USD/CAD Price Analysis: Struggles to find acceptance above 100 DMA, bullish potential intact

- USD/CAD climbs to its highest level since January and draws support from a combination of factors.

- Sliding Crude Oil prices undermines the Loonie and provides a goodish lift amid sustained USD buying.

- The overbought RSI on hourly charts fails to assist bulls to find acceptance above the 100-day SMA.

The USD/CAD pair builds on this week's goodish rebound from the vicinity of the monthly low and gains strong follow-through traction on Friday. The momentum lifts spot prices to the 1.3535-1.3540 region, or the highest level since January 6, and is sponsored by a combination of factors.

Crude Oil prices tumble to a one-and-half-week low amid worries that rising borrowing costs will dampen economic growth and dent fuel demand. This, in turn, undermines the commodity-linked Loonie, which, along with relentless US Dollar buying, acts as a tailwind for the USD/CAD pair.

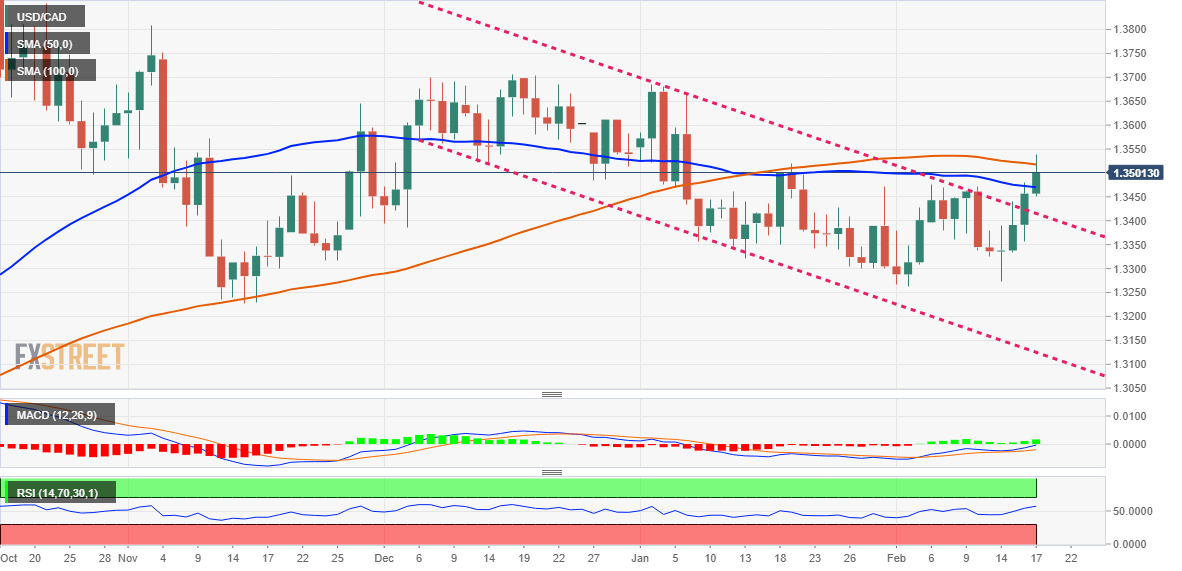

From a technical perspective, the overnight sustained strength above the 1.3400 mark, representing the top end of over a two-month-old descending channel, was seen as a fresh trigger for bulls. A subsequent move beyond the 50-day SMA supports prospects for a further appreciating move.

Spot prices, however, struggle to find acceptance above the 100-day SMA amid overbought RSI (14) on hourly charts. Hence, it will be prudent to wait for a convincing break through the said barrier, currently around the 1.3520 region, before placing fresh bullish bets around the USD/CAD pair.

The subsequent positive momentum should allow bulls to surpass an intermediate barrier near the 1.3570 area and aim to reclaim the 1.3600 round-figure mark. The upward trajectory could get extended further towards retesting the YTD peak, around the 1.3680-1.3685 region touched in January.

On the flip side, any subsequent pullback below the 1.3475-1.3470 horizontal resistance breakpoint, coinciding with the 50-day SMA, could be seen as a buying opportunity and remain limited near the 1.3400 mark. The latter should act as a strong base for the USD/CAD pair, which if broken might negate the positive outlook.

USD/CAD daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.