risks remaining to the downside, as technical set up favors the bears in the near-term.

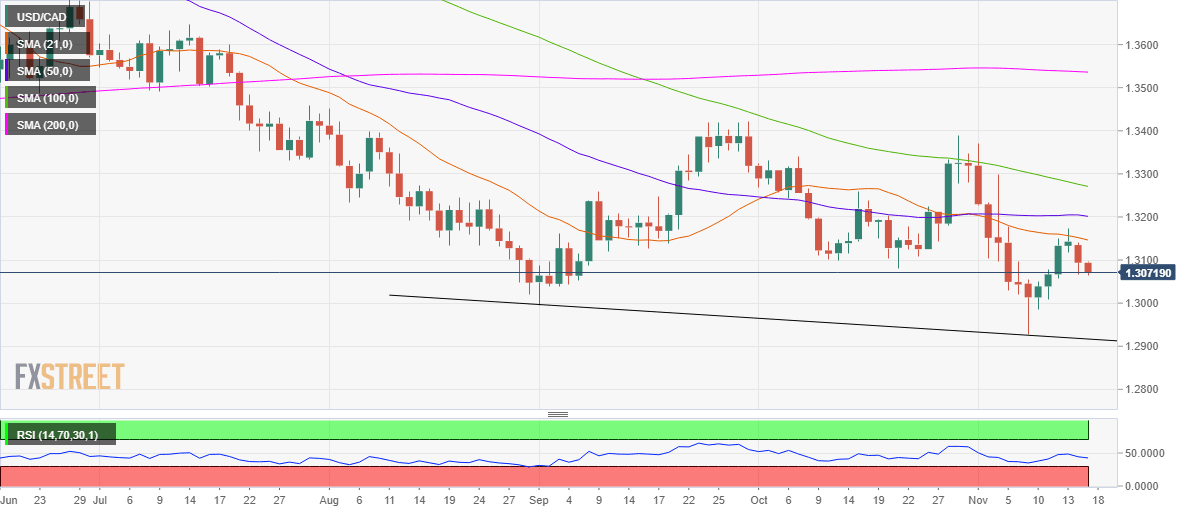

Looking at the daily chart, the spot trades below all major daily moving averages (DMA), with the 14-day Relative Strength Index (RSI) pointing south below the midline, suggesting that there is more room to the downside.

Therefore, the price could drop to test the 1.3000 level should the November 12 low of 1.3056 give way.

Further south, the two-month-old falling trendline support at 1.2916 could be put to test if the sellers extend their control.

Alternatively, daily closing above the 21-DMA at 1.3146 is needed to reviving last week’s upbeat momentum.

The next relevant resistance is seen at the horizontal 50-DMA of 1.3201, which could likely challenge the bulls’ commitments.

USD/CAD: Daily chart

USD/CAD: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.