USD/CAD Price Analysis: Gains traction and tests the 100-day EMA at around 1.3410

- USD/CAD resumed its uptrend once it reclaimed the February 1 daily high at 1.3379.

- USD/CAD Price Analysis: A daily close above 1.3400 will exacerbate a rally to 1.3500. otherwise, further downside is expected.

USD/CAD climbs in the North American session after hitting a daily low of 1.3311 before Wall Street opened. Nevertheless, a strong US jobs report bolstered the US Dollar, the strongest currency in the FX space. At the time of writing, the USD/CAD exchanges hand at 1.3402.

USD/CAD Price Analysis: Technical outlook

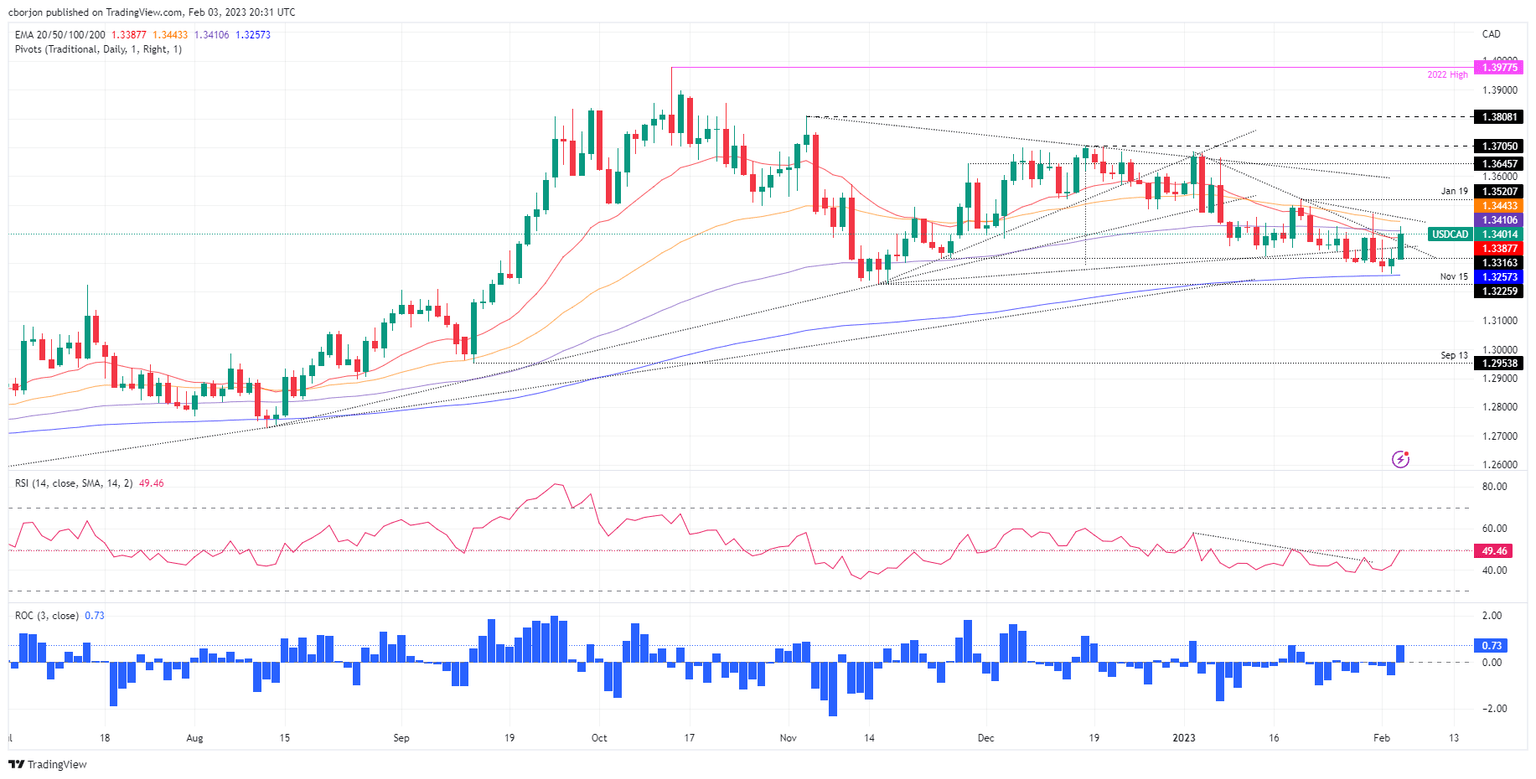

Technically speaking, the USD/CAD is still neutral-to-upward biased, though it reclaimed some resistance levels after testing the 200-day Exponential Moving Average (EMA) a couple of days ago. On its way north, the USD/CAD pair conquered an upslope-support trendline that was broken on January 31, which means the uptrend could resume shortly.

Therefore, the USD/CAD next resistance would be the 50-day EMA at 1.3443. Break above, and the USD/CAD pair would rally to January 31 daily high at 1.3471, followed by 1.3500.

As an alternate scenario, the USD/CAD first support would be the 1.3400 mark. Once cleared, the USD/CAD might test the 20-day EMA at 1.3388, followed by a downslope trendline turned support at 1.3355-65, and then the 1.3300 psychological barrier.

USD/CAD Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.