USD/CAD Price Analysis: Attempted recovery stalls near trading range support breakpoint

- USD/CAD staged a solid rebound from two-week lows, albeit lacked follow-through.

- The overnight break below a two-week-old trading range still favours bearish traders.

- A sustained move beyond the 1.2625 region is needed to negate the negative outlook.

A combination of supporting factors assisted the USD/CAD pair to regain positive traction on Friday and recover a part of the overnight slump to two-week lows. The US dollar was back in demand amid a fresh leg up in the US Treasury bond yields. Apart from this, a weaker tone around crude oil prices undermined the commodity-linked loonie and provide an additional boost to the USD/CAD pair.

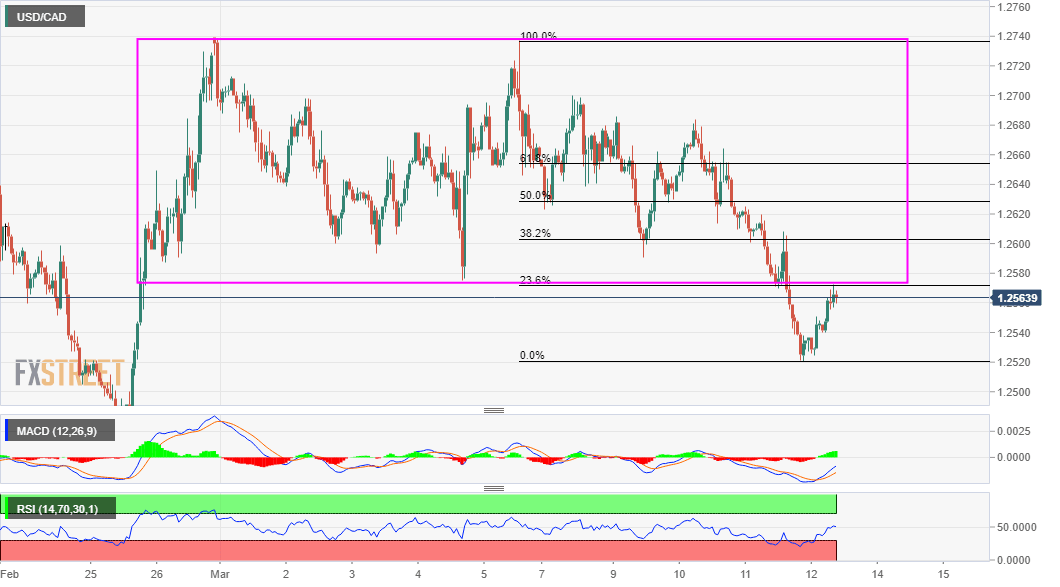

The intraday positive move, however, stalled just ahead of a trading range support breakpoint near the 1.2575 region. This coincides with the 23.6% Fibonacci level of the 1.3737-1.2521 slide and should act as a pivotal point for traders. Meanwhile, oscillators on 4-hourly/daily charts maintained their bearish bias and are yet to gain any meaningful traction on the 1-hourly chart. The set-up remains tilted in favour of bearish traders and supports prospects for further losses.

That said, investors might refrain from placing aggressive bets, rather prefer to wait for Friday's release of the Canadian monthly jobs report. This, in turn, warrants some caution before positioning for any firm intraday direction.

In the meantime, any further move up might confront resistance near the 1.2600 mark (38.2% Fibo. level). This is followed by the overnight swing high, around the $1.2625 region, which if cleared might trigger a short-covering rally. The USD/CAD pair might then aim to reclaim the 1.2700 mark with some intermediate resistance near the 61.8% Fibo. level, around the 1.2655 region. The momentum could further get extended towards challenging the 1.2740-50 heavy supply zone.

On the flip side, the 1.2520 level now seems to act as immediate support. Some follow-through selling, leading to subsequent weakness below the key 1.2500 psychological mark will turn the USD/CAD pair vulnerable to retest multi-year lows, around the 1.2470-65 region.

USD/CAD 1-hourly chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.