US Dollar resides just below two-year high ahead of Christmas

- The US Dollar off to a positive start on Monday after a rather sluggish start of the day.

- Upward revisions from the preliminary November Durable Goods release set the tone for a stronger Greenback.

- The US Dollar Index (DXY) has the two-year high in reach.

The US Dollar (USD) is rallying on Monday, with the US Dollar Index (DXY) close to a fresh two-year high print. The moves comes after the US Dollar gained ground on the back of the November Preliminary Durable Goods release. As always, the actual number is less important with the big upside revision from 0.3% to 0.8% sweeping the Greenback higher.

The US economic calendar will start to settle down as of new with a few minor second-tier data points still to be released. The US Treasury still has its work cut out with several bond auctions. Meanwhile a big sigh of relief rolls through US markets after a government shutdown got averted at last minute ahead of the Christmas and New Year's holidays.

Daily digest market movers: US Treasury hard at work

- A government shutdown was averted on Friday in the very final hours. The White House announced on Saturday that US President Joe Biden had signed the legislation, which funds the government through mid-March.

- At 13:30 GMT, the Chicago Fed National Activity Index for November came in at -0.12 from -0.40 in the previous release.

- US Durable Goods saw its prelimenary November release come in at -1.1% against the previous 0.3%. Though, the US Dollar rallied on the back of that upward revision from the previous 0.3% to 0.8%. The Durable Goods reading without Cars and Transportation came in at -0.1%, coming from 0.2%.

- At 15:00 GMT, the US Consumer Confidence index for December got released. It fell to 104.7, coming from 111.7. Here as well some upward revisions for the prior reading, to 112.8.

- The US Treasury will have its work cut out this Monday with four auctions: At 16:30 GMT, a 3-month, a 52-week and a 6-month bill will be allocated in the markets. At 18:00 GMT, a 2-year Note will be auctioned.

- Asian equities have doing quite well, ending their six-day losing streak. European and US equities not so much, with losses across the board in both continents.

- The CME FedWatch Tool for the first Fed meeting of 2025 on January 29 sees a 91.4% chance for a stable policy rate against a small 8.6% chance for a 25 basis points rate cut.

- The US 10-year benchmark rate trades at 4.56%, just below the 4.59% high from last week.

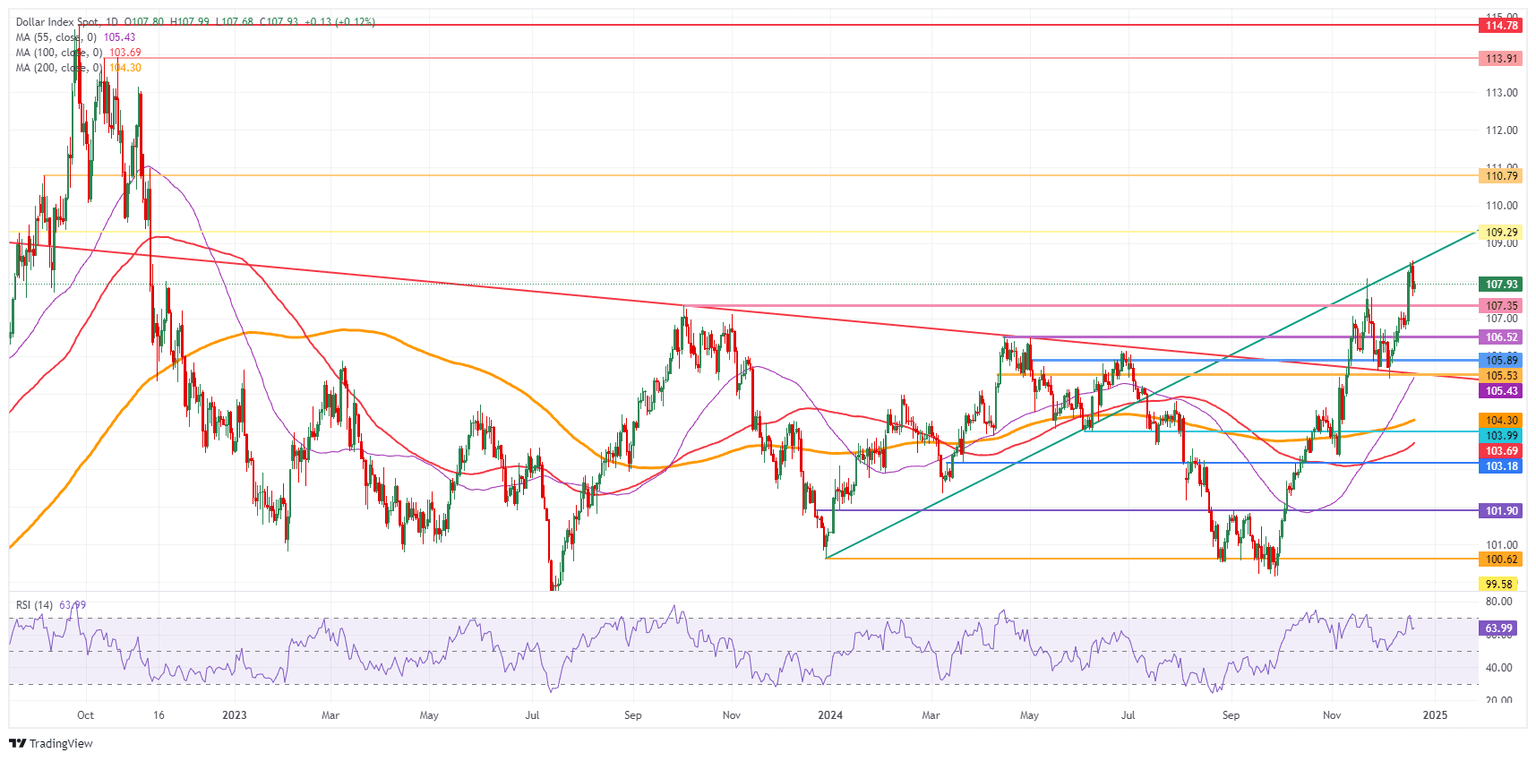

US Dollar Index Technical Analysis: Nearing the end

The US Dollar Index (DXY) is set for the final normal trading day before Christmas with a rather light calendar ahead. Traders will change their strategy and will likely only trade short-term moves. So, keep in mind that any moves could be short-lived and face quick profit-taking.

On the upside, a trend line originating from December 28, 2023, is acting as a moving cap. The next firm resistance comes in at 109.29, which was the peak of July 14, 2022, and has a good track record as a pivotal level. Once that level is surpassed, the 110.00 round level comes into play.

The first downside barrier comes in at 107.35, which has now turned from resistance into support. The second level that might be able to halt any selling pressure is 106.52. From there, even 105.53 could come under consideration while the 55-day Simple Moving Average (SMA) at 105.23 is making its way up to that level.

US Dollar Index: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.