USD/CAD breaks below 1.2400 on good Canadian Manufacturing PMI ahead risk events

- USD/CAD stalls at 1.2400, retreated to 1.2350 on good Canadian macroeconomic data.

- Positive market mood, and rising crude oil prices, boost the CAD prospects.

- Canadian IHS Markit Manufacturing PMI reading was better than expected.

The USD/CAD slides during the New York session, down 0.27%, trading at 1.2356 at the time of writing. A risk-on market mood, alongside rising crude oil prices, boosts the Canadian dollar.

During the Asian session, the US Dollar was firmly bid, trading as high as 1.2400. However, once the Canadian IHS Markit PMI Manufacturing reading was released, the pair broke beneath the 1.2400 figure as renewed optimism surrounded the Loonie.

US Dollar Index below 94 again, despite rising US T-bond yields

In the meantime, the US Dollar Index, which measures the greenback's performance against a basket of six peers, slumps 0.18%, breaking below 94, sitting at 93.95. Contrarily, the US T-bond 10-year benchmark note, which dramatically influences the US dollar, rises three and a half basis points, up to 1.589%.

Canadian IHS Markit Manufacturing PMI reading was better than expected

On the macroeconomic front, the Canadian economic docket featured the IHS Markit Manufacturing PMI for October rose to 57.7, better than the 57.2 expected and higher than the September reading. That motivated CAD bulls, which promptly spurred a downward move towards the 1.2350 familiar level, but lacked the conviction to push the pair towards 1.2300, as the Federal Reserve November meeting, is around the corner.

Concerning the US economic docket, the Institute for Supply Management (ISM) revealed the Manufacturing PMI for October, which rose to 60.8 more than the 60.6 estimated. Although the reading was good, it fell short against the September reading. Moreover, the new orders slumped to a 16-month low as factories continued to experience raw materials shipment delays.

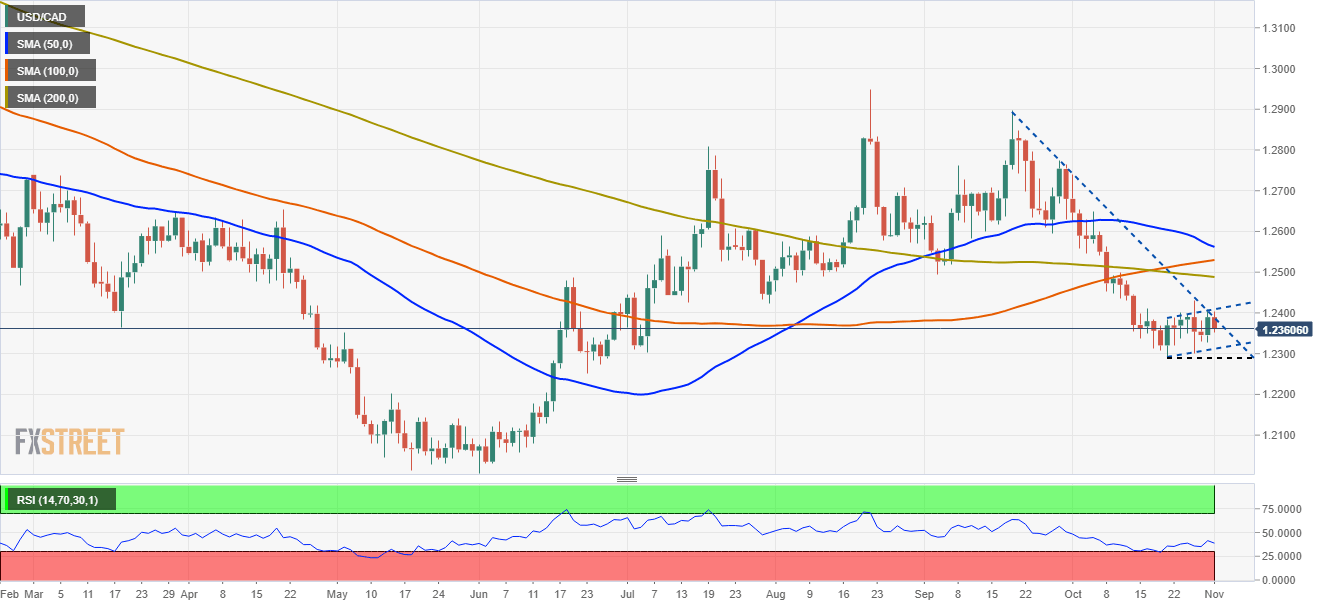

USD/CAD Price Forecast: Technical outlook

Daily chart

The USD/CAD pair unsuccessfully tested a downslope resistance trendline, which caused a retracement from 1.2400 towards 1.2360, in line with the downward bias depicted by daily moving averages (DMA's) located above the spot price. Furthermore, the price action of the last eight days has formed a bearish flag, which in case of a downward break, would open the door for 1.2278, immediately followed by the June 23 low at 1.2252.

The Relative Strength Index (RSI) is at 37, well below the 50-mid line edging slightly lower, indicating that bears are in control. However, fundamental and macroeconomic news suggests that market participants would remain on the sidelines, awaiting the Federal Reserve meeting.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.