US Treasury yields climb as Fed Minutes highlight wait-and-see mode

- US 10-year yield rises to 4.473% as investors digest the Fed's concerns about inflation and tariffs.

- $70B 5-year auction clears at 4.071%, slightly below recent average ahead of Thursday's 7-year sale.

- Weak Richmond Fed data underscores economic slowdown; all eyes on GDP and Core PCE later this week.

US Treasury yields climbed on Wednesday following the release of the latest Federal Reserve (Fed) meeting minutes from May 6-7, which revealed the US central bank's concerns about tariffs and their impact on inflation and economic activity.

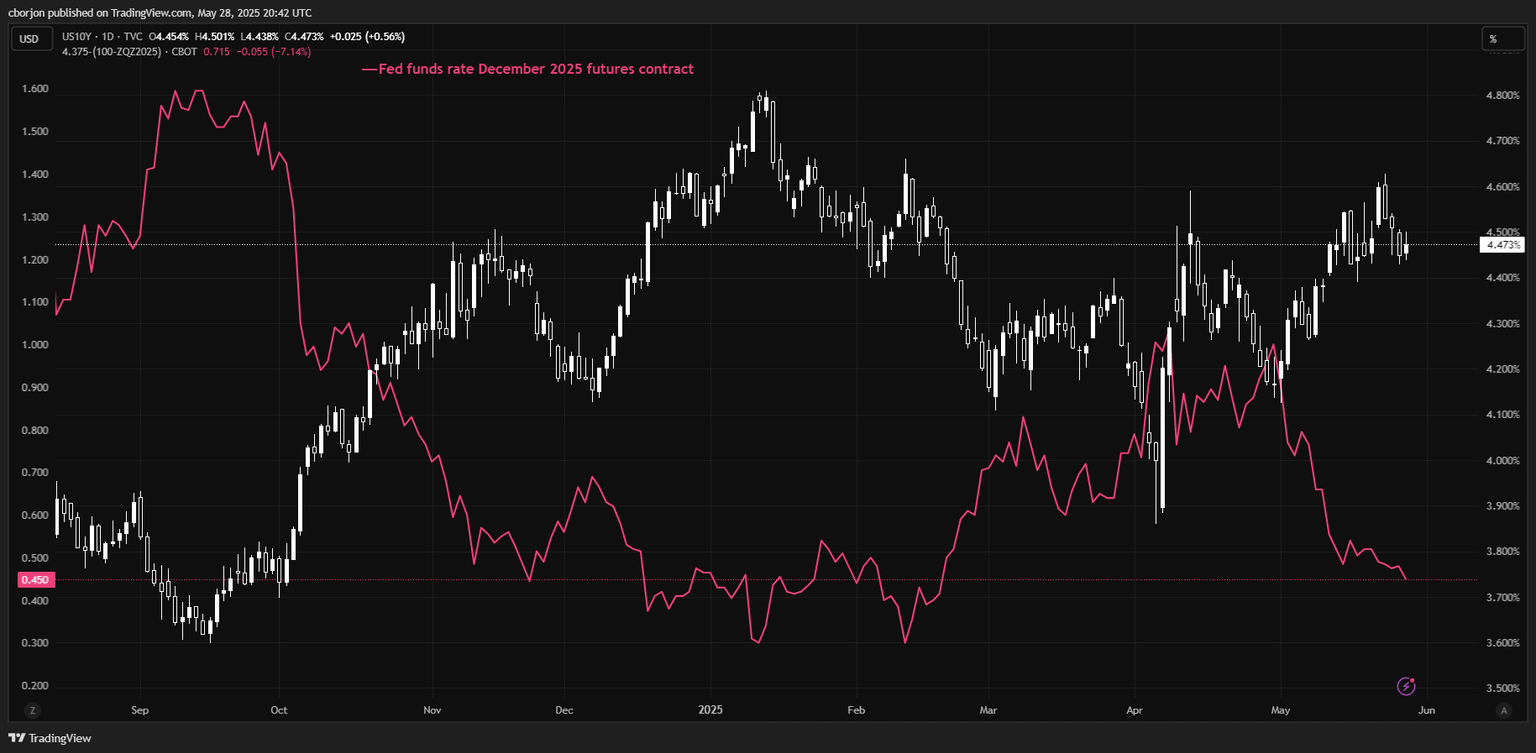

Treasury yields rise across curve after Fed signals caution; markets price in 45 bps in cuts by year-end

The latest Federal Reserve minutes revealed that officials support a cautious approach to rate adjustments amid elevated economic uncertainty and rising risks of stagflation.

In response, money markets priced 45 basis points of rate cuts by the end of the year.

The US 2-year T-note yield, the most sensitive to interest rate changes, rises one and a half basis points (bps) to 3.994%.

The US 10-year Treasury note yield surges three basis points to 4.473%, as market participants remain skeptical that the Fed will lower rates in the second half of the year.

The US 5-year note $70 billion auction reached a high yield of 4.071%, surpassing the previous auction's 3.995% yield, although it remained below the six-auction average of 4.204%. On Thursday, the US Treasury is expected to offer $44 billion in 7-year T-notes.

US economic data was scarce, although the Richmond Fed reported that manufacturing and service activity continued to show an ongoing economic slowdown in both sectors.

Ahead this week, investors are eyeing the release of GDP and labor indicators on Thursday. By Friday, the release of the Core Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation gauge, is expected to dip slightly.

US 10-year yield vs. Fed funds rate December 2025 easing expectations

(This story was corrected on May 28 at 21:13 GMT to say market participants remain skeptical that the Fed will lower rates in the second half of the year, not the first)

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.