USD/CAD drops towards 1.2450 as Canada adds 230.7K jobs in June

- Unemployment Rate in Canada dropped to 7.8% in June vs. 7.7% expected

- USD/CAD drops further below 1.2500 after the data.

The Canadian economy added 230,700 jobs in June when compared to 68,000 job losses reported in May and expectations of +195,000, the latest data published by Statistics Canada showed on Friday.

Meanwhile, the Unemployment Rate in Canada dropped to 7.8% in June from 8.2% in May, missing estimates of 7.7%.

Additional takeaways

Canada June full-time employment -33.2k, part-time employment +263.9k.

Canada June participation rate 65.2%; vs may 64.6%.

Canada June average hourly wage of permanent employees +0.1% YoY vs. May -1.4%.

Canada goods sector -48k jobs in June, services sector +278.6k jobs.

Market reaction

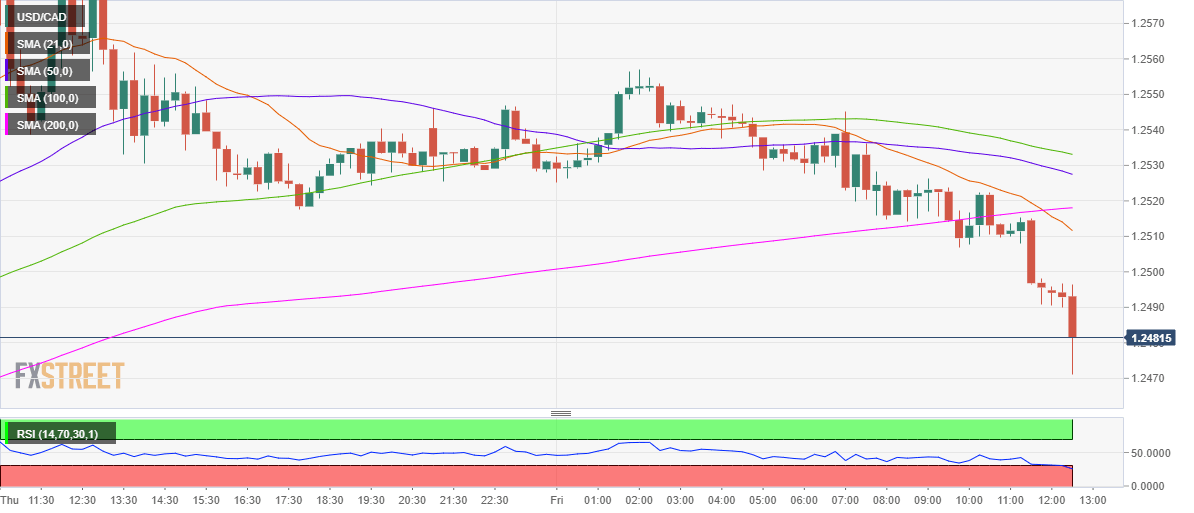

The USD/CAD pair dropped to a daily low of 1.2470 on a bigger-than-expected jump in job gains last month.

As of writing, the pair is trading at 1.2476, down 0.45% on the day.

USD/CAD 15-minutes chart

USD/CAD technical levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.