US Dollar Index Price Analysis: Overbought levels could spark a corrective move

- DXY climbs to new highs near 110.30 on Monday.

- A technical correction should not be ruled out.

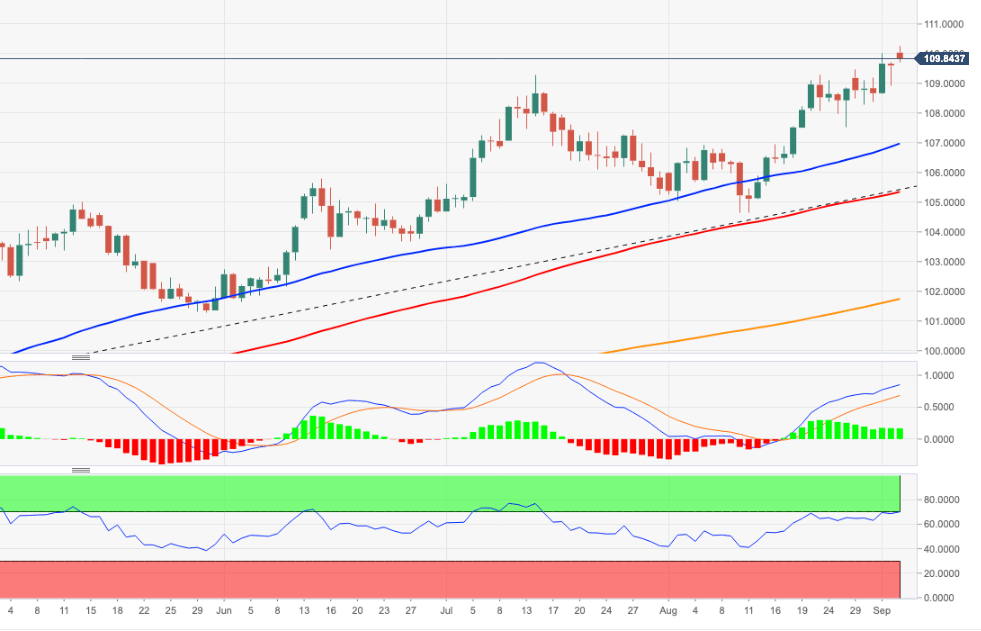

DXY extends the march north to the vicinity of 110.30, where it seems to have met some initial resistance.

The short-term bullish view in the dollar remains well in place for the time being and propped up by the 7-month support line, today around 105.70.

However, the current overbought conditions of the index could trigger some corrective downside, which should be seen as a buying opportunity.

Still on the upside, the surpass of the recent top could face the next barrier at the weekly highs at 111.90 (June 6 2002) and 113.35 (May 24 2002).

Looking at the long-term scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 101.06.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.