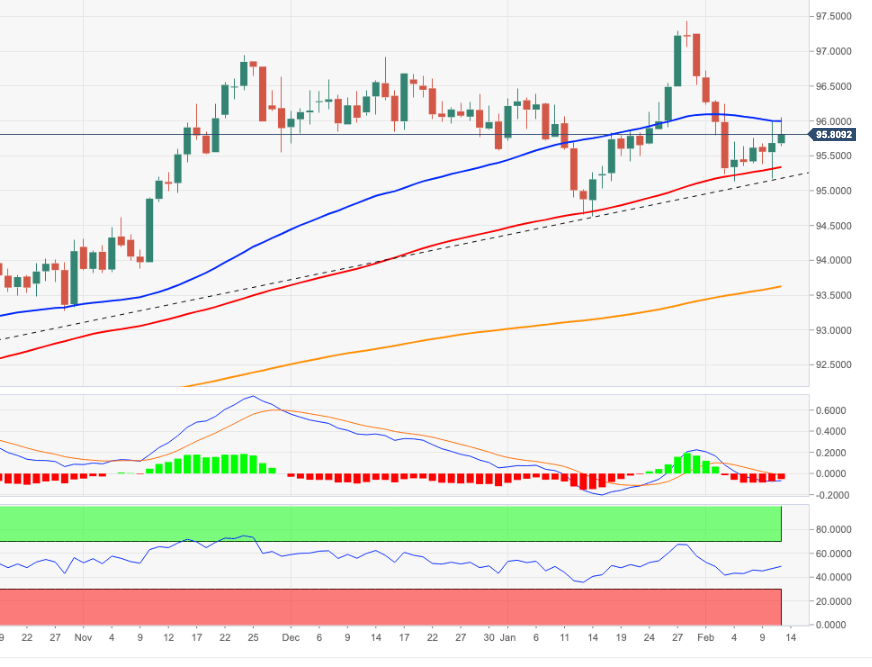

US Dollar Index Price Analysis: Tough barrier now emerged around 96.00

- DXY extends the recovery in the second half of the week.

- The index faltered once again around the 96.00 region.

DXY now alternates gains with losses after failing to surpass the key barrier at 96.00 earlier in the session.

The inability of the index to garner convincing upside traction, ideally in the short term, could prompt sellers to return to the market. That scenario should force the dollar to initially retest the so far monthly low at 95.13 (February 4) ahead of the 2022 low at 94.62 (January 14).

In the near term, the 5-month line near 95.20 is expected to hold the downside for the time being. Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.59.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.