US stock market news: Blink Charging Co (BLNK) + Ideanomics (IDEX) may propel higher if they join forces

- Blink Charging Co and Ideanomics Inc have the potential to surge if the harness their combined synergies.

- NASDAQ: BLNK is set for a correction after surging over 40% on Tuesday.

- NASDAQ: IDEX is fending off concerns about its finances and seems ready to rise.

NASDAQ: BLNK and NASDAQ: IDEX have both been gaining ground in recent months amid growing demand for electric vehicles. EVs have been popularized by Elon Musk's Tesla and by two other factors. The coronavirus pandemic has sent people away from public transport and into socially distanced vehicles – and the trend of going green is gaining ground, especially with less pollution during the lockdown.

Regardless of COVID-19, the two firms have a clear synergy – Ideanomics makes the cars and Blink Charging makes the charges. Will they collaborate? It is essential to note that Miami-based Blink and Delaware-registered Ideanomics operate in different places – BLNK in the US and IDEX in Asia. Will this make cooperation complicated or prevent fears of competition?

For the time being, both firms operate independently and their stocks are worth separate examination.

BLNK Stock Price

NASDAQ: BLNK closed at $5.68 on Tuesday, up over 40%, and over 250% above the levels it changed hands at in early June. Premarket indicators are pointing to a downside correction. Is it a "buy the dip" opportunity? Bargain-seekers – perhaps using the Robinhood app – may find it attractive.

Ideanomics Inc stock

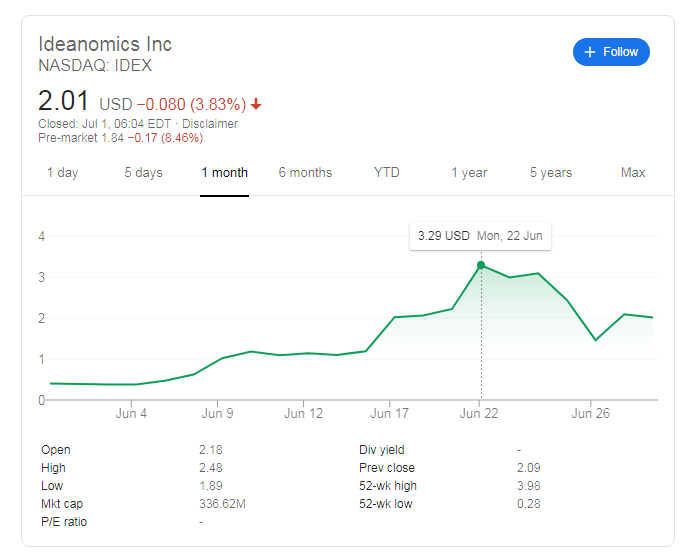

NASDAQ: IDEX has also enjoyed an upward trajectory, surging from a penny stock status early last month to a peak of $3.98. However, it has been under pressure from short-sellers in recent days. Several investors raised suspicions that the firm is in dire financial straits, triggering a denial from Ideanomics.

Premarket trading suggests that Ideanomics Inc is set to extend this downside correction and fall below the $2 mark. Also here, bargain-seekers may come into play.

Both stocks are set for short-term falls, but like in electronics, two negatives can turn into a positive if they are placed together.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.