USD/CAD Price Analysis: Snaps two-day winning streak above the 1.3500 mark

- USD/CAD recovery loses steam near 1.3510 ahead of the Canadian PMI data.

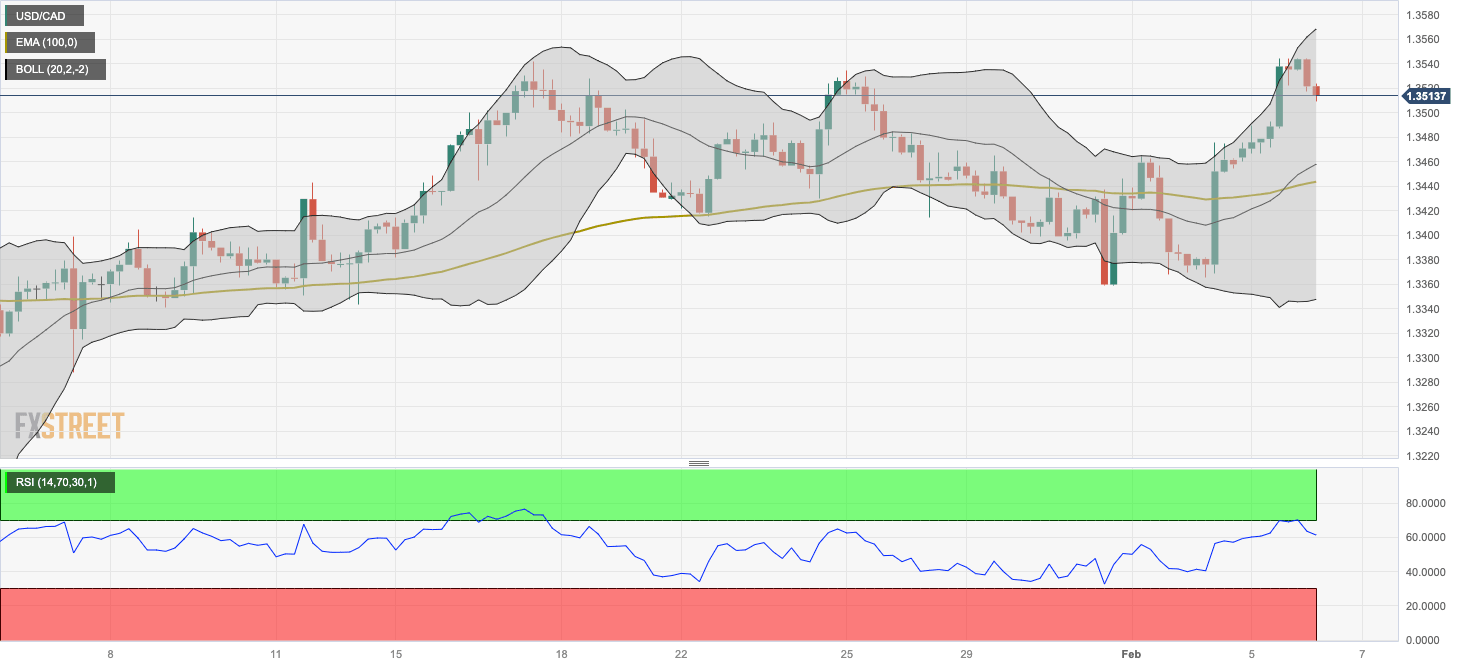

- The pair resumes its uptrend above the key EMA; RSI indicator is above the 50.0 midlines.

- The first upside target is seen at 1.3545; the initial support level is located at 1.3460.

The USD/CAD pair loses traction near the intraday low during the early European trading hours on Tuesday. The decline of the US Dollar (USD) acts as a headwind for the pair. Later on Tuesday, the Canadian Ivey Purchasing Managers Index (PMI) for January will be due, which is estimated to ease to 55.0 in January from 56.3 in December. At press time, USD/CAD is trading at 1.3510, down 0.22% on the day.

Technically, USD/CAD resumes its uptrend and holds above 100-period Exponential Moving Averages (EMA) on the four-hour chart. Furthermore, the Relative Strength Index (RSI) stands above the 50.0 midlines, hinting that further upside looks favorable.

The first upside barrier for USD/CAD will emerge near a high of January 5 at 1.3545. Any follow-through buying above the latter will see a rally to the upper boundary of the Bollinger Band at 1.3569. A sustained break could take the pair to a high of December 12 at 1.3618, followed by a high of November 27 at 1.3711.

In the case of a bearish trading environment, the initial support level is seen near a high of February 1 at 1.3460. The next downside target is located near the 100-period EMA at 1.3443. The additional downside filter to watch is 1.3395 (low of January 20), en route to 1.3365 (low of February 2), and finally at 1.3347 (the lower limit of the Bollinger Band).

USD/CAD four-hour chart

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.